As market conditions shift, brokers have begun conducting stress tests

Freight Brokers Face New Challenges as Market Shifts

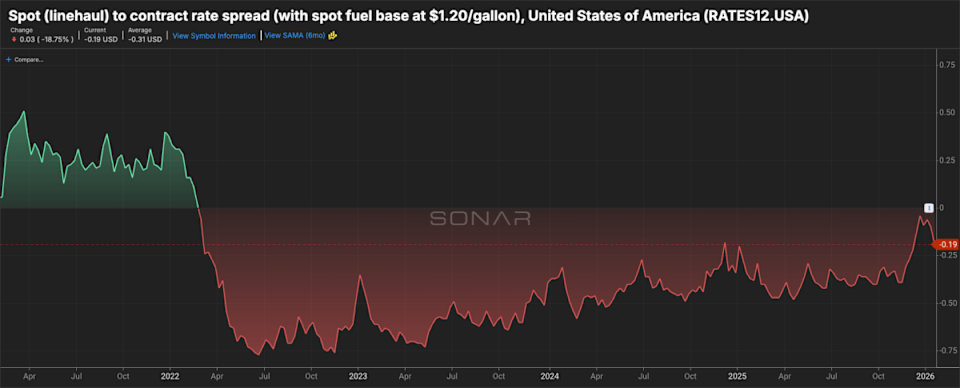

For nearly two years, the freight industry has been stuck in a prolonged slump, leaving brokers to navigate razor-thin profits and increasingly strict lending conditions. Now, with early signs pointing to a possible market rebound, recent updates from RXO and C.H. Robinson serve as a reminder: an improving market doesn’t necessarily mean smoother sailing for brokers.

In reality, the period of transition can be the most difficult, both financially and operationally.

RXO’s latest quarterly report highlights just how delicate broker margins remain. The company continues to grapple with downward pricing pressure, shrinking margins, and the ongoing challenge of managing carrier expenses while shippers remain cautious.

As John Kingston of FreightWaves notes, “Recent results illustrate what happens when the freight market strengthens abruptly, as it did in the last month of the quarter, forcing 3PLs to cover previously booked loads at higher spot rates.”

Brokers often encounter their greatest difficulties not at the market’s lowest point, but during the initial stages of recovery. RXO’s commentary reflects this trend. While capacity is still widely available, it’s no longer consistently inexpensive. Spot rates can rise rapidly, contract rates adjust more slowly, and brokers are left to choose between sacrificing margins or risking customer relationships.

This pressure is expected to intensify as 2026 progresses.

Key Pressure Points for Brokers

One of the most immediate risks in a rising market is the strain on working capital. As carrier rates climb faster than shippers’ contract adjustments, brokers must cover higher payments before they see increased revenue. Larger firms with stronger balance sheets can weather this, but it’s a significant challenge for others.

RXO addressed this issue by stressing the importance of disciplined pricing and careful lane selection. Their message was clear: not every load is worth pursuing during a market shift. Pursuing growth without protecting margins simply increases risk. According to RXO’s fourth-quarter report, “The bottom line GAAP net loss was $46 million in the fourth quarter. That was more than a $25 million GAAP net loss in the fourth quarter of 2024, and $14 million in the third quarter.”

Operationally, volatility favors brokers who maintain strong carrier partnerships and have real-time insight into pricing at the lane level. Those who rely too much on static models or broad averages risk mispricing freight and suffering the consequences later.

C.H. Robinson’s Distinct Approach

C.H. Robinson’s recent performance offers a sharp contrast.

Despite persistent challenges, Robinson’s leadership struck a more optimistic note during earnings calls. They emphasized gains in productivity, strict cost controls, and better execution. Investors responded positively, boosting the company’s stock even as overall freight conditions remained uncertain.

Strategic Adjustments at C.H. Robinson

Damon Lee, CFO of C.H. Robinson, commented that their North American Surfact Transport group remains on track to achieve a 40% target. He explained that decisions about expanding margins or reinvesting for growth would depend on the quality and sustainability of earnings improvements.

Robinson’s advantage isn’t just its size. The company has used the downturn to overhaul operations, invest in technology, and streamline its workforce to better match demand. This has given them the flexibility to handle short-term margin pressures without losing strategic momentum.

CEO Dave Bozeman added, “There may be changes in staffing as we shift toward a more customer-centric approach and automate many processes, especially those involving entry-level roles. In some cases, we’re not replacing departing staff.”

What Brokers Should Prioritize Now

As signs of recovery emerge, brokers should look beyond headline rate increases and focus on the underlying factors. Volatility at the lane level, the mix of customers, and the strength of carrier relationships will be more important than overall market trends.

Managing credit risk is also crucial. Shippers who are slow to raise rates may also delay payments, putting additional pressure on cash flow. Brokers who tighten credit policies or actively manage receivables may be better prepared if conditions become more challenging.

Ultimately, the experiences of RXO and C.H. Robinson highlight a key reality: the next phase of the market will reward those who execute well, not just those who are optimistic. The easy profits of previous upcycles are unlikely to return in the same way.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Dorsey’s Block cutting up to 10% of staff, Bloomberg News reports

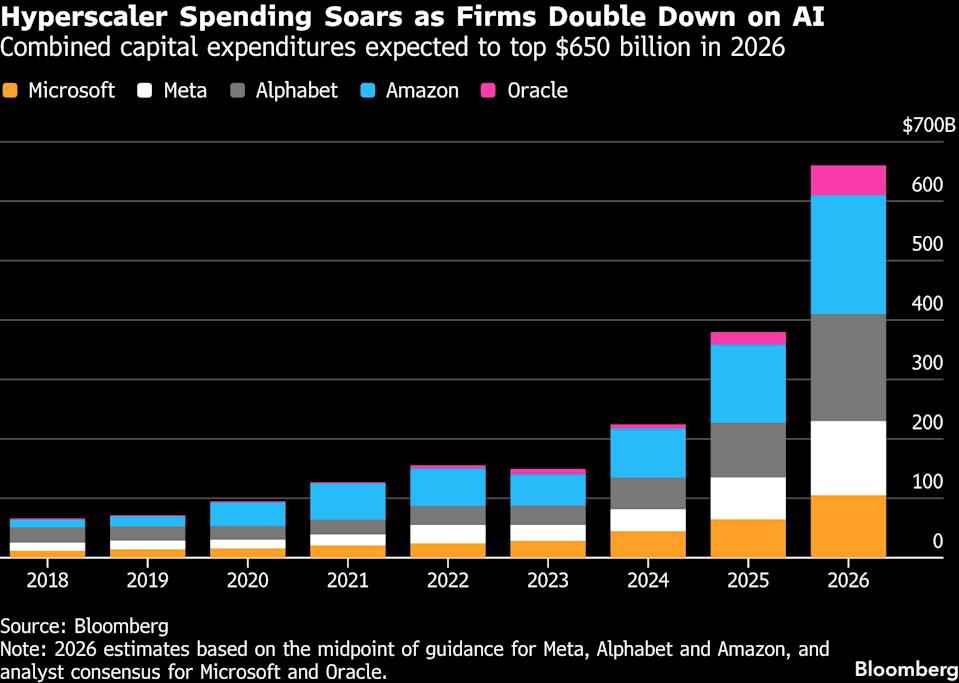

Tech’s aggressive move into AI could trigger a negative reaction in the bond market: Credit Weekly

Next Meme Coin Ready to Burst? Top 5 Tokens Poised for Green Candles This February