Tether deepens ties with Anchorage Digital through $100M equity investment at $4.2B valuation

Stablecoin issuer Tether USDT announced a $100 million strategic equity investment in Anchorage Digital, expanding an existing relationship between the two firms with a focus on regulated digital asset infrastructure.

Anchorage Digital Bank is a federally regulated digital asset bank in the U.S., offering staking, custody, governance, settlement, and stablecoin issuance to institutions and innovators globally.

Separately, Anchorage Digital confirmed the investment values the firm at $4.2 billion and also announced its first-ever employee tender offer, allowing long-tenured employees to sell a portion of their equity at the same valuation. The company added that it prioritized employee liquidity over raising additional primary capital.

While the investment is financial, the companies framed it as part of a broader strategic alignment focused on strengthening the core infrastructure required for digital assets to operate safely, at scale, and within clear regulatory frameworks.

Focus on regulation

Tether said that as it has grown in scale, it is increasingly focused on operating within established legal and regulatory environments, including working closely with regulated institutions that prioritize transparency, oversight, and long-term market integrity. In a statement on Thursday, Tether said the Anchorage Digital investment aligns with that approach.

Tether cited its experience using Anchorage Digital Bank's banking, compliance, and custody infrastructure as a factor in its decision to make a strategic equity investment, including its role as issuer of the "Made in America" stablecoin, USAT, its newly-launched federally regulated alternative to USDT.

The introduction of USAT follows the U.S. Congress's passing of stablecoin legislation in the form of the GENIUS Act last summer. Bo Hines, the former crypto policy advisor to the White House, became CEO of Tether's U.S. division last September.

"Tether exists to challenge the status quo and build global infrastructure for freedom," Tether CEO Paolo Ardoino said, adding that the investment reflects a shared belief in secure, transparent, and resilient financial systems.

Anchorage Digital co-founder and CEO Nathan McCauley said the investment validates years of work building regulated infrastructure and adds momentum as the firm continues developing services for stablecoin issuance and broader market adoption.

Both companies said they share the view that the future of finance depends on open systems built on strong governance and regulatory clarity, with the goal of enabling broader participation in digital assets while promoting stability and long-term confidence in the ecosystem.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Pump.fun acquires Vyper to expand cross-chain trading terminal

Japan's biggest banks ready to increase JGB holdings despite growing losses

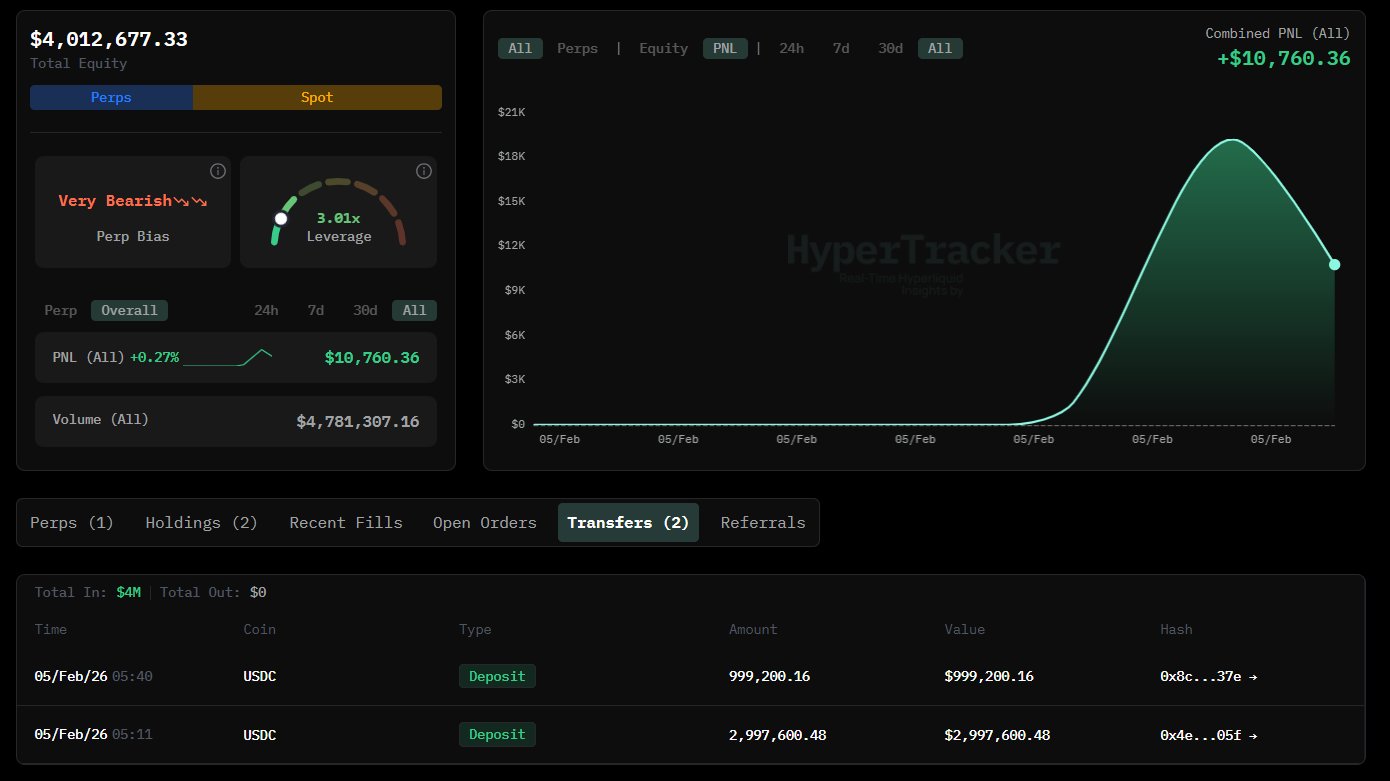

$4mln Hyperliquid whale opens 3x SOL short – Trouble ahead for Solana?