"Evacuation Order" Triggers Safe-Haven Surge! US Urges Citizens to Leave Iran, Gold Rebounds Nearly 2%

Huitong Network, February 6th—— As tensions escalate, the United States has advised its citizens to leave Iran, as critical diplomatic negotiations face severe disagreements and military threats. The “emergency escalation signal” of the geopolitical crisis is driving safe-haven buying. During Friday's Asia-European session, spot gold fluctuated higher, now trading near $4,870 per ounce, with a daily increase of about 2%.

As the high-stakes U.S.-Iran diplomatic talks scheduled for Friday (February 6th) in Oman approach, tensions continue to rise. The U.S. has issued an urgent security alert, advising American citizens to “leave Iran immediately.” The notice released by the Virtual U.S. Embassy in Iran warns Americans to arrange their own departure and not to rely on assistance from the U.S. government.

The “emergency escalation signal” of the geopolitical crisis is fueling safe-haven buying. During Friday's Asia-European session, spot gold fluctuated higher, now trading near $4,870 per ounce, with a daily increase of about 2%.

This warning comes as representatives from Washington and Tehran are preparing for their first formal meeting since the major conflict in 2025, but there is little sign of common ground on the agenda.

High-risk Talks Full of Uncertainty

The U.S. delegation is expected to include envoy Steve Vitkoff and Donald Trump’s son-in-law Jared Kushner. They are expected to meet with a team led by Iran’s Foreign Minister Abbas Araghchi.

However, major disagreements over the format and location of the talks have cast a shadow over their prospects for success, and the possibility of U.S. military action remains. The negotiations were initially planned to be held in Istanbul, with Turkey, along with other regional powers such as Egypt, Qatar, and Saudi Arabia, serving as key mediators.

On Tuesday, Tehran requested a last-minute change, moving the meeting location to Oman and restricting attendance to only Iranian and U.S. officials.

Core Disputes Leading to Deadlock

The diplomatic maneuvering is taking place against a backdrop of growing military pressure. The U.S. has been amassing forces in the Gulf region, and President Trump has recently toughened his rhetoric, threatening military strikes should Tehran fail to meet a series of U.S. demands.

Reportedly, the key demands of the U.S. government include:

Complete disposal of Iran’s enriched uranium stockpile;

Strict limitations on Tehran’s ballistic missile program;

Ceasing the provision of weapons and funding to armed groups across the Middle East.

Military Expansion and Domestic Pressures

The current deadlock has been further complicated by Iran’s domestic situation. In early 2026, nationwide protests in Iran heightened tensions, and the government responded with a harsh crackdown. Reportedly, as of Wednesday, at least 6,883 people have died.

Although President Trump had previously threatened to intervene in support of the protesters, he ultimately did not take military action at the time.

Safe-haven Buying Flows into Gold

The U.S. “emergency evacuation warning” for Iran and the ensuing high-risk talks

In the short term, this is the “trigger” igniting safe-haven buying in gold, directly pushing up gold prices. In the medium to long term, it reveals the deep and irresolvable contradictions between the U.S. and Iran, and this structural risk will continue to provide a “risk premium” for gold.

Against a backdrop of global disorder and intensified power rivalry, events like the Iran crisis continually remind the market: gold is not just a hedge against inflation, but also “strategic insurance” against international system disorder and military conflict. The deepening of this perception will fundamentally help raise the long-term valuation anchor for gold.

(Spot Gold Daily Chart, source: EasyHuitong)

At 14:16 (GMT+8), spot gold was quoted at $4,866.51 per ounce.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

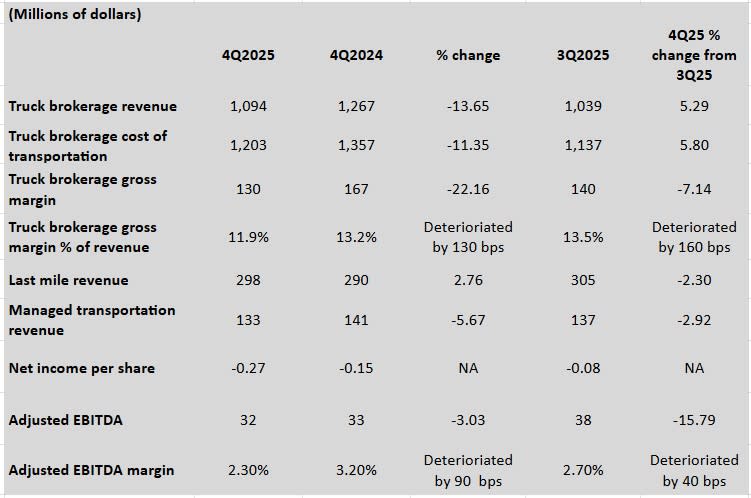

First impression: Challenging conditions for brokers reflected in RXO's fourth quarter financial results

Bitcoin Institutional Selling Warning: CryptoQuant CEO Reveals Critical One-Month Rebound Threshold

XRP Holds Near $1.12 After Sharp February Drop Shakes Market

Tesla Considers Increasing Solar Cell Production in New York, Arizona, and Idaho