$20 Billion Is Significantly Less Than $100 Billion. How Might the OpenAI Investment Impact Nvidia Shares?

Nvidia and OpenAI: The Latest Developments

Last September, Nvidia (NVDA) attracted significant attention with its announcement of a potential investment of up to $100 billion in OpenAI, the creator of ChatGPT. The plan involved OpenAI constructing at least 10 gigawatts of AI data centers powered by Nvidia hardware.

However, recent reports have shifted the narrative. According to Bloomberg, Nvidia and OpenAI are now close to finalizing a $20 billion investment deal—far less than the previously discussed $100 billion. This news has sparked widespread speculation, with some media outlets suggesting that the original agreement between the two tech giants has collapsed, casting Nvidia in a negative light.

Related News from Barchart

Adding to the intrigue, The Wall Street Journal has reported that Nvidia is questioning the sustainability of OpenAI’s business model, fueling further uncertainty around the partnership.

Despite the swirling rumors, I believe there’s more to the story. Let’s take a closer look at what’s really unfolding.

Nvidia’s Market Performance

Nvidia has risen to become the world’s most valuable company by market capitalization, thanks to its advanced graphics processing units (GPUs). These chips, often used in large clusters, are essential for high-performance computing tasks like AI training and inference.

At its peak last year, Nvidia’s market value exceeded $5 trillion, though it currently stands at $4.2 trillion.

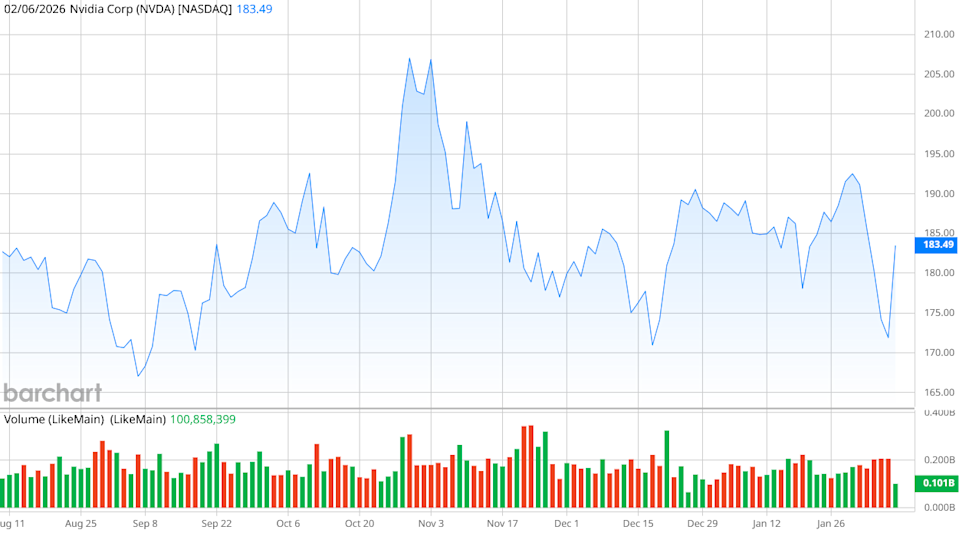

Over the past year, Nvidia’s stock has climbed 42%. While impressive, this growth is slower compared to the previous three years, during which the stock soared by over 700%. So far in 2026, Nvidia shares have dipped 6.6% as the semiconductor industry prepares for another potential rally.

Currently, Nvidia trades at a price-to-earnings (P/E) ratio of 44.6. While this may seem high, it’s a notable decrease from the trailing P/E of 62.2 seen in late 2024. The forward P/E is 23.5, which is relatively modest considering Nvidia’s rapid ascent in recent years.

The Nvidia-OpenAI Partnership: What’s Really Happening?

Nvidia’s announcement of its collaboration with OpenAI last September sparked both excitement and skepticism. Critics argued that Nvidia’s proposed $100 billion investment would primarily benefit itself, as OpenAI would be purchasing vast quantities of Nvidia GPUs.

It’s natural for some observers to look for weaknesses in Nvidia’s strategy. There’s often a tendency to scrutinize industry leaders, and Nvidia, as a dominant force in semiconductors, is no exception.

Understanding the Investment Timeline

Before drawing conclusions, it’s important to revisit Nvidia’s original statement from September. The company made it clear that its investment in OpenAI would be incremental, with funding provided as each gigawatt of capacity is brought online. The first gigawatt of Nvidia systems is scheduled for deployment in the second half of 2026, utilizing Nvidia’s upcoming Vera Rubin platform.

In reality, Nvidia is on track to complete the initial phase of its investment, just as outlined nearly six months ago.

What to Expect from Nvidia’s Upcoming Earnings

Nvidia will release its financial results for the fourth quarter of fiscal 2026 on February 25. During the earnings call, CEO Jensen Huang is expected to address questions about the OpenAI partnership and other company initiatives.

I anticipate that the upcoming earnings report will help alleviate many of the concerns currently surrounding Nvidia. In the third quarter of 2026, Nvidia reported record revenue of $57 billion, with $51.2 billion generated by its data center division. Year-over-year, revenue increased by 62%, while net income and earnings per share rose by 65% and 67%, respectively.

Analysts project that Nvidia will report Q4 2026 earnings per share of $1.45, representing a more than 70% increase from the previous year. If Nvidia meets these expectations and continues to see strong demand for its Blackwell and Rubin chips, the stock is likely to regain momentum following the earnings release.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

The Federal Reserve’s Major 2026 Question: What Should Be Considered a Typical Interest Rate?

Why is Howmet (HWM) shares surging so sharply today

Bitcoin Entry Point: Fidelity’s Strategic $65K Call Reveals Crucial Portfolio Shift