Bitcoin extends its prolonged decline, reaching a new 15-month low at $67,000

Bitcoin Hits 15-Month Low Amid Prolonged Downturn

Bitcoin's value continued its downward trend on Thursday, dropping by 11% to reach $67,000—the lowest point the cryptocurrency has seen in over a year.

Once promoted as “digital gold,” bitcoin has now shed 46% of its value since peaking at $126,210.50 on October 6, according to data from Coinbase. By 10:30 a.m. EST on Thursday, the price hovered around $67,245.

Market Reaction Following 2024 Election

After Donald Trump was elected president in November 2024, bitcoin prices climbed steadily for nearly a year, fueled in part by hopes that the new administration would be more supportive of cryptocurrencies.

Crypto Companies Face Steep Losses

The recent sell-off has taken a toll on companies involved in cryptocurrency trading and those that have made bitcoin investment their primary business. Coinbase Global’s shares dropped 9.1%, Robinhood Markets declined by 8.1%, and Riot Platforms, a bitcoin mining firm, saw its stock fall by 10%.

Strategy, formerly known as MicroStrategy and the largest of the crypto treasury firms that raise capital solely to purchase bitcoin, experienced a 13% decrease. The company currently holds 713,502 bitcoins, as reported on its website. With an average acquisition cost above $76,000 per bitcoin, the company’s investment is now underwater. On Thursday morning, its bitcoin holdings were valued at approximately $47.8 billion, falling short of the $54.3 billion the company spent.

Trump-Linked Crypto Ventures Also Decline

American Bitcoin, a company partly owned by Eric Trump and Donald Trump Jr., dropped 6.6% and has lost over 80% of its value since October 7.

Other cryptocurrency projects connected to Trump have also suffered. The market capitalization of the World Liberty Financial token ($WLFI) has plummeted to around $3.25 billion, down from over $6 billion in mid-September. Meanwhile, the price of the $TRUMP meme coin, named after President Donald Trump, has fallen to $3.93, a steep drop from its $45 price tag just before the January inauguration.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Japan's biggest banks ready to increase JGB holdings despite growing losses

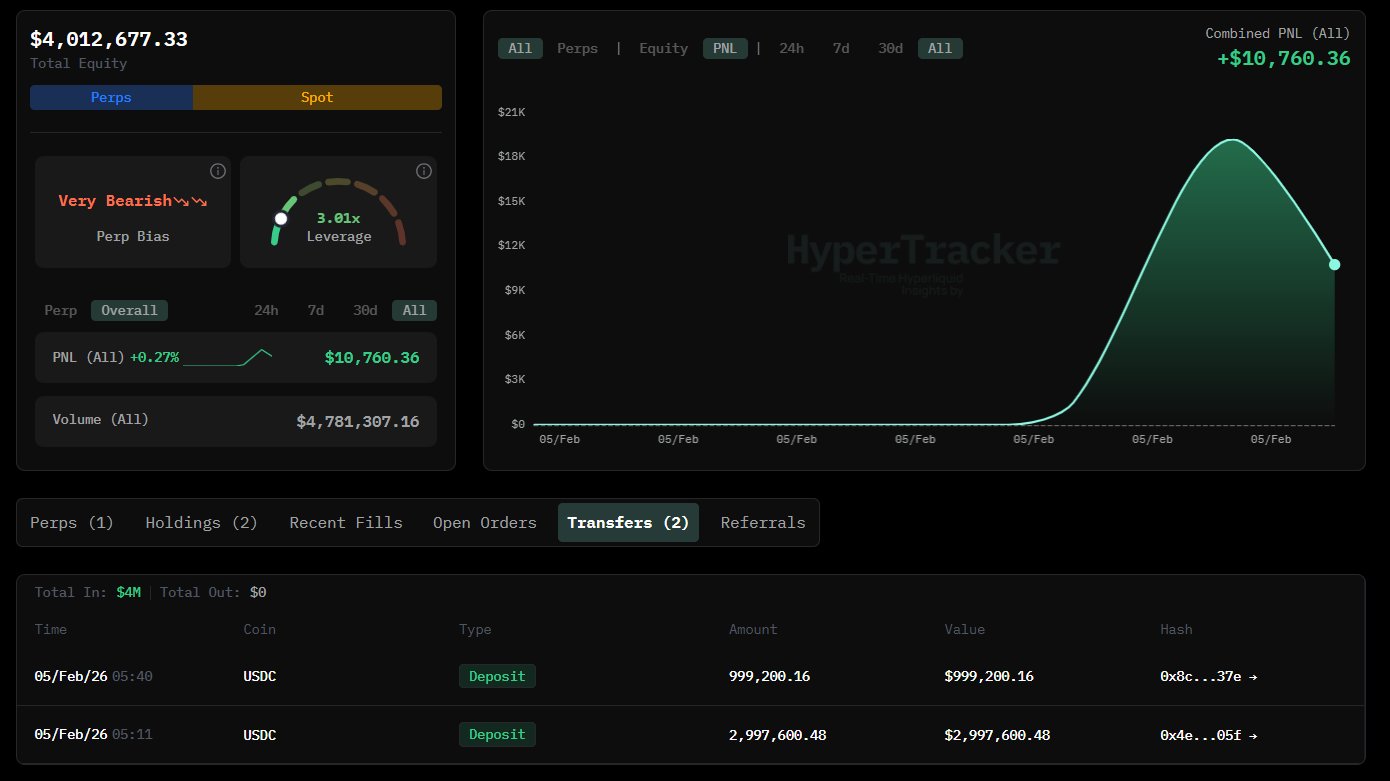

$4mln Hyperliquid whale opens 3x SOL short – Trouble ahead for Solana?

Affirm unveils a new artificial intelligence solution designed for retailers