Affirm CEO states that reports of the American consumer's 'decline' are 'significantly overstated'

Affirm CEO Remains Upbeat on U.S. Consumer Strength

Max Levchin, CEO of Affirm (AFRM), is unconvinced by predictions of an impending recession. In a conversation with Yahoo Finance after Affirm’s fiscal 2026 Q2 earnings announcement, Levchin remarked, “Reports of America’s decline are greatly overstated, to be honest.”

Levchin highlighted robust consumer activity and strong demand for Affirm’s offerings, including its buy now, pay later (BNPL) services, as proof that American shoppers remain resilient.

Drawing on Affirm’s internal metrics, Levchin—who also co-founded PayPal (PYPL)—pointed to consistently healthy repayment trends. He explained that the company’s repayment data, which tracks whether customers pay off their balances or default, has shown little variation over the past two years, indicating that consumer financial behavior has remained steady.

Levchin attributes Affirm’s ability to maintain high credit standards to its proprietary artificial intelligence underwriting system. He described these in-house AI models as the company’s “secret ingredient,” allowing Affirm to identify and serve financially stable customers.

Mixed Economic Signals

Despite Levchin’s optimism, broader economic indicators suggest a more complicated picture. While Affirm’s data points to financially sound borrowers, the University of Michigan’s Index of Consumer Sentiment reveals that many Americans remain cautious. Although the index climbed to 57.3 in February—surpassing forecasts—it is still 20% lower than its peak last year. This gap indicates that while consumers are still spending, especially through BNPL options, they are doing so amid concerns about inflation and job security.

Even with Affirm surpassing both revenue and earnings expectations and Levchin’s positive outlook, investors reacted coolly. The company’s shares fell nearly 7% in Friday trading after the earnings release.

This market response may be linked to Affirm’s forward guidance, which projects a slowdown in gross merchandise volume (GMV) growth to 30% in the third quarter and 25% in the fourth quarter. Although GMV jumped 36% year-over-year in the latest quarter, analysts remain cautious about whether consumers can sustain this pace.

The key issue for investors is whether Affirm is truly attracting financially healthy customers or simply serving as a last resort for those facing cash shortages.

Affirm CEO Max Levchin told Yahoo Finance he sees continued strength in U.S. consumer demand, citing high shopping activity and interest in the company’s services. (John Lamparski/Getty Images)

Affirm’s Competitive Edge and Brand Loyalty

Levchin believes Affirm’s business model offers a significant competitive advantage that software-only rivals cannot match. He noted that 96% of Affirm’s transactions now come from returning customers, which he sees as evidence that Affirm has evolved into a leading consumer brand, capable of competing with industry giants like PayPal.

He emphasized, “If your company is just focused on software and lacks a strong brand, now is the time to realize how difficult it will be to stand out. Brand loyalty and deep integration with merchants are what set us apart, especially as AI makes basic software features more common.”

Analyst Perspective and Market Outlook

Citi analyst Bryan Keane remains optimistic about Affirm, maintaining a Buy rating and a $100 price target. Keane observed that while Affirm exceeded Q2 expectations, investors may have been hoping for even more aggressive guidance for the second half of the year. He also pointed out that Affirm’s active merchant base grew by 42% year-over-year, and the company continues to secure attractive funding despite turbulence in the private credit market.

Francisco Velasquez is a reporter at Yahoo Finance.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Palmer Luckey-backed Erebor receives US national banking charter, WSJ reports

What the 2022 Crypto Winter Reveals About Bitcoin’s Latest Sell-Off

BC-Select Stock Indices

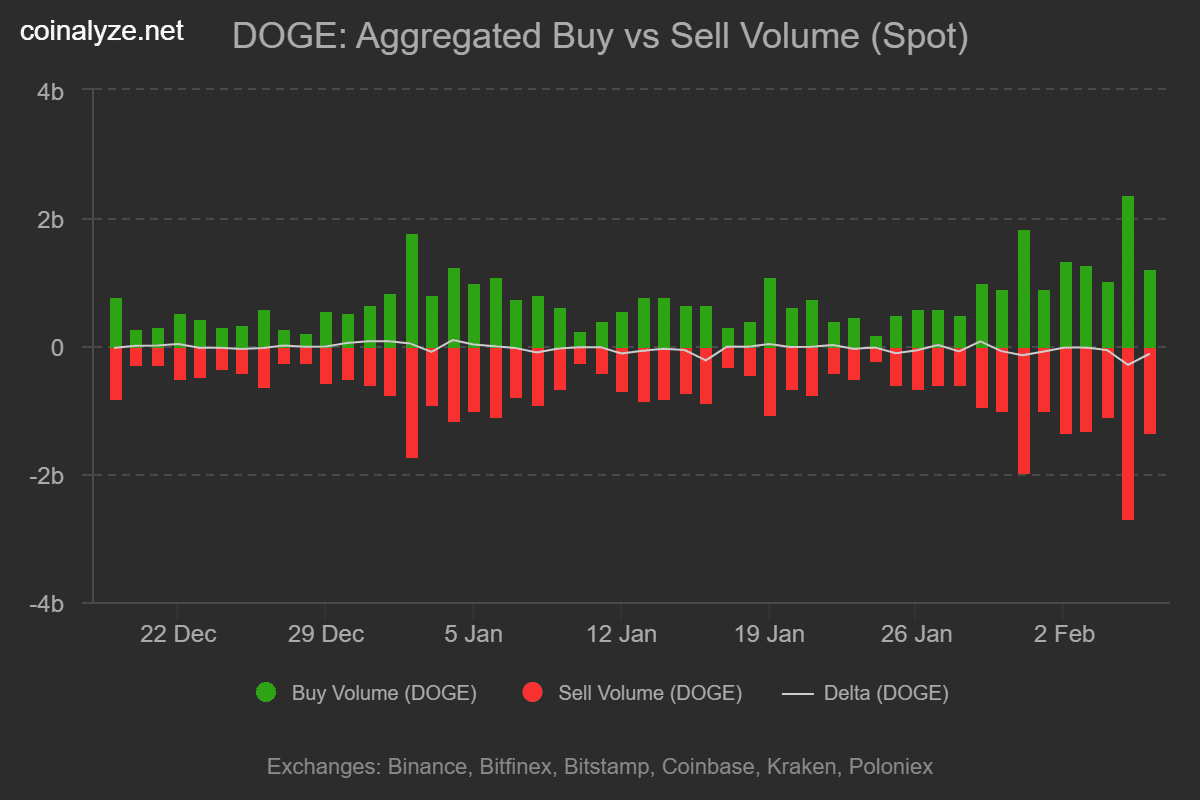

Dogecoin Rebounds From August Lows as Market Shows Signs of Recovery