As Bitcoin slides deeper below recent cost bases, weak hands are capitulating. However, smart money might just be repositioning, rather than retreating.

Loss realization accelerated as Bitcoin [BTC] corrected by nearly 40–50% from its $126,000 peak to the $70,000-zone in the recent days, triggering fear-driven distribution. Retail and Short-Term Holders led the capitulation, dumping into losses as long liquidations cascaded across derivatives markets.

Panic intensified as the Fear & Greed Index sank to 5–20 too. All while liquidity thinned and amplified downside volatility.

Markets reacted with compressed depth and sharp downward wicks. Still, dip accumulation and institutional absorption emerged as countermeasures, stabilizing the sentiment slightly while traders remained defensively bearish.

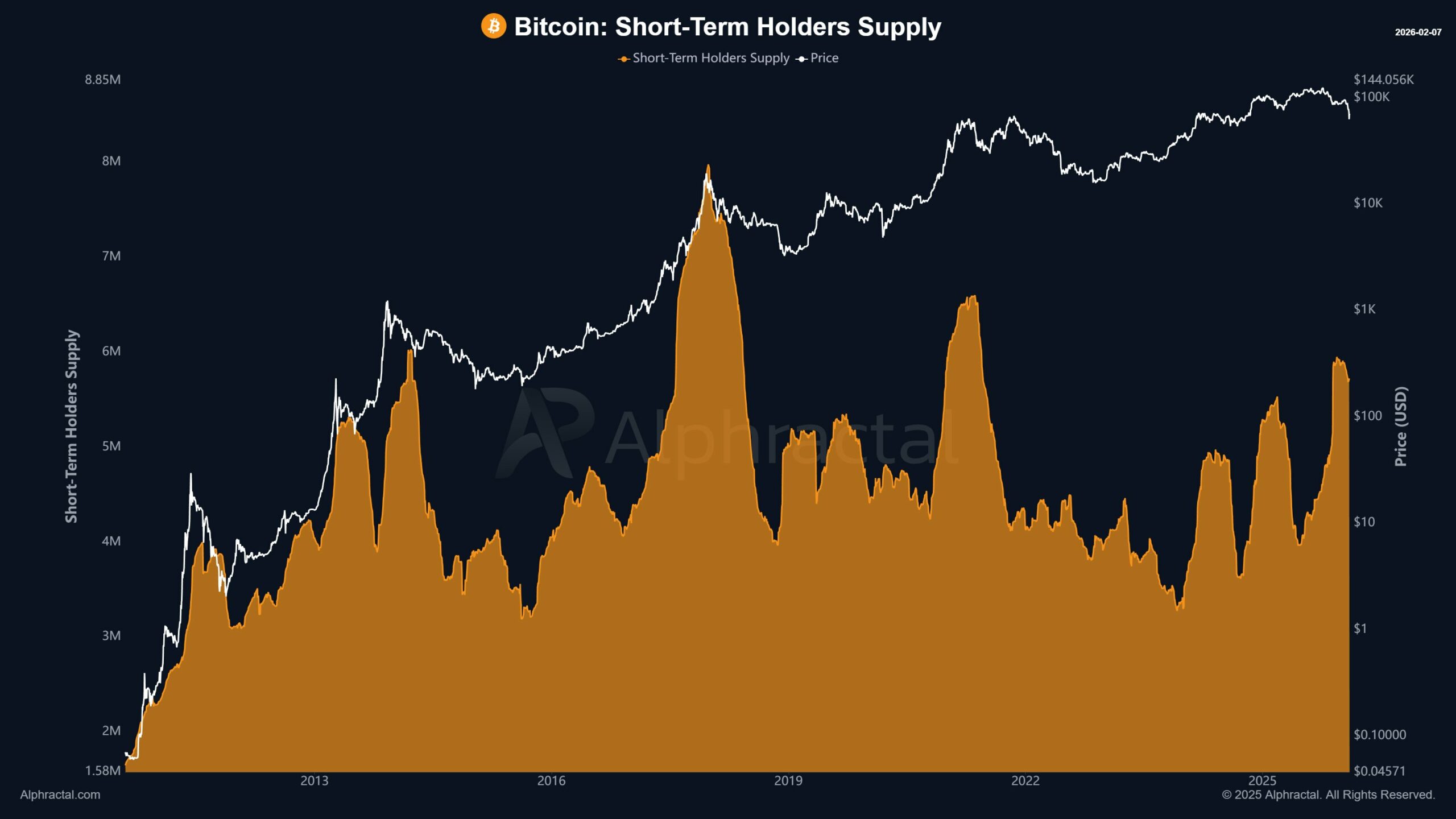

Short-Term holder supply contracts as new demand fades

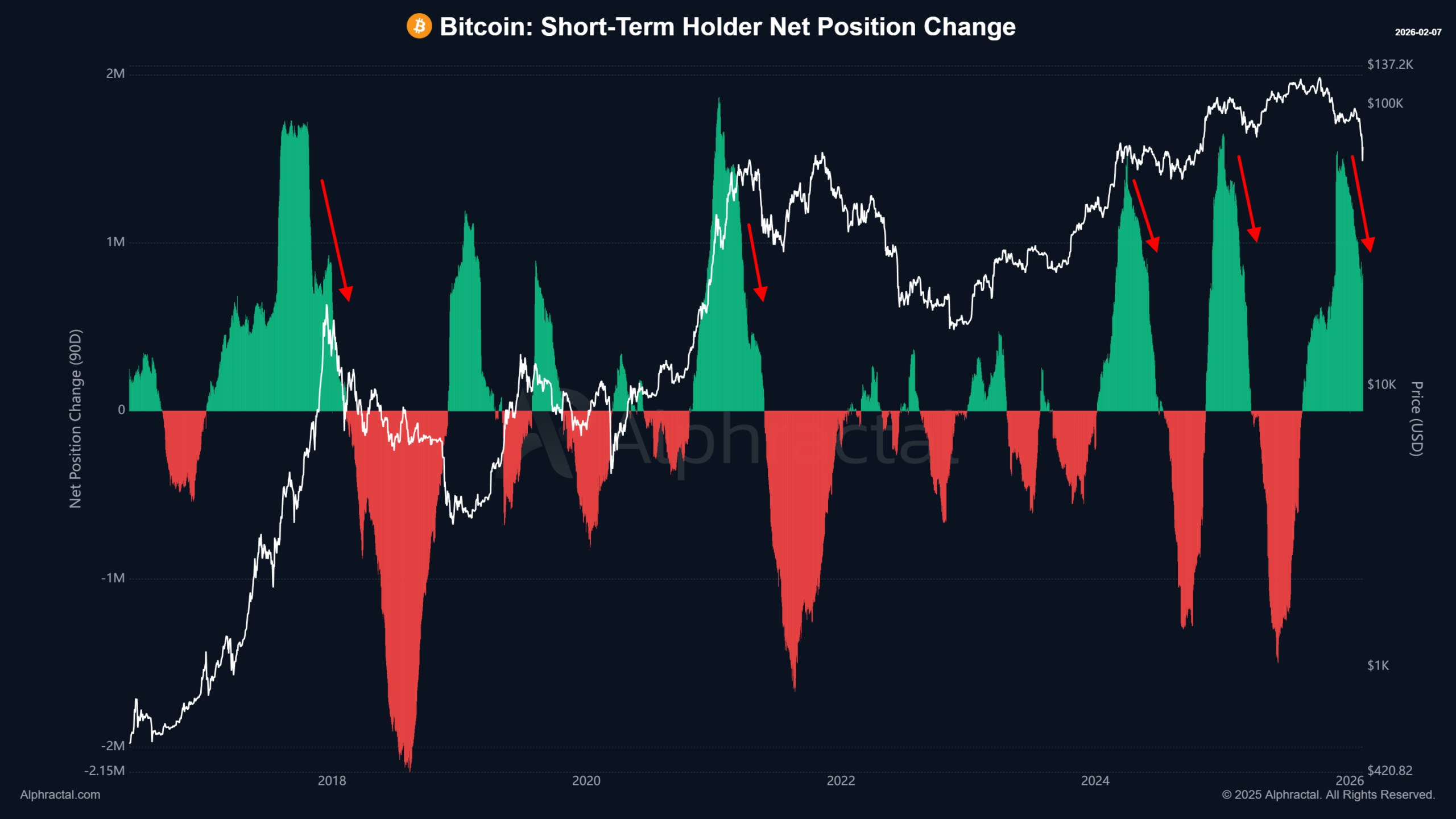

Short-term holder dynamics have now extended the prior capitulation and whale divergence phase.

Initially, the STH supply expanded during the late-cycle rally, peaking near 8 million BTC as speculative demand surged. However, as the price corrected towards the $60,000–$70,000 band, distribution followed. The supply contracted steadily too, reflecting forced exits and loss realization.

Simultaneously, the 90-day net position change flipped deeply negative, with drawdowns nearing -1.5 million to -2 million BTC across cycles.

These developments signaled fading participation from new entrants. Retail accumulation stalled while underwater holders de-risked themselves.

That’s not all though as market liquidity thinned alongside this withdrawal. Without fresh inflows, upside continuation lost structural support. Instead, the data seemed to point to absorption and base-building. Hence, recovery now hinges on renewed demand, improved sentiment, and sustained positive net positioning.

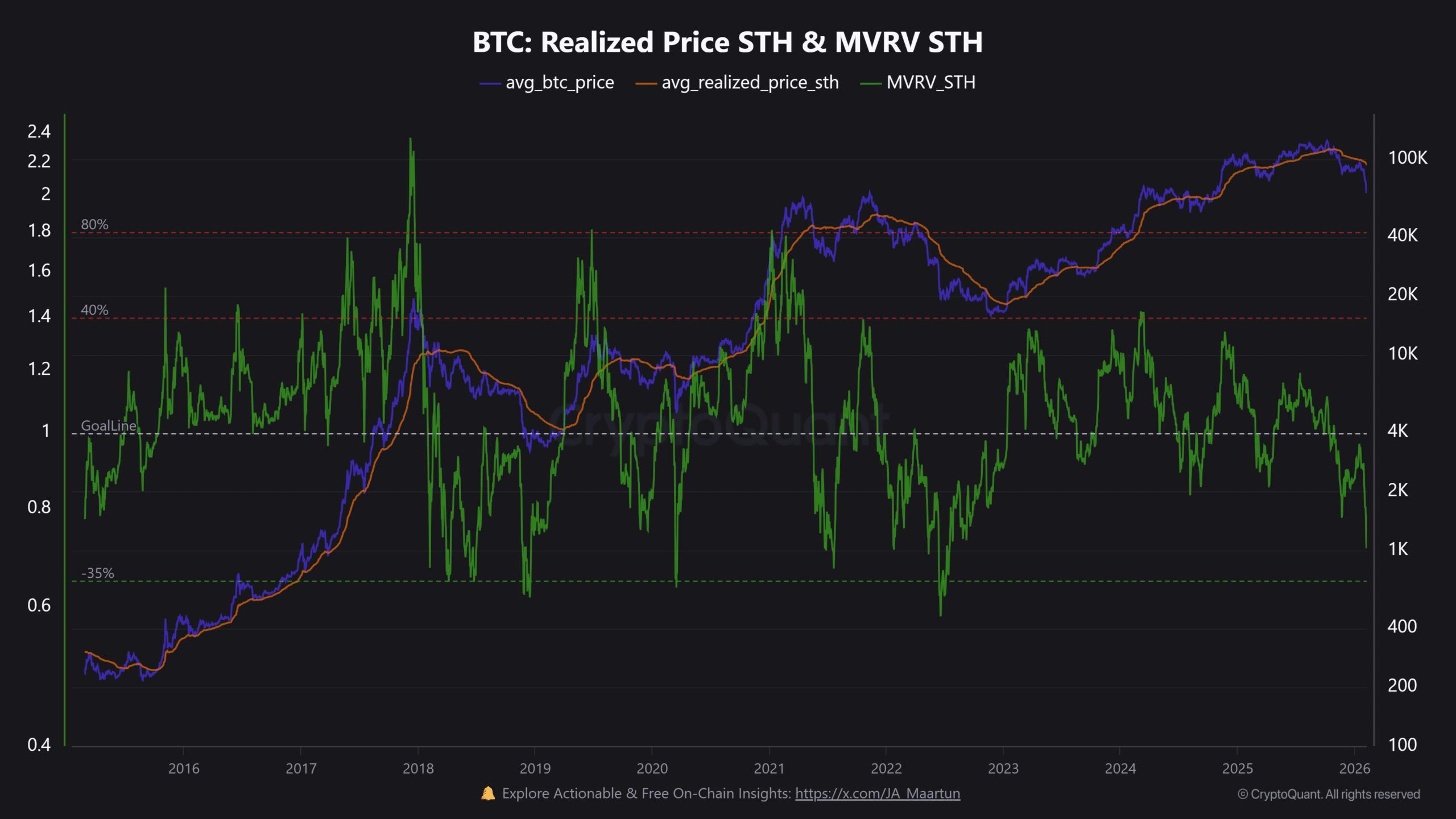

Building on the prior supply contraction and distress flows, cost-basis stress remains the core driver. At the time of writing, Bitcoin was valued at just above $69,000. Since the STH realized price has been holding at around $92,000–$92,500, recent buyers have been left underwater.

As this gap widened, the profitability compressed further. The STH-MVRV slid to about 0.75–0.78, confirming deep unrealized losses. Selling pressure followed as underwater holders de-risked themselves. Market sentiment weakened alongside this stress too.

Historically, such sub-1.0 MVRV zones mark washout phases. Thus, stabilization will now depend on the MVRV recovering towards 1.0 and the price reclaiming the cost basis. If loss flows taper while the price bases, capitulation could exhaust itself, allowing structure to rebuild gradually.

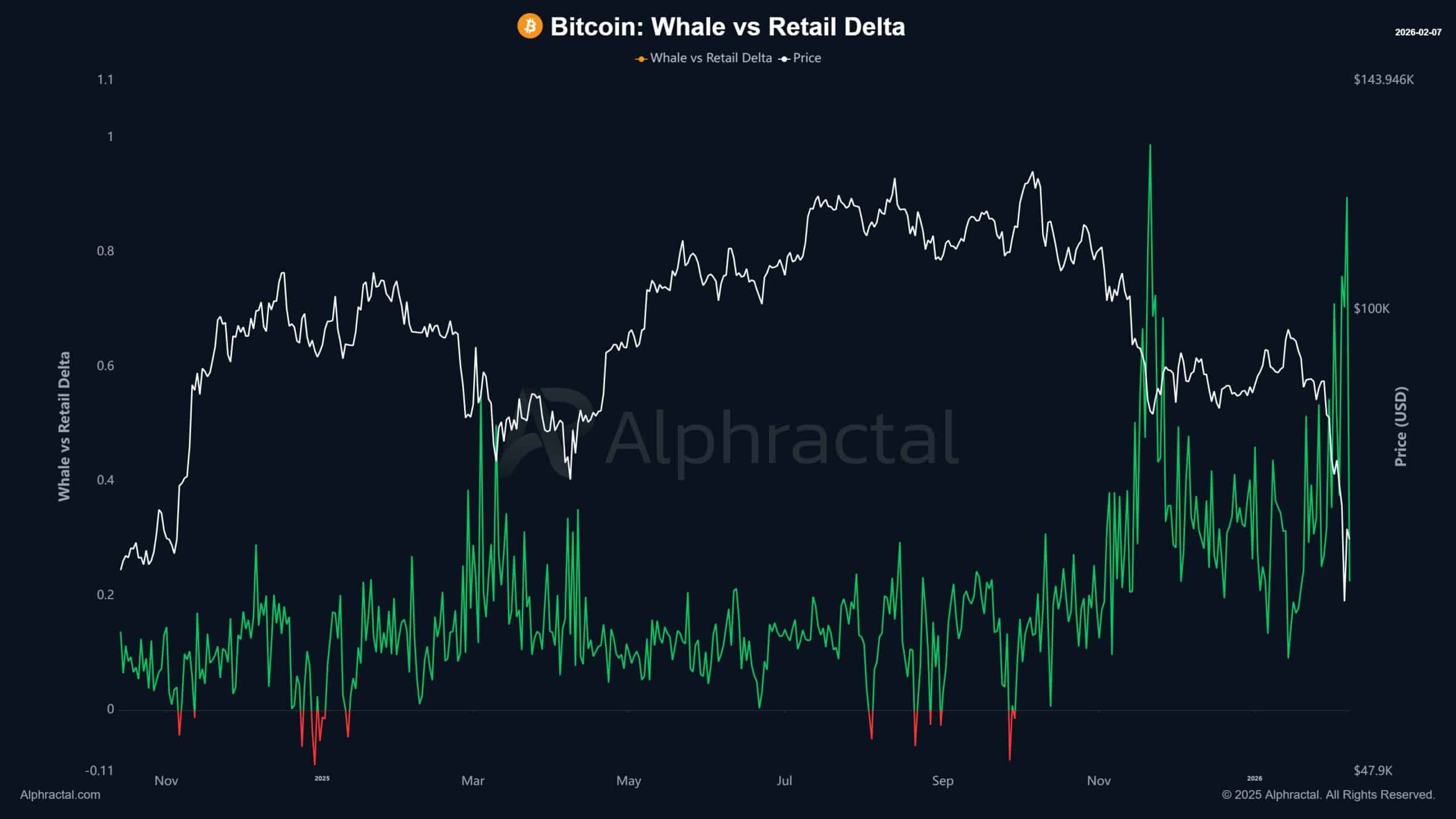

Retail optimism collides with whale caution

Whale positioning seemed to be reinforcing the structural shift too. As BTC stabilized near $69,000 after heavy loss realization, the whale vs. retail Delta spiked above 0.8 – A sign that large players have been closing longs while opening shorts.

This rotation followed cost-basis compression and weakening upside momentum. Whales aimed to hedge exposure and engineer consolidation, rather than chase recovery.

Meanwhile, retail flows remained directionally long, driven by dip-buy optimism and rebound expectations. Such a divergence widened the positioning imbalance.

As smart money de-risked into strength, volatility compressed and upside follow-through weakened. Consequently, market structure tilted towards range formation, reinforcing a near-term consolidation regime.

Final Thoughts

-

Retail capitulation has been accelerating as STH supply contracts and cost-basis stress deepened.

-

Whale hedging and short positioning into weakness hinted at consolidation risk, leaving Bitcoin vulnerable to one final downside liquidity sweep.