Key Takeaways

- ASTER bounced strongly from key support near $0.403, triggering a 10% relief rally.

- The daily chart shows a descending broadening wedge, a pattern often linked to bullish reversals.

- Price is now targeting the $0.63–$0.64 zone, aligning with the upper wedge and 50-day MA.

- A confirmed breakout above $0.6334 could open upside toward $0.95.

- Failure to clear resistance may lead to consolidation or another retest of lower support.

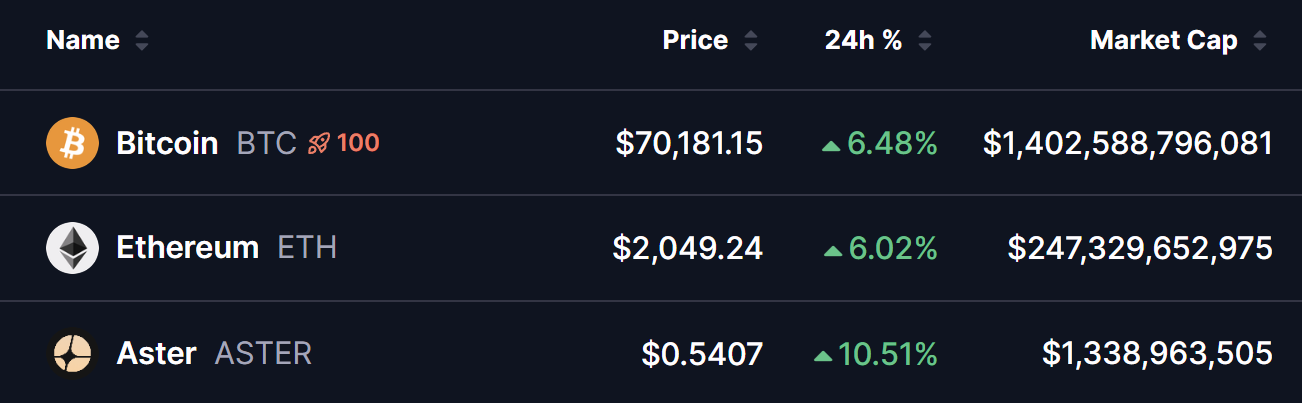

The crypto market is finally showing signs of relief after days of heavy selling.

Bitcoin (BTC) has rebounded more than 6%, reclaiming the $70K level after briefly dipping toward $60K, while Ethereum (ETH) is also up over 6% on the day. This broader recovery has sparked fresh momentum across altcoins — and one token catching attention is Aster (ASTER).

Source: Coinmarketcap

Source: Coinmarketcap

ASTER is currently up roughly 10%, trading near the $0.54 area. More importantly, its daily chart is flashing a potentially meaningful bullish setup that could shape the next leg of price action.

Descending Broadening Wedge Pattern in Play

On the daily timeframe, ASTER appears to be forming a descending broadening wedge — a classic bullish reversal structure that often develops during prolonged corrective phases.

Price recently swept the lower boundary of the wedge near $0.4032, where buyers stepped in aggressively and defended support. That reaction sparked the current rebound, pushing ASTER back toward the $0.54 zone and hinting at a shift in short-term momentum.

Aster (ASTER) Daily Chart/Coinsprobe (Source: Tradingview)

Aster (ASTER) Daily Chart/Coinsprobe (Source: Tradingview)

This kind of move is typical for broadening wedges: sellers lose control near the lower trendline, volatility expands, and price begins rotating higher inside the pattern.

What’s Next for ASTER?

If bullish momentum continues, ASTER could soon challenge the upper wedge resistance along with its 50-day moving average, which currently aligns around the $0.63–$0.64 region.

A clean daily close above $0.6334 would strengthen the bullish reversal thesis and likely attract breakout traders. In that scenario, the chart points toward a potential upside target near $0.9568, which stands out as the first major resistance and a key test for any sustained rally.

However, this remains a technical bounce for now.

If ASTER fails to break above the upper wedge boundary, price could slip back into consolidation or attempt another pullback toward mid-range support. A decisive breakdown below $0.403 would invalidate the bullish structure and tilt momentum back in favor of sellers, delaying any recovery attempt.

Big picture

With Bitcoin reclaiming $70K and risk appetite slowly returning, ASTER’s bounce off key support arrives at an important moment. The descending broadening wedge suggests the token may be entering a volatility expansion phase, where sharp moves — especially to the upside — become more likely.

For now, bulls will be watching closely to see whether ASTER can reclaim $0.63 and confirm the reversal. Until then, expect choppy price action — but the technical groundwork for further gains is clearly starting to form.

About Author: Nilesh Hembade is the Founder and Lead Author of Coinsprobe, with over 5 years of experience in the cryptocurrency and blockchain industry. Since launching Coinsprobe in 2023, he has been providing daily, research-driven insights through in-depth market analysis, on-chain data, and technical research.