SBI Holdings unveils Layer 1 proof of concept for tokenized stocks co-developed with Startale Group

Tokyo-based financial giant SBI Holdings is teaming up with Startale Group, the blockchain R&D firm behind Sony’s Layer 2, to build a bespoke Layer 1. The new network, called Strium, will be purpose-built to support real-world assets, with a particular focus on tokenized securities.

The move comes amid an explosion of interest in onchain equities leveraging blockchains for novel 24/7 spot and derivatives stock markets. Crypto native firms like Kraken, established fintechs like Robinhood, and even legacy organizations like the NYSE are all rapidly developing onchain stock capabilities.

“Unlike crypto native perpetual platforms focused primarily on digital assets, Strium is focused on serving global capital markets through a blockchain-native exchange architecture, advancing faster market formation, deeper liquidity, and scalable global access without the constraints of direct asset issuance or custody,” the Strium team wrote in an announcement.

SBI and Startale first announced a collaboration on a round-the-clock RWA trading platform in August 2025. The idea was to provide access to both U.S., Japanese, and other countries’ equities with near-instant cross-border settlement times, fractional ownership, and DeFi composability.

The firms also recently teamed up to develop a yen-denominated stablecoin for global settlement and institutional adoption.

"The whole financial market is moving from an offchain environment to onchain,” Sota Watanabe, founder of Startale Group, previously said. “We believe that the tokenized stock revolution is the largest opportunity and onchain trading is the next frontier. "This isn't just about digitizing existing assets, it's about creating entirely new financial primitives that merge the trust of traditional equities with the composability and accessibility of DeFi."

Startale recently raised an additional $13 million from Sony, as it works to build out functionality for the IP-focused Ethereum L2 Soneium, co-developed by Sony Block Solutions Labs. The Startale development group also operates Astar Network, said to be Japan’s largest public blockchain.

Asia’s onchain securities market

Strium Network is being pitched as the “foundational exchange layer for Asia’s onchain securities markets,” with the possibility of leveraging SBI Holdings’ 80 million existing customers and institutional expertise across securities, banking, and financial services. The press release notes it will empower “institutional and professional participants to access, trade, and unlock assets in ways that were previously constrained by traditional market structures.”

Startale and SBI also note that a testnet is expected to roll out soon, and that its proof-of-concept, unveiled today, “will demonstrate key technical capabilities around settlement efficiency, resilience under high-load and demanding scenarios, and interoperability with both traditional financial systems and blockchain networks.”

The initial announcement for a round-the-clock tokenized stock trading platform did not mention the development of a new Layer 1. The initial goal was to advance onchain features like account abstraction, institutional custody, and real-time compliance monitoring of international regulations, while also fulfilling

Additionally, August’s announcement said SBI and Startale would establish and operate two joint venture companies, one focused on R&D and the other on brand and business expansion, The Block previously reported.

SBI has been ramping up its crypto-related activity in recent months, particularly involving stablecoins. The firm disclosed it invested $50 million in Circle’s initial public offering and is reportedly developing crypto ETFs that could list on the Tokyo Stock Exchange.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Sony Stock Rises 6% Following Upgraded Outlook and Strong Sales

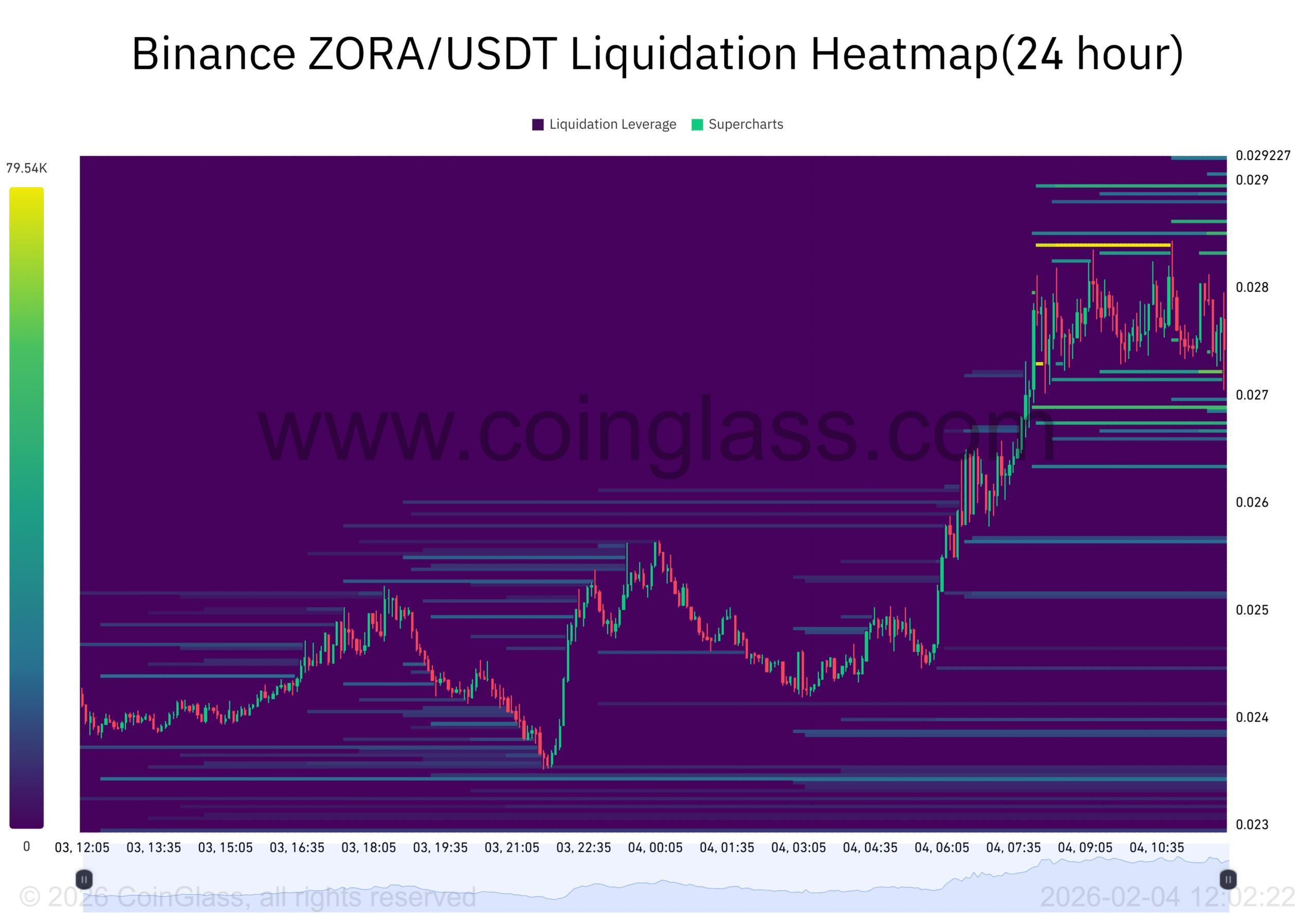

ZORA rebounds from multi-month lows: Early trend reversal or short squeeze?