The sharp decline in cryptocurrencies drags related stocks down, with digital asset treasury stocks plunging collectively

In the past, buying and holding cryptocurrencies for the long term was once considered a foolproof way for some companies to quickly reap massive gains. Now, as bitcoin has fallen more than 45% from its peak, the share prices of these companies have also declined alongside digital assets.

Digital Asset Treasury (DAT) companies’ stocks typically traded at a premium to their underlying crypto holdings, but as token prices have retreated, many DAT stocks are now trading at a discount.

On Thursday, bitcoin fell below $70,000, hitting its lowest level since October 2024. At the same time, ether dropped to its lowest point since May 2025.

“Since 2020, we've seen wave after wave of bubbles: meme stocks, tokens, SPACs, one after another,” said Michael Lebowitz, portfolio manager at RIA Advisors. “Digital Asset Treasury companies are just one of these speculative bubbles, with the bubble existing in the premium, and now that layer of premium has collapsed.”

Data shows that so far this year, the median return for DATs listed in the US and Canada is -17%. In contrast, the median return for S&P 500 constituents is up 5%.

B. Riley Securities analyst Fedor Shabalin said that as pressure continues to mount, DATs have lost their appeal for investors.

“That was a short period of excitement, and then investors began to realize: for them to buy these stocks, for any premium over the underlying crypto assets to be justified, these companies need to generate additional income wherever possible,” Shabalin said.

But since bitcoin does not generate income, those DATs with weaker share prices and looming debt repayments have had to sell their crypto assets to create extra revenue. This was previously unimaginable.

Bitcoin treasury company Empery Digital announced on Monday that, as its shares were trading at a discount, it had started selling bitcoin to fund stock buybacks. In December, Peter Thiel-backed ether treasury company ETHZilla announced it had sold $74.5 million worth of tokens to repay debt.

As one of the earliest DATs, Strategy’s share price once traded at more than double the premium to its bitcoin holdings, but now trades at just a 9% premium. Founded by Michael Saylor, the company’s share price is down 26% so far this year. On Wednesday, Canaccord Genuity slashed its price target for the stock by 61%, citing the drop in bitcoin’s price and the shrinking premium. Strategy is set to announce its fourth-quarter earnings after Thursday’s close and is expected to report billions of dollars in losses due to fluctuations in the value of its bitcoin holdings.

Although some DATs like Strategy have strong enough balance sheets to weather the current downturn, other companies have had to explore alternative options. In 2025, bitcoin treasury company Strive, co-founded by former Republican presidential candidate Vivek Ramaswamy, agreed to acquire competitor Semler Scientific. DATs typically finance crypto asset purchases by issuing bonds or stocks, but as crypto prices remain sluggish, smaller players in the sector may face default risk if they are not acquired by larger firms.

Although the drop in DAT stock prices and premiums has been swift, RIA’s Lebowitz said he is not surprised by this downturn.

“If you want to hold bitcoin, then just hold bitcoin directly. I think investors are finally starting to realize this,” he said.

Editor: Chen Yujia

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

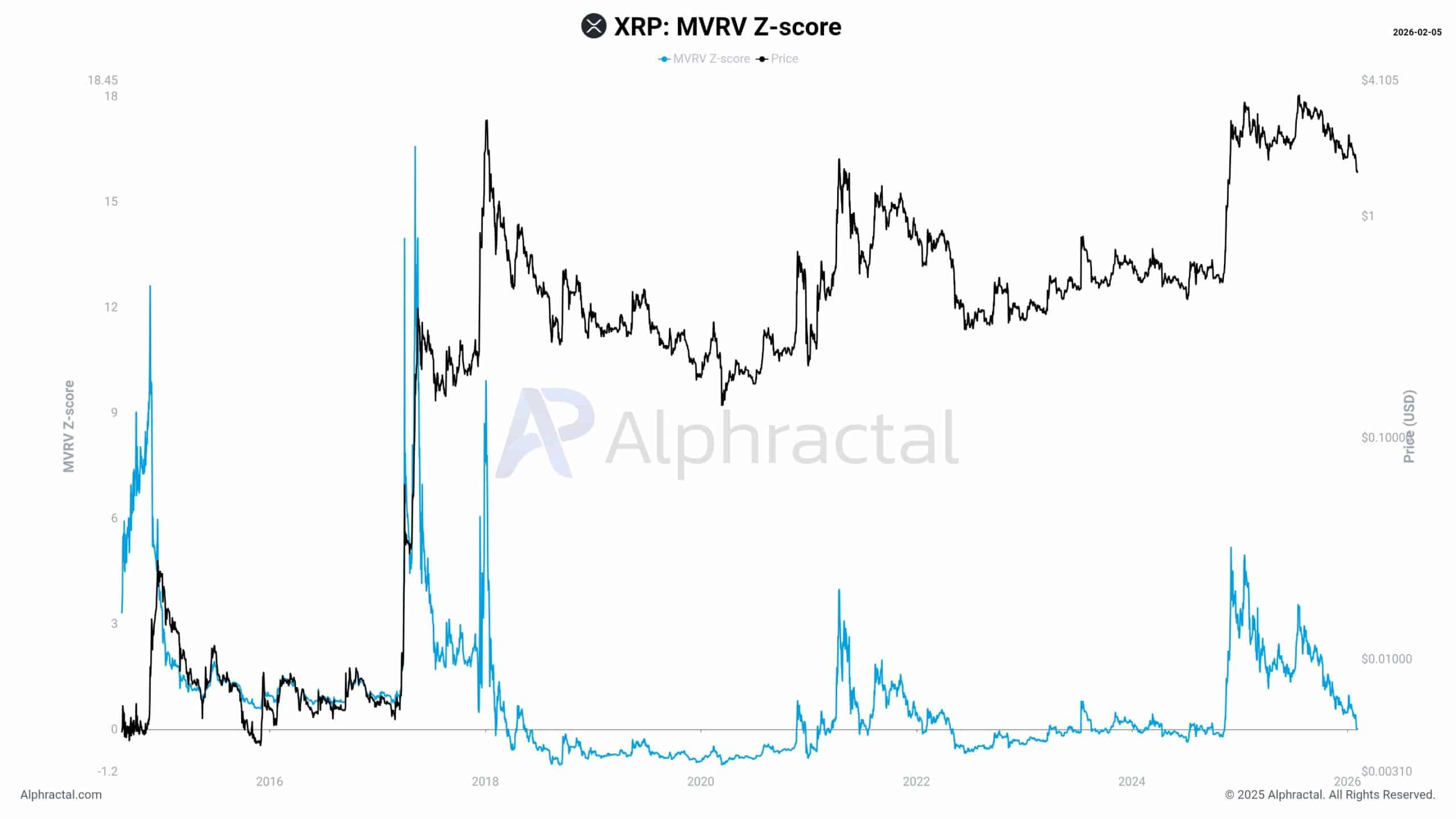

XRP retraces 61% from its peak – But THIS signal hints at deeper trouble

Pump.fun acquires Vyper to expand cross-chain trading terminal

Japan's biggest banks ready to increase JGB holdings despite growing losses