As Bitcoin declines roughly 50% from its all-time high, dragging the entire market into a state of extreme fear, corporate giants are doubling down. Metaplanet, often referred to as “Asia’s MicroStrategy,” has reaffirmed its Bitcoin-first strategy despite the carnage.

CEO Simon Gerovich recently stated that there is no change to the company’s approach, promising to steadily accumulate Bitcoin even as the firm’s stock tumbles and its treasury sits on huge unrealized losses. This steadfastness highlights the risks of holding mature, volatile assets during a bear market cycle.

But for smaller investors, the ability to pivot into high-growth early-stage token launches that are uncorrelated with the current market crash is very important. Projects like Vortex FX ($VFX), EarnBIT ($EBT), EarnPark, and EscapeHub ($ESCAPE) are emerging as notable contenders among new crypto assets.

Metaplanet and the market crash

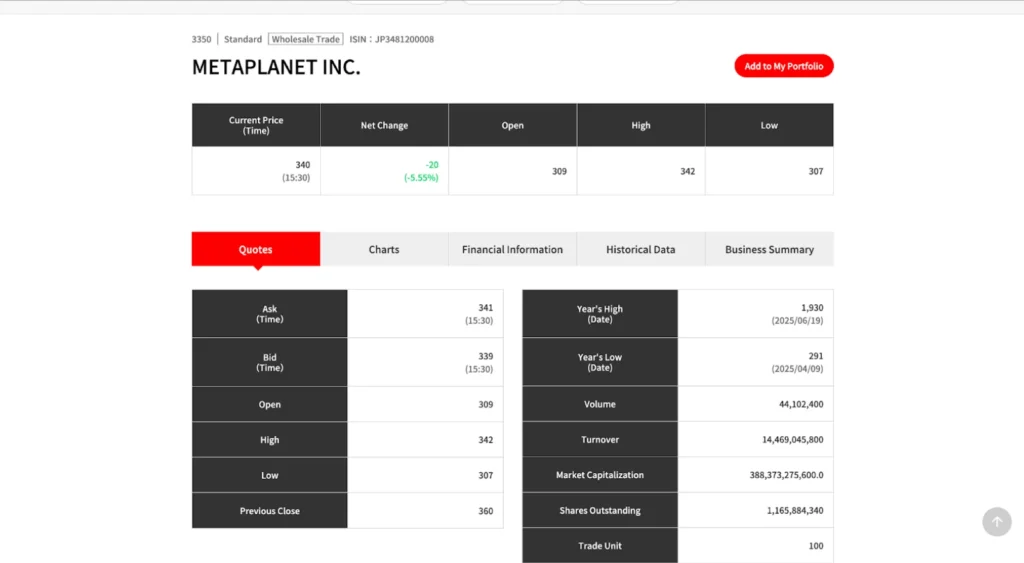

Doubling down on a Bitcoin-first strategy while the wider market suffers its worst drawdown in years is a bold move, but it comes with high costs. Metaplanet’s stock on the Tokyo Stock Exchange closed down 5.56% on February 6th, reflecting investor anxiety.

The corporate crypto whale, ranked fourth among public Bitcoin treasury companies, is now sitting on unrealized losses as Bitcoin trades roughly 50% below its October 2025 all-time high of $126,080.

The pain is widespread. Over $1.8 billion of crypto long positions were liquidated in a single day, and the Crypto Fear & Greed Index has fallen to levels not seen since the Terra Luna collapse. Even Strategy, the largest public holder of Bitcoin, logged a $12.4 billion net loss in the fourth quarter of 2025.

Smart investors have already moved beyond the current crypto market crash and are seeking new growth opportunities in the digital asset space.

1. DeepSnitch AI ($DSNT): Exploring growth potential

Among new digital asset projects, DeepSnitch AI is gaining attention for showing resilience during the global market downturn. While billions are wiped off the market cap of major coins, DeepSnitch AI continues to accelerate, having successfully raised more than $1,500,000.

With the token price currently set at $0.03906, early investors have already secured paper gains exceeding 153%. The community’s conviction is huge, with over 34 million tokens staked in the protocol, locking up a significant portion of the supply.

The true power of DeepSnitch AI lies in its strategic decision to implement a postponed launch. Access Asymmetry grants eligible participants exclusive use of the platform’s live tools, such as SnitchScan and SnitchGPT, offering advanced data for informed decisions.

Maturity Asymmetry gives early adopters the time to master the system’s signals, building a non-transferable edge. Finally, Timing Asymmetry offers an opportunity to buy a mature product at an attractive entry valuation.

Consider a hypothetical $10,000 investment at the current price, resulting in 260,109 DSNT tokens. If DeepSnitch AI meets rising demand and the token price appreciates significantly, that initial investment could result in considerable returns. Such upside potential is why many highlight DeepSnitch AI as a project to watch for aggressive growth.

2. Vortex FX ($VFX)

Vortex FX stands out as a project aiming to provide access to the vast forex market. Its token launch began in September 2025 and has attracted substantial investor interest so far. The native token acts as an interface for staking rewards as well as other platform benefits.

What places Vortex FX among projects of interest is its reported connection to an existing trading business executing over 1,500 lots per day.

They also state that a significant portion of monthly trading revenue is directed toward staking rewards and token buybacks, giving the project a yield component not always present in similar launches.

3. EarnBIT ($EBT)

EarnBIT introduces a combination of crypto exchange features with live streaming. The aim is to integrate content consumption and trading activity on a single platform.

Content creators can earn rewards in the native $EBT token, which supports a growing creator economy in the exchange’s ecosystem. The project is reportedly in its first stage of a four-phase rollout, offering initial entry opportunities.

While EarnBIT presents an intriguing early-stage opportunity, it may carry higher execution risks compared to established utility tools like DeepSnitch AI, which can serve traders across exchanges, indicating a wider scalability potential.

4. EarnPark

EarnPark offers a combination of DeFi and CeFi services, enabling users to earn interest on digital assets while bridging traditional and decentralized finance. The project is noted for having an established operation and infrastructure.

Information from the team suggests that the company is based in the UK and is working to maintain a secure and globally accessible platform.

With more than $20 million in assets under management, EarnPark seeks to solve high entry barriers and complexity often associated with DeFi. However, investors looking to recover from a market downturn may seek higher risk-return multipliers.

This is where DeepSnitch AI offers a different value proposition, aiming for capital appreciation opportunities that could outpace the more modest returns of yield-focused platforms.

5. EscapeHub ($ESCAPE)

This platform enables creation of DeFi tokens with greater ease and no required coding skills. EscapeHub provides tools for wallet analysis, DEX data aggregation, and promotional support for users.

The project states it has undergone multiple audits and applies a progressive price increase model, which may reward early buyers. Nevertheless, the regulatory landscape presents challenges for new token issuances.

While EscapeHub offers utility for those launching new tokens, regulatory hurdles may impact its adoption. On the other hand, DeepSnitch AI provides tools for navigating regulatory changes, reinforcing its relevance in the evolving crypto market.

The bottom line

DeepSnitch AI offers intriguing upside potential, aiming to turn small investments into significant gains. The project is highlighted for its features and potential growth in the digital asset market.

FAQs

What new digital asset project stands out during the market crash?

DeepSnitch AI ($DSNT) is seen as a standout project, providing intelligence tools that are in demand and aiming to offer growth potential during market volatility.

How do I find promising upcoming crypto projects?

To find promising upcoming crypto projects, look for those with active products, a strong community, and a transparent team.

Is Vortex FX a safe bet among early-stage projects?

Vortex FX is considered a notable contender among early-stage projects due to its revenue model and reported audits.

Can DeepSnitch AI achieve significant growth?

DeepSnitch AI is considered to have potential for significant growth driven by strong community engagement and unique platform features.

What differentiates DeepSnitch AI from EarnBIT or EarnPark?

While EarnBIT and EarnPark serve specialized markets, DeepSnitch AI is designed to provide broad-based market intelligence for traders, making it attractive for those seeking scalability and higher growth.