3 Undervalued Software Stocks Worth Buying During the Current Pullback

Software Stocks Face Historic Downturn, Presenting Unique Investment Opportunities

The software industry has recently experienced its steepest decline ever, opening doors for investors who can see beyond the current market turmoil. According to Jefferies, approximately 73% of software stocks are now considered oversold—a record high. The broader technology sector is also under pressure, with nearly 45% of companies reaching oversold levels.

Amid this widespread selloff, three companies—DocuSign (DOCU), Intuit (INTU), and Atlassian (TEAM)—distinguish themselves. Each is showing oversold signals on their RSI indicators while maintaining flawless 100% opinion scores from Barchart analysts.

This rare combination indicates that, despite heavy selling, analysts remain confident in these companies’ core strengths.

Related Stories from Barchart

Such resilience is uncommon, suggesting that Wall Street still sees solid fundamentals in these companies, even as their share prices are under pressure.

Let’s explore what sets each of these companies apart.

DocuSign: Leading the Way in Agreement Management

DocuSign’s shares have suffered alongside the broader software market, but CFO Blake Grayson highlighted at a recent Nasdaq investor event that the company’s long-term prospects are being overlooked.

DocuSign is advancing its Intelligent Agreement Management (IAM) platform, which streamlines everything from drafting to post-signature management of agreements. The company recently surpassed 25,000 IAM customers, a significant jump from 10,000 in April, marking rapid growth for a product introduced in mid-2025.

Grayson noted that DocuSign now manages 150 million consented agreements on its IAM platform, giving it a substantial data edge. When comparing public contract data searches to those using its own database, DocuSign achieved a 15-point improvement in recall precision.

“Using tools like ChatGPT can yield partially accurate results,” Grayson explained. “Our 15-point improvement is highly valuable and enhances the trust our clients place in DocuSign.”

The company now serves nearly 1.8 million customers, including around 275,000 direct sales clients. Importantly, IAM users are increasing their e-signature activity, creating a positive feedback loop that benefits both the IAM and e-signature businesses.

DocuSign has improved its dollar net retention rate from 98% two years ago to 102% today, mainly through better customer retention, as IAM is still too new to drive significant expansion.

Management anticipates the potential for high single-digit or even double-digit growth as IAM adoption rises and customer churn continues to decrease.

Among 20 analysts covering DOCU, six rate it a “Strong Buy” and 14 suggest “Hold.” The average price target is $85.12, well above its current price of about $46.

Intuit: Harnessing AI to Revolutionize Tax and Financial Services

Mark Notarainni, head of Intuit’s consumer platform, recently discussed at the Barclays conference how artificial intelligence is transforming products like TurboTax and Credit Karma, broadening the company’s reach. Intuit began its journey as an AI-first platform seven years ago, long before AI became mainstream, and that foresight is now yielding significant benefits.

- TurboTax reduced tax preparation time by 12% last year by using AI to tailor the process and present only relevant questions.

- The company expects further improvements this tax season, aiming to integrate AI into 90% of its offerings.

- The assisted tax segment represents a vast opportunity, with 88 million Americans still relying on assistance to file taxes, representing a $37 billion market.

- AI is helping Intuit’s experts serve more clients efficiently by automating routine tasks.

- Developers at Intuit are now 40% more productive with AI, enabling faster product development, such as business tax solutions.

- Intuit projects $135 million in efficiency gains this year, allowing it to support more customers.

- Credit Karma is rolling out AI-powered tools, including a refund assistant, a debt assistant that operates year-round, and Credit Spark, which helps Gen Z users improve their credit scores by analyzing spending habits.

- The platform boasts 43 million monthly active users among 140 million members, providing numerous opportunities for engagement beyond the tax season.

Of the 31 analysts following INTU, 20 rate it a “Strong Buy,” three a “Moderate Buy,” seven a “Hold,” and one a “Strong Sell.” The consensus price target is $800, compared to the current price of about $435.

Atlassian: Securing Long-Term Customer Commitments

Atlassian recently surpassed $6 billion in annualized revenue and achieved its first $1 billion cloud revenue quarter, a 26% increase year-over-year. However, the most telling sign of its momentum is the 44% year-over-year growth in remaining performance obligations, which now total $3.8 billion.

During the February earnings call, CEO Mike Cannon-Brookes highlighted that three consecutive quarters of accelerating RPO growth indicate customers are making multi-year commitments to Atlassian’s platform, looking well beyond 2026.

“We’re seeing tens of thousands of seats signing multi-year deals, not just for 2026, but for 2027, 2028, and 2029,” Cannon-Brookes said.

In the second quarter, Atlassian closed a record number of contracts exceeding $1 million in annual value, nearly doubling the previous year’s total. The Rovo AI platform now has over 5 million monthly active users, and more than 1,000 customers have upgraded to the Teamwork Collection, purchasing over 1 million seats.

Data shows that AI is driving increased usage of Jira, not replacing it. Teams using AI-powered code generation tools are creating 5% more tasks, have 5% more monthly active users, and are expanding Jira seats 5% faster than those not using such tools. Cloud net revenue retention has remained at 120% for three consecutive quarters, indicating that existing customers are deepening their commitments even in a challenging market.

Of the 28 analysts covering TEAM, 20 rate it a “Strong Buy,” one a “Moderate Buy,” and seven a “Hold.” The average price target is $217.40, compared to the current price of about $98.

Conclusion

While software stocks are still trading at high valuations—around eight times sales—this does not signal a blanket buying opportunity for the entire sector. However, DocuSign, Intuit, and Atlassian combine technical oversold signals with robust analyst support and improving business fundamentals, indicating that the recent downturn has created genuine value in these names.

The challenge for investors is to separate stocks that are undervalued for good reason from those where market fear has caused prices to disconnect from underlying business performance.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

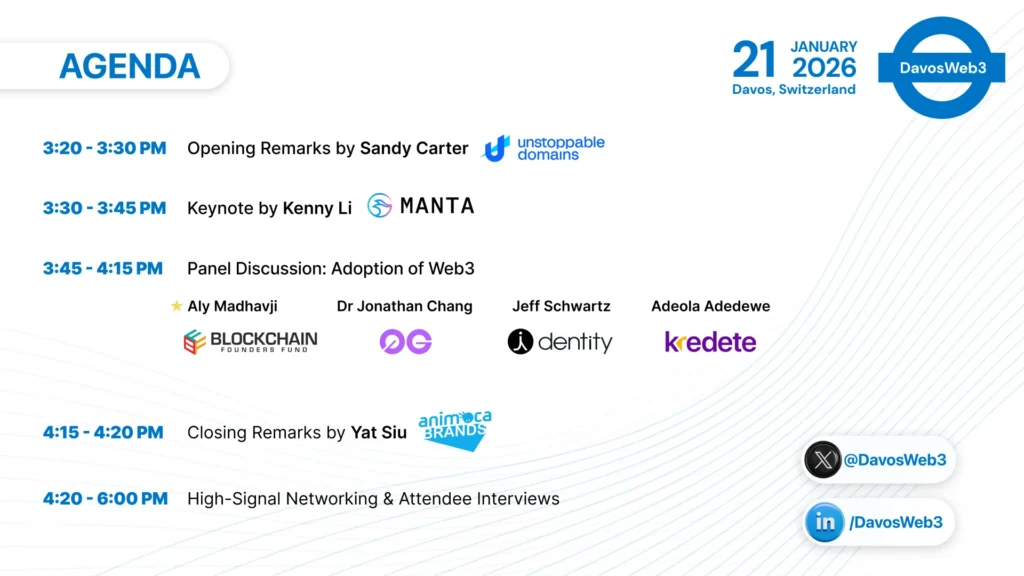

DavosWeb3 2026: Leaders Converge to Drive Responsible Web3 Adoption and Global Impact

Pandemonium Hits XRP: Critical Price Predictions You Need to Know

Cryptos Brace For Volatility As Fed Decisions Loom

Explainer – Why is Bitcoin under so much sell pressure right now?