Butterfield Bank (NTB) Q4 Results: Anticipated Outcomes

Butterfield Bank Set to Announce Earnings: What Investors Should Know

Butterfield Bank, an offshore financial institution listed on the NYSE under the ticker NTB, is scheduled to release its latest earnings report this Monday after the closing bell. Here’s a breakdown of what to expect from the upcoming announcement.

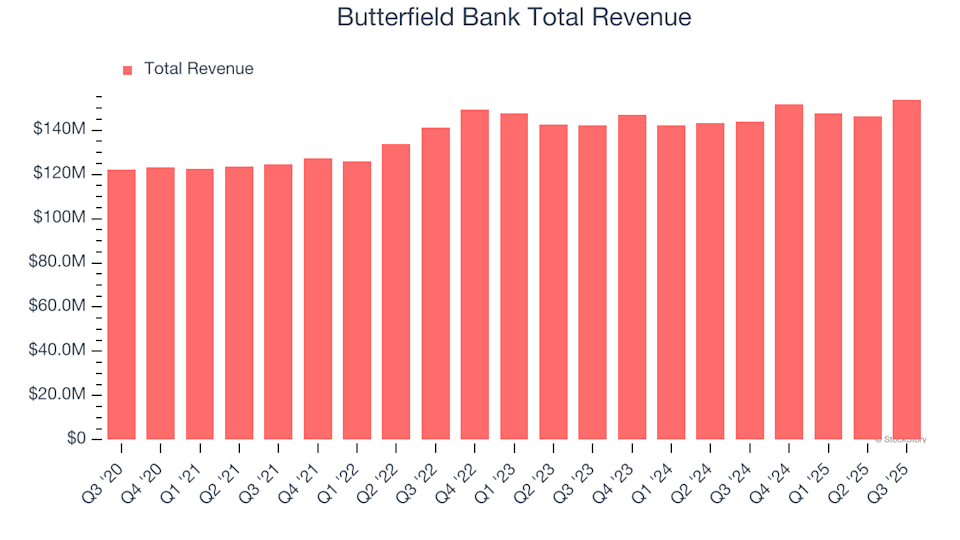

In the previous quarter, Butterfield Bank delivered a robust performance, surpassing revenue forecasts by 3.9% with reported revenues of $153.9 million—a 6.8% increase compared to the same period last year. The company not only exceeded revenue projections but also outperformed analysts’ expectations for earnings per share.

Analyst Projections for the Quarter

For this quarter, market analysts anticipate Butterfield Bank’s revenue will reach $153.5 million, representing a modest 1.1% year-over-year growth—a slower pace than the 3.4% increase seen in the same quarter last year. Adjusted earnings per share are expected to come in at $1.47.

Over the past month, analysts have largely maintained their forecasts, indicating confidence in the bank’s steady performance. Notably, Butterfield Bank has consistently outperformed Wall Street’s revenue estimates for the past two years, with an average beat of 3.3% each quarter.

Regional Banking Sector Insights

Looking at other regional banks for context, some peers have already shared their fourth-quarter results. Merchants Bancorp saw its revenue decline by 4.4% year over year but still surpassed analyst expectations by 7.8%. UMB Financial, on the other hand, reported a significant 67.5% jump in revenue, beating estimates by 7%. Following these announcements, Merchants Bancorp’s stock climbed 15.7%, while UMB Financial’s share price remained steady.

Market Sentiment and Price Targets

Investor confidence in the regional banking sector has been positive, with average share prices rising 7.9% over the past month. Butterfield Bank’s stock has gained 5.5% during this period. Heading into earnings, the average analyst price target for Butterfield Bank stands at $50.67, compared to its current price of $53.06.

Special Report: The Future of Enterprise Software Stocks

Many newer investors may not be familiar with the classic investment strategies outlined in “Gorilla Game: Picking Winners In High Technology,” published over two decades ago when tech giants like Microsoft and Apple were emerging. Applying those timeless principles today, enterprise software companies harnessing generative AI could become tomorrow’s industry leaders. In this spirit, we invite you to explore our exclusive free report on a rapidly growing, profitable enterprise software company that is capitalizing on automation and poised to benefit from the next wave of generative AI.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

High-Risk, High-Reward: 5 Crypto Coins Worth the Risk in This Market Cycle with 100X Potential

Block Layoffs: Jack Dorsey’s Firm Announces Devastating 10% Workforce Cut

Cryptocurrency Investor Sentiment Plummets as Google Searches Hit Alarming Yearly Low

Vitalik Buterin Says Most DeFi Is a Lie—Here’s What Really Counts