Stocks Surge as Tech Sector Makes a Strong Recovery

Major U.S. Stock Indexes Surge

On Friday, the S&P 500 Index climbed 1.97%, the Dow Jones Industrial Average advanced 2.47%, and the Nasdaq 100 rose 2.15%. Futures for March E-mini S&P increased by 1.92%, while March E-mini Nasdaq futures gained 2.07%.

Market Recap: Tech and AI Stocks Lead Rally

U.S. stocks saw a strong rally to end the week, with the Dow Jones Industrial Average reaching a record high. Technology shares, including chipmakers, software firms, and companies tied to artificial intelligence infrastructure, rebounded sharply after recent declines. The rally gained further momentum following a surprise jump in consumer sentiment, as reported by the University of Michigan, which reached its highest level in six months.

Amazon Faces Investor Concerns

On the downside, Amazon.com shares dropped over 5% after the company revealed plans to invest $200 billion this year in data centers, semiconductors, and other infrastructure, raising doubts about the long-term payoff of its aggressive artificial intelligence strategy.

Economic Indicators and Inflation Expectations

The University of Michigan’s consumer sentiment index for February unexpectedly climbed by 0.9 points to 57.3, the highest reading in half a year and surpassing forecasts for a decline to 55.0.

Short-term inflation expectations for the next year fell to 3.5%, a 13-month low and below the anticipated 4.0%. However, expectations for inflation over the next five to ten years edged up to 3.4%, slightly above the expected 3.3%.

Consumer credit in December increased by $24.045 billion, far exceeding the projected $8 billion and marking the largest monthly gain in a year.

Federal Reserve Commentary

Federal Reserve officials delivered mixed messages on Friday. Vice Chair Philip Jefferson expressed cautious optimism about the U.S. economic outlook, noting that robust productivity could help bring inflation back to the Fed’s 2% target. In contrast, Atlanta Fed President Raphael Bostic emphasized the importance of maintaining restrictive monetary policy to ensure inflation returns to target levels.

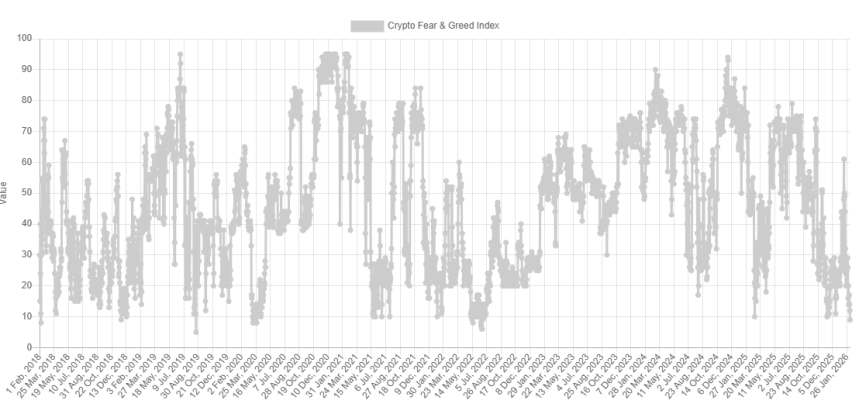

Cryptocurrency Market Update

Bitcoin rebounded from a 1.25-year low on Friday, surging over 11% and boosting stocks tied to cryptocurrencies. The digital asset is recovering after a sharp selloff that saw it drop more than 50% from its October peak. Data from Coinglass shows that investors withdrew $434 million from U.S. Bitcoin ETFs on Thursday, and approximately $2.1 billion in long crypto positions were liquidated in the past 24 hours.

Corporate Earnings Season Highlights

The fourth-quarter earnings season is underway, with over 150 S&P 500 companies reporting results this week. Earnings have generally supported stock prices, as 79% of the 293 companies that have reported so far have exceeded expectations. Bloomberg Intelligence projects S&P 500 earnings growth of 8.4% for Q4, marking the tenth straight quarter of year-over-year gains. Excluding the largest technology firms, earnings are still expected to rise by 4.6%.

Markets are currently pricing in a 19% probability of a 25 basis point rate cut at the next Federal Reserve policy meeting scheduled for March 17-18.

Global Markets and Economic Data

International equity markets ended the week with mixed results. The Euro Stoxx 50 advanced 1.23%, Japan’s Nikkei 225 rose 0.81%, while China’s Shanghai Composite slipped 0.25%.

Interest Rate Developments

March 10-year Treasury note futures ended Friday slightly lower, with yields rising to 4.202%. The pullback in Treasuries followed a strong rally in equities, which reduced demand for safe-haven assets. The unexpected improvement in consumer sentiment and hawkish remarks from Atlanta Fed President Bostic also weighed on bond prices.

European bond yields were mixed: Germany’s 10-year bund yield rebounded to finish unchanged at 2.842%, while the UK’s 10-year gilt yield dropped by 4.4 basis points to 4.514%.

European Economic Reports

- Germany’s industrial production for December fell 1.9% month-over-month, a larger decline than the expected 0.3% and the steepest drop in four months.

- German trade data was more positive, with December exports rising 4.0% (the biggest increase in four years) and imports up 1.4%, both beating forecasts.

- Swaps indicate only a 3% chance of a 25 basis point rate cut by the European Central Bank at its March 19 meeting.

Notable U.S. Stock Movers

- Semiconductor and AI infrastructure stocks rebounded, with ARM Holdings and Super Micro Computer both jumping over 11%, and Nvidia gaining more than 8%. Advanced Micro Devices, KLA Corp, Lam Research, and Marvell Technology each rose over 8%. Broadcom added more than 7%, Applied Materials over 6%, Seagate Technology over 5%, and both Intel and ASML Holding NV climbed more than 4%.

- Cryptocurrency-related stocks also surged as Bitcoin rallied. MicroStrategy soared over 26%, MARA Holdings jumped more than 22%, Riot Platforms rose over 19%, Galaxy Digital Holdings gained more than 16%, and Coinbase Global advanced over 12%.

- Bill Holdings surged more than 36% after reporting better-than-expected Q2 earnings and raising its full-year profit outlook.

- Roblox climbed over 9% following strong Q4 bookings and an upbeat full-year forecast.

- Gen Digital rose more than 7% after issuing a full-year earnings forecast above consensus.

- Caterpillar gained over 6% after receiving an outperform rating and a price target of $800 from CICC.

- Vistra Corp advanced more than 4% after Goldman Sachs upgraded the stock to buy with a $205 price target.

- Estee Lauder added over 2% after Citigroup upgraded the stock to buy with a $120 price target.

- On the downside, Molina Healthcare dropped more than 25% after posting an unexpected Q4 loss and issuing a weak full-year outlook.

- Stellantis NV fell over 23% after announcing charges of approximately 22.2 billion euros for the second half of 2025, double market expectations.

- Doximity slid more than 16% after forecasting full-year revenue below consensus.

- Illumina declined over 9% after reporting a Q4 gross margin below estimates.

- Amazon.com lost more than 5% after revealing its massive spending plans for AI infrastructure.

- Centene dropped over 3% after projecting full-year revenue below analyst expectations.

- Hims & Hers Health fell more than 2% after the FDA signaled it would crack down on companies marketing unauthorized copycat drugs, following Hims’ launch of a cheaper alternative to the Wegovy weight-loss pill.

Upcoming Earnings Reports (February 9, 2026)

Companies scheduled to report include: AECOM, Amentum Holdings, Amkor Technology, Apollo Global Management, Arch Capital Group, Becton Dickinson, Brixmor Property Group, Cincinnati Financial, Cleveland-Cliffs, CNA Financial, Corebridge Financial, Dynatrace, Kilroy Realty, Kyndryl Holdings, Loews, Medpace Holdings, ON Semiconductor, Principal Financial Group, Simpson Manufacturing, UDR, Vornado Realty Trust, and ZoomInfo Technologies.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

BlackRock bitcoin ETF options errupt in crash: Hedge fund blowup or just market madness?

Bitcoin Sentiment Worst Since 2022 Bear As Price Crash Continues

Corn Slips as the Weekend Approaches

Wheat Ends Lower on Friday