Tower Semiconductor Has Entered a Fresh AI Partnership with Nvidia. Is Now the Right Time to Invest in TSEM Shares?

Tower Semiconductor Partners with NVIDIA to Advance AI Data Centers

Tower Semiconductor (TSEM) has recently gained attention in the semiconductor industry by forming a significant partnership with NVIDIA (NVDA). This collaboration is focused on enhancing artificial intelligence (AI) data center infrastructure through the development of advanced silicon photonics technologies.

Announced on February 5, the agreement will see Tower scaling up AI infrastructure using 1.6T optical modules for data centers, specifically tailored for NVIDIA’s networking standards. This innovation is expected to potentially double data transfer speeds, addressing the critical challenge of high-speed connectivity in AI-powered computing environments.

Latest Updates from Barchart

The news of this partnership triggered a notable surge in TSEM’s stock price, highlighting increased investor enthusiasm for companies at the forefront of AI, data center expansion, and cutting-edge semiconductor solutions. With this momentum, investors are now considering whether TSEM remains an attractive buy, or if the current valuation already reflects the recent excitement.

Overview of Tower Semiconductor

Tower Semiconductor operates as a foundry specializing in high-value analog and mixed-signal integrated circuits, including silicon photonics, RF CMOS, SiGe, CMOS image sensors, and power management technologies. Based in Migdal HaEmek, Israel, Tower serves a broad range of industries, such as automotive, industrial, AI infrastructure, and communications. The company’s market capitalization stands at approximately $15.4 billion.

Over the last year, TSEM shares have delivered impressive results, driven by strong investor confidence in the company’s strategic position within the semiconductor sector. The stock has soared by 179.7% over the past 52 weeks.

In 2026, TSEM continued to trade at elevated levels, holding onto much of its previous gains. On February 3, the stock reached a new 52-week high of about $142.68, reflecting ongoing investor interest in the company’s advancements in next-generation semiconductor technology.

The recent collaboration with NVIDIA to expand 1.6T AI data center optical modules further boosted the stock, resulting in a 6.4% intraday increase on February 5. Year-to-date, TSEM is up by 18.4%.

Currently, TSEM trades at a premium compared to its industry peers, with a forward price-to-earnings ratio of 52.69.

Financial Highlights

Tower Semiconductor reported its third-quarter 2025 financial results on November 10, 2025. For the quarter ending September 30, revenue reached around $396 million, marking a 6.8% year-over-year increase and a 6% rise from the previous quarter.

Net income for Q3 2025 was $53.6 million, nearly matching the $54.6 million reported in Q3 2024. Adjusted earnings per share stood at $0.55, compared to $0.57 a year earlier. Gross profit remained steady at $93 million, similar to the previous year’s results.

Looking ahead, management has provided optimistic guidance, projecting fourth-quarter 2025 revenue of approximately $440 million, plus or minus 5%. If achieved, this would represent a 14% year-over-year increase and an 11% sequential gain.

The company is also investing an additional $300 million to expand its silicon photonics and SiGe operations, including the expansion of Fab 3, while ensuring full utilization of the facility. As part of this initiative, Tower is extending its lease at the Newport Beach site by up to 3.5 years beyond 2027.

Analysts anticipate earnings per share of about $1.85 for fiscal 2025, roughly flat compared to the previous year, but expect a 32.4% increase to $2.45 in fiscal 2026. Tower Semiconductor is set to announce its fourth quarter and full-year 2025 results on February 11.

Analyst Outlook for TSEM

In the past month, Benchmark raised its price target for Tower Semiconductor from $120 to $150, maintaining a “Buy” recommendation. The firm cited Tower’s leadership in RF infrastructure connectivity and its strong market share in key connectivity segments. Benchmark expects Tower’s competitive advantage to remain robust in the coming years, supported by its adaptable manufacturing model and ongoing capacity expansion.

Overall, TSEM holds a consensus rating of “Moderate Buy.” Of the five analysts covering the stock, three rate it as a “Strong Buy,” while two recommend holding.

With TSEM currently trading above the average analyst price target of $134, the highest target on the Street at $150 suggests there could still be an additional 7.9% upside.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Japan’s Nikkei surpasses 56,000 for the first time. Authorities issue caution over possible yen intervention.

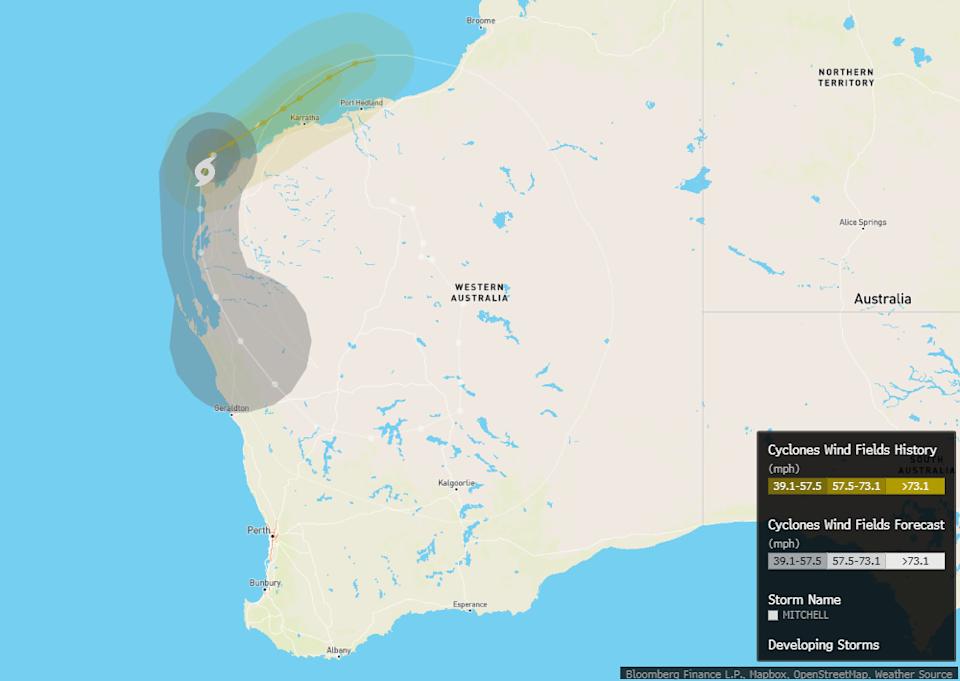

Major Australian iron ore port resumes operations as cyclone threat diminishes

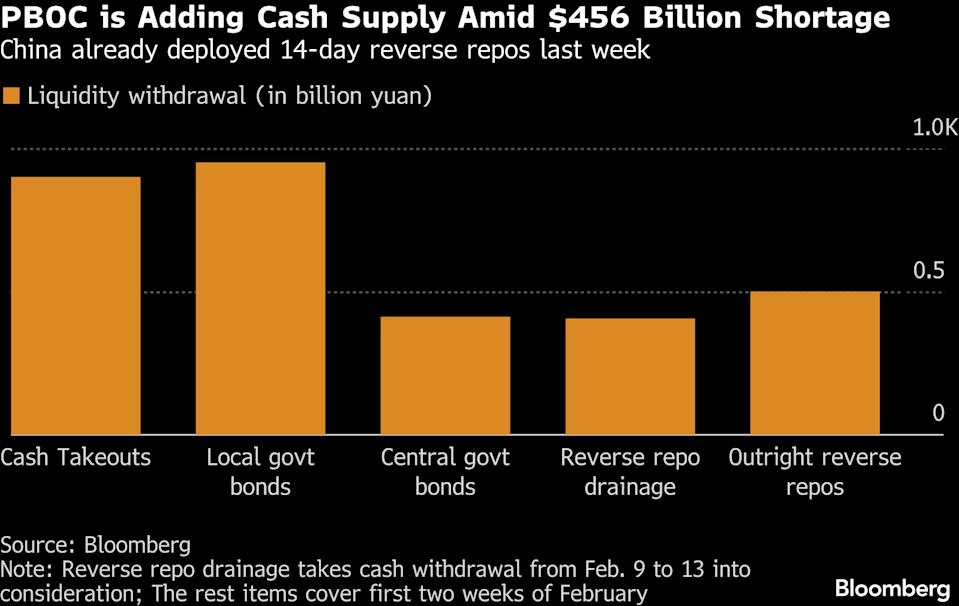

China Injects Funds to Address a $456 Billion Liquidity Gap

Oil Prices Fall as Lower Supply Threats Follow Eased Middle East Tensions