Rumble, CECO Environmental, Knowles, Cognex, and Flex Experience Significant Surge—Key Insights You Should Be Aware Of

Market Overview: Key Developments

Several stocks experienced notable gains during the afternoon as major market indices rebounded following a period of significant declines.

This upward momentum was largely driven by a resurgence in technology shares and a sharp recovery in Bitcoin, which had recently stabilized after a steep drop from its October highs. Improved U.S. consumer confidence and recognition of the positive impact of large-scale AI investments—such as Amazon’s planned $200 billion expenditure—on semiconductor companies like Nvidia and Broadcom also boosted investor optimism. These companies, often seen as foundational suppliers, saw their shares climb by as much as 7%, helping the S&P 500 return to positive territory for 2026. The Dow Jones Industrial Average made headlines by surpassing the 50,000 mark for the first time in history.

Market reactions to news can be exaggerated, and sharp declines often create opportunities to acquire strong stocks at attractive prices.

The following companies were among those affected:

- Rumble (NASDAQ:RUM), a digital media and content platform, surged 8%. Considering an investment in Rumble?

- CECO Environmental (NASDAQ:CECO), specializing in industrial and environmental services, advanced 7.4%. Interested in CECO Environmental?

- Knowles (NYSE:KN), a manufacturer of electronic components, rose 8.6%. Thinking about Knowles as an investment?

- Cognex (NASDAQ:CGNX), a company focused on specialized technology, gained 7.2%. Considering Cognex?

- Flex (NASDAQ:FLEX), another electronic components and manufacturing firm, increased by 7%. Interested in Flex?

Spotlight on Knowles (KN)

Knowles shares typically show limited volatility, with only eight instances of price swings greater than 5% in the past year. Today’s significant movement suggests the market views the latest developments as noteworthy, though it may not fundamentally alter the company’s outlook.

The last major shift occurred 16 days ago, when Knowles stock climbed 3.5% after President Trump eased concerns about a potential trade conflict with Europe by canceling planned tariffs on U.S. allies.

This rally followed a productive meeting in Davos with NATO Secretary General Mark Rutte, where a preliminary agreement concerning Greenland and the Arctic was reached. By clearly stating that military action was off the table and suspending the 10% tariffs previously scheduled for February 1st, the administration provided much-needed reassurance to the markets after a sharp sell-off earlier in the week. Leading technology and semiconductor companies, including Nvidia and AMD, led the rebound as investors shifted back toward growth-oriented stocks. The previous “Sell America” trend reversed dramatically, with the Nasdaq Composite rising 1.5% and the S&P 500 recovering its 2026 losses. A steadier bond market also contributed to the recovery, as easing inflation concerns related to tariffs caused the 10-year Treasury yield to fall from recent highs, improving the environment for equities overall.

Knowles: Performance and Industry Insights

Since the start of the year, Knowles has gained 22.9%, reaching a new 52-week high at $26.99 per share. An investor who purchased $1,000 worth of Knowles stock five years ago would now see that investment grow to $1,310.

The book Gorilla Game, published in 1999, accurately foresaw the dominance of Microsoft and Apple in the tech sector by identifying early platform leaders. Today, enterprise software companies integrating generative AI are emerging as the next industry giants.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Palmer Luckey-backed Erebor receives US national banking charter, WSJ reports

What the 2022 Crypto Winter Reveals About Bitcoin’s Latest Sell-Off

BC-Select Stock Indices

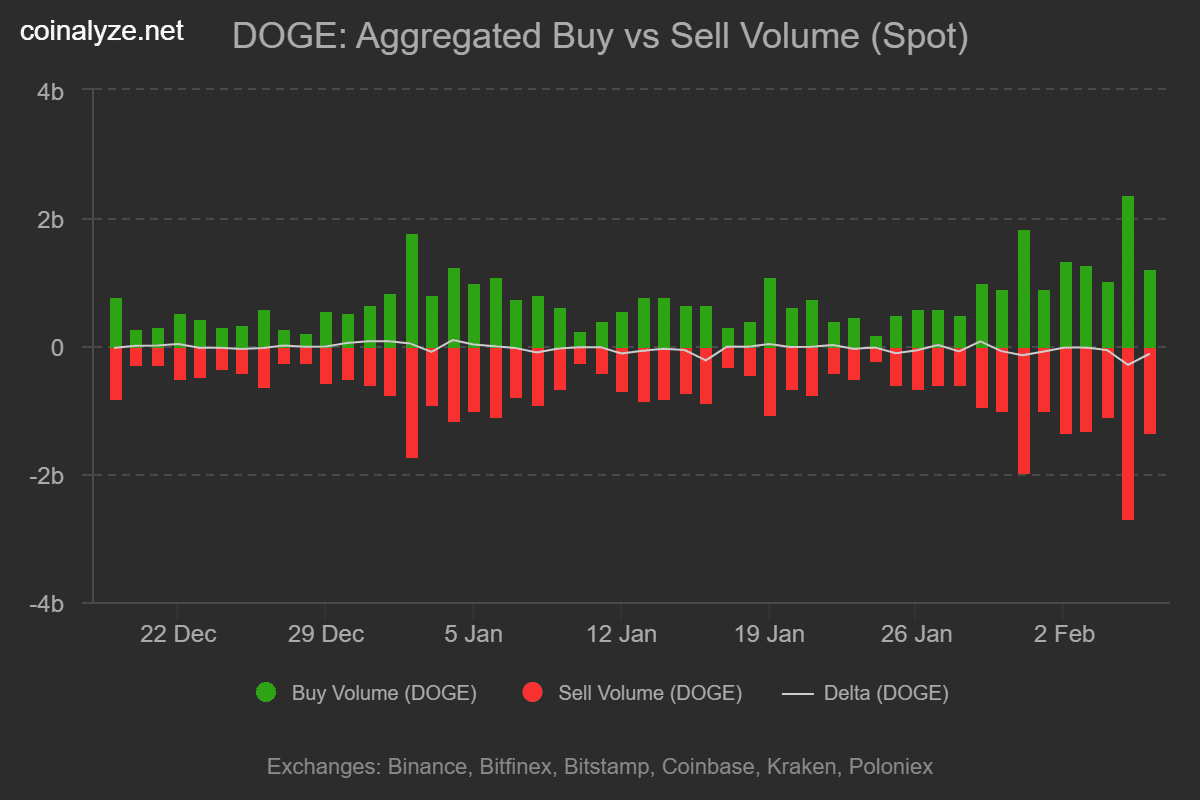

Dogecoin Rebounds From August Lows as Market Shows Signs of Recovery