Ethereum ETFs Hemorrhage $81M as Investors Reach Breaking Point Near $1,900 Support

Ethereum (ETH) and its corresponding exchange-traded funds (ETFs) are enduring a high-stress test on Friday as the broader crypto market enters a deep capitulation phase. Following a week of relentless selling, Ethereum spot ETFs saw another $81 million leave their vaults today. This exodus coincides with Ether’s price dropping nearly 5% in 24 hours, briefly touching a low of $1,920.

Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

While Bitcoin is grabbing headlines with its record $10 billion volume, the Ethereum ecosystem is quietly facing its own structural crisis as it attempts to find a durable floor.

Grayscale’s ETHE Continues to Lead the Exodus

The Grayscale Ethereum Trust (ETHE) remains the primary driver of negative sentiment in the space. On Friday, the fund faced another heavy round of redemptions, pushing its cumulative historical net outflow toward a staggering $5.2 billion.

Because ETHE converted from a private trust with higher fees, investors have been using every price rally, and now every crash, as an excuse to rotate their capital into cheaper alternatives or exit the market entirely. This persistent dumping has created a constant ceiling for Ethereum’s price over the past month.

Fidelity and Bitwise Fight to Hold the Line

Despite the overall negative trend, other major players are trying to position the current price as a generational buying opportunity. The Fidelity Ethereum Fund (FETH) and the Bitwise Ethereum ETF (ETHW) have both seen their daily trading volumes surge over 200% above their 30-day averages.

- Fidelity (FETH) is currently trading near its 52-week low of $18.60, with some AI-driven models now rating it as a “Strong Buy” based on oversold technical indicators.

- Bitwise (ETHW), meanwhile, has been incredibly active in the options market, where traders are currently using “puts” to hedge against a further slide toward the $1,700 support zone.

There Is a Flush Out in Progress

The combination of high volume and falling prices often signals that the market is clearing the deck. The liquidation of over $2.6 billion in leveraged crypto positions over the last 24 hours suggests that many weak hands have finally been forced out.

For long-term investors, this aggressive reset is a necessary part of a bottoming process. While Ethereum is currently down over 40% from its all-time high, historical data suggests that February often provides a rebound. The question now is whether the $1,900 support level can hold through the weekend or if the sell-off still has one more leg down.

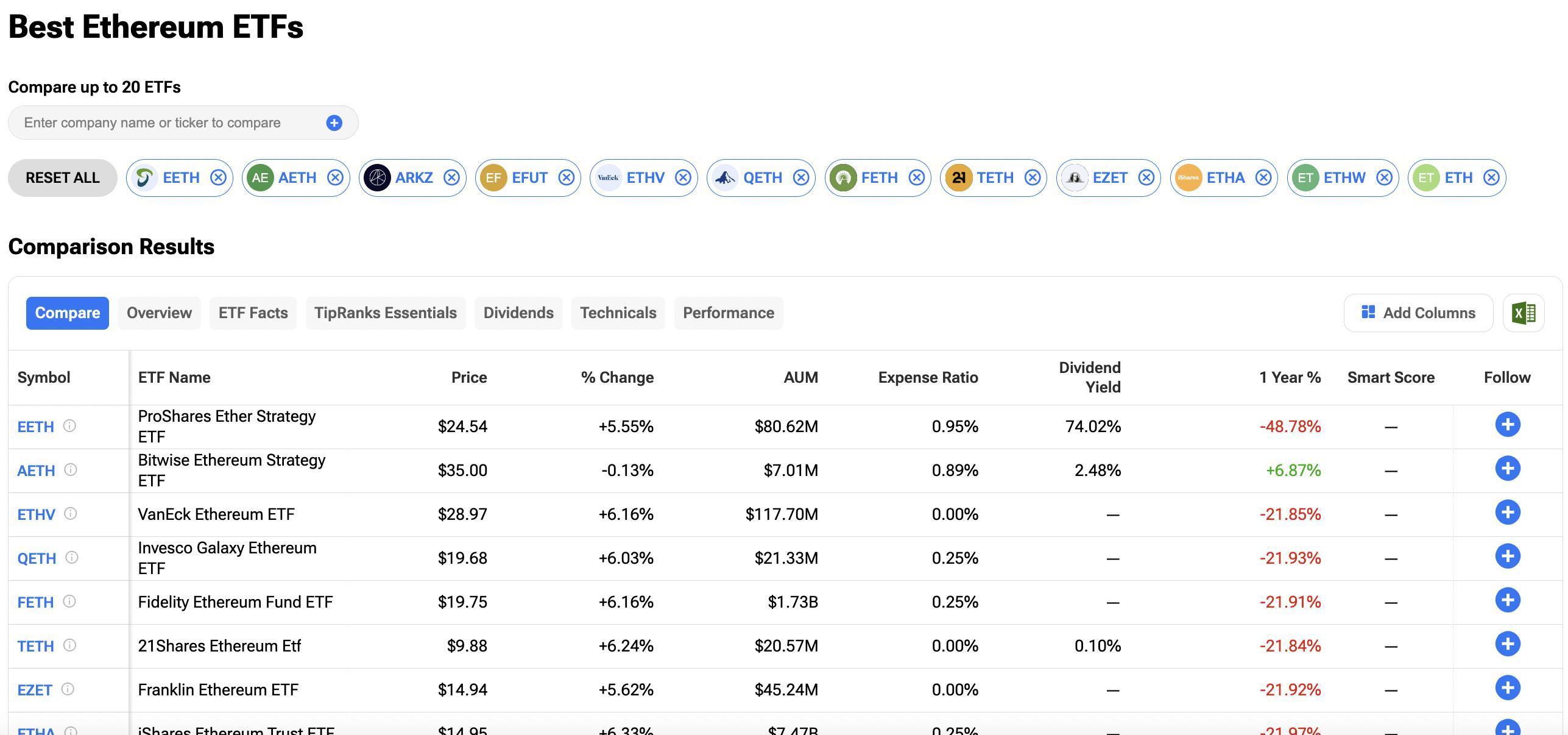

Investors can compare Ethereum ETFs on TipRanks’ ETF Comparison Tool. Click on the image below to find out more.

Copyright © 2026, TipRanks. All rights reserved.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Exclusive: BlackRock may make an offer for New York's biggest container terminal

MegaETH Foundation to use USDM stablecoin revenue to fund MEGA token buybacks

Bitcoin returns above $70,000, almost recovers all losses from Thursday

Crypto Bloodbath: Bitcoin Drops Over 20% in a Week as Market Sentiment Turns Severely Bearish