Biogen (BIIB) Q4 Preview: Key Information Before Earnings Release

Biogen Set to Announce Earnings: Key Insights for Investors

Biogen (NASDAQ:BIIB) is scheduled to release its latest financial results this Friday before the market opens. Here’s a breakdown of what shareholders should keep in mind.

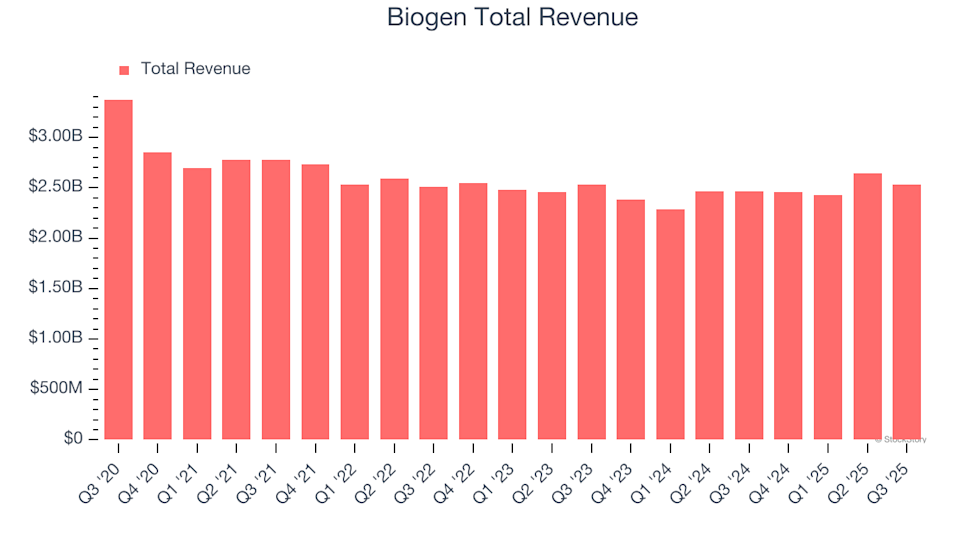

In the previous quarter, Biogen surpassed Wall Street’s revenue forecasts by 8.6%, posting $2.53 billion in sales—a 2.8% increase compared to the same period last year. The company not only exceeded revenue expectations but also outperformed on earnings per share.

Should You Buy or Sell Biogen Ahead of Earnings?

Wondering whether Biogen is a good investment as earnings approach?

Analyst Expectations for This Quarter

For the upcoming quarter, analysts predict Biogen’s revenue will drop by 10.3% year-over-year to $2.20 billion, marking a shift from the 2.9% growth seen in the same quarter last year. Adjusted earnings per share are projected to reach $1.63.

Over the past month, most analysts have maintained their forecasts for Biogen, indicating expectations for steady performance as the company heads into its earnings report. Notably, Biogen has missed revenue projections twice in the last two years.

How Biogen’s Peers Are Performing

Several other biotechnology companies have already shared their fourth-quarter results, offering some context for Biogen’s upcoming report. Amgen achieved an 8.6% increase in revenue year-over-year, beating analyst estimates by 4.1%, while AbbVie’s revenue rose 6% but came in 1.5% below expectations. Following its results, Amgen’s stock climbed 8.1%.

For a deeper dive, check out our full reviews of Amgen’s performance and AbbVie’s results.

Market Trends and Biogen’s Position

Recent discussions about tariffs and changes to corporate taxes have sparked concerns about economic stability in 2025. While some biotech stocks have managed to perform well despite market volatility, the sector as a whole has lagged, with average share prices falling 4% over the past month. In contrast, Biogen’s stock has risen 1.9% during the same period. Analysts currently have an average price target of $192.72 for Biogen, compared to its recent price of $185.42.

Looking Ahead: The Next Big Winners in Tech

Many younger investors may not be familiar with the classic book "Gorilla Game: Picking Winners In High Technology," published over two decades ago when Microsoft and Apple were just beginning to dominate. Applying those timeless strategies today, enterprise software companies harnessing generative AI could become tomorrow’s industry leaders. In this spirit, we invite you to explore our exclusive free report on a high-growth, profitable enterprise software stock that’s capitalizing on automation and poised to benefit from the generative AI trend.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Maersk Q4 meets forecasts, falling freight rates to weigh on 2026 profits

Joseph Lubin DAI Loan: A Strategic $31.4M ETH Collateral Move Analyzed

UK's BT says on track to meet forecasts for the year

ASE Technology Hldg: Q4 Financial Results Overview