Crypto market downturn intensifies as investors abandon high-risk assets

Bitcoin and U.S. Currency at Interpol World Congress

Photo by Roslan Rahman

Bitcoin Faces Steep Decline

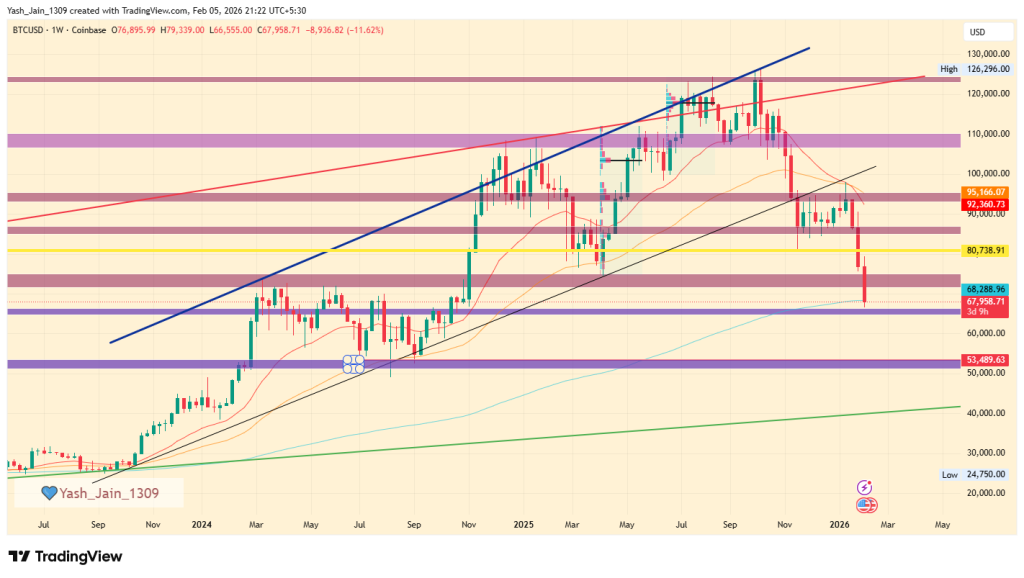

On Thursday, Bitcoin experienced a sharp drop, tumbling over 10% to fall below $66,000 in afternoon trading—a price point not seen since October 2024. This dramatic fall highlights the sensitivity of cryptocurrencies to shifts in investor sentiment away from riskier assets.

Just months ago, Bitcoin had reached record highs above $125,000 per coin. However, in the four months since, the cryptocurrency has shed nearly half its value.

This sell-off is part of a broader trend, as investors move away from volatile assets like cryptocurrencies and tech stocks, instead favoring traditional safe havens such as gold.

Since Bitcoin’s peak last October, its performance has diverged significantly from gold. As of Thursday afternoon, Bitcoin’s value had dropped 32% since February 2025, while gold surged by 70%.

In 2025 alone, gold has gained more than 14%, whereas Bitcoin has declined by over 20%.

The downturn in crypto has also affected the U.S. dollar, as cautious investors reconsider their asset allocations.

The dollar’s weakness is being driven by renewed trade and tariff threats from the Trump administration, along with uncertainty stemming from strained relations with U.S. allies over Greenland, unrest in Iran, and the capture of Venezuela’s president earlier this year.

As capital exits the crypto market, investors are turning to safer options like Treasury bonds, European and Asian equities, and precious metals such as silver and gold.

The Broader Impact on Crypto

Bitcoin’s rapid decline is causing concern throughout the cryptocurrency sector. Often referred to as “digital gold,” Bitcoin has been considered the most stable crypto asset, expected to retain value during turbulent times, much like physical gold.

According to Citi analysts, inflows into Bitcoin exchange-traded funds (ETFs) have dried up as prices continue to fall. These ETFs were a major driver behind Bitcoin’s surge last year.

Additionally, Bitcoin’s price has now slipped below the average purchase price for many U.S. spot Bitcoin ETF investors, which Citi estimates to be around $81,600.

This downturn is also impacting companies and investors who heavily invested in Bitcoin during its rally.

Shares of Strategy, the largest corporate Bitcoin holder, dropped more than 10% on Thursday as Bitcoin’s price fell below the company’s average acquisition cost for its substantial holdings.

Strategy has accumulated over 713,000 Bitcoins, with an average purchase price of approximately $76,000 per coin.

Wider Fallout Across the Crypto Market

With Bitcoin now trading well below key levels, investor anxiety about further losses is mounting.

This pressure is spreading throughout the crypto industry, affecting businesses closely linked to digital asset trading and valuation.

- Coinbase, a leading U.S. crypto exchange

- Circle, a financial firm specializing in crypto and stablecoins

- Robinhood, a popular trading platform

All have seen their share prices fall alongside Bitcoin.

Investor Michael Burry, known for predicting the 2008 financial crisis, warned that Bitcoin’s plunge could lead to dire scenarios, even describing the situation as a potential “death spiral” in a recent Substack post.

Policy Shifts and Regulatory Uncertainty

The nomination of former Federal Reserve governor Kevin Warsh as Trump’s pick for Fed chair has also prompted a reassessment of asset values.

Although Trump has emphasized the need for a Fed chair who supports lower interest rates, Warsh is perceived as more hawkish on inflation compared to other candidates.

Markets anticipate that Warsh will be reluctant to implement rapid rate cuts, and higher rates combined with tighter liquidity typically make high-risk investments like crypto less attractive.

This week, Treasury Secretary Scott Bessent stated in Washington that the U.S. government lacks the authority to intervene and support cryptocurrencies in the event of a crash, dampening hopes for a government rescue—even from an administration generally supportive of crypto.

Despite favorable signals from the White House, the crypto sector continues to struggle with the lack of comprehensive regulatory clarity from Congress.

“Progress on crypto legislation has been made, but it remains slow and inconsistent,” Citi analysts observed.

Lawmakers have advanced some crypto-related bills in recent months, including measures to clarify digital asset regulation and oversight of stablecoins. However, broader rules governing market structure, which are seen as essential for providing certainty, remain stalled in Congress.

As a result, some investors remain pessimistic about Bitcoin’s prospects, even if regulatory clarity eventually arrives.

“Even with clearer regulations, many investors may still hesitate to invest in such a volatile asset class,” wrote Louis Navellier, an investment manager and strategist at Navellier & Associates.

This article was first published on NBCNews.com.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Affirm unveils a new artificial intelligence solution designed for retailers

Bitcoin on the cusp of $60,000 as investors flee risky bets

Is the “Perfect Storm” Here? Liquidations Explode as Bitcoin Bleeds Below $70K & DXY Rises

Bitcoin Price Survival Test: Is a $53K Revisit Inevitable?