Inflation, Corporate Profits, and Other Major Events to Monitor This Week

This Week’s Market Outlook: Key Events and What to Watch

This week brings a condensed schedule of major economic updates, with a rare mid-week employment report set for Wednesday at 8:30am, quickly followed by Friday’s January Consumer Price Index (CPI) release. This unusual timing means investors will have little opportunity to react between the labor market update and the crucial inflation data, intensifying the challenge of interpreting the latest trends in price pressures and economic momentum.

On Tuesday, the December retail sales report will offer a final look at holiday shopping activity and provide clues about consumer spending strength as 2026 begins. The week’s earnings announcements are diverse, featuring technology heavyweights like Cisco (CSCO) on Wednesday and Arista Networks (ANET) on Thursday, which will shed light on demand for networking equipment. Major consumer brands such as McDonald’s (MCD), Coca-Cola (KO), Shopify (SHOP), and Airbnb (ABNB) are also set to report, offering a broad perspective on different sectors. Meanwhile, Treasury auctions on Wednesday and Thursday will gauge investor demand for longer-term government bonds amid ongoing uncertainty about Federal Reserve leadership and persistent inflation worries.

Five Major Market Themes to Monitor This Week

1. Wednesday’s Employment Report: A Mid-Week Labor Market Check

The January jobs report, released Wednesday morning, compresses the time between labor market data and Friday’s inflation figures, creating a unique scenario for investors. Key metrics such as nonfarm payrolls, unemployment rate, and wage growth will be closely examined for signs of either a cooling or resilient job market—factors that will shape the policy landscape for the incoming Federal Reserve chair. Wage trends are particularly significant, as robust increases could reinforce inflation concerns, while moderation would support hopes for easing price pressures. Thursday’s initial jobless claims will provide further context on weekly employment trends. With major corporate earnings also landing mid-week, markets may see heightened volatility if economic signals diverge. Strong job numbers paired with elevated inflation could weigh on interest-rate sensitive sectors, while softer employment and subdued inflation might encourage expectations for a more accommodative Fed, despite leadership uncertainty.

2. Retail Sales: Gauging Consumer Strength

Tuesday’s December retail sales data will serve as a comprehensive review of holiday spending and set the tone for consumer momentum in early 2026. Analysts will scrutinize both headline and core figures to determine whether households are maintaining spending levels or beginning to cut back in the face of economic headwinds, higher prices, and market volatility. This report will help clarify whether a strong labor market is translating into continued consumer activity or if inflation and slower income growth are prompting caution. Earnings from Coca-Cola (KO), Ford (F), and Spotify (SPOT) on Tuesday, McDonald’s (MCD) on Wednesday, and Airbnb (ABNB) on Thursday will provide additional insights into consumer behavior across various industries, from beverages and autos to dining and travel.

3. Enterprise Technology and Cloud Infrastructure Trends

Results from Cisco (CSCO) on Wednesday and Arista Networks (ANET) on Thursday will offer a window into corporate technology spending and data center investment, especially as questions linger about the durability of AI-driven growth. Cisco’s earnings will be analyzed for signals on IT budgets, demand for network hardware, and cybersecurity adoption, as well as commentary on AI infrastructure needs. Arista’s performance, with its strong ties to cloud service providers, will be particularly telling for hyperscale data center investment trends. Forward-looking guidance from both companies will help investors assess whether the AI infrastructure buildout is set to continue or if growth is plateauing. Positive surprises could help stabilize tech sector sentiment, while disappointing results may deepen concerns about the sector’s outlook.

4. Digital Platforms and Fintech in Focus

This week also features earnings from several fast-growing digital platforms. Robinhood (HOOD) will report on Tuesday, providing updates on retail trading activity, cryptocurrency transactions, and the sustainability of its business model. Shopify (SHOP) and AppLovin (APP) will release results on Wednesday, highlighting trends in e-commerce and mobile gaming advertising. Coinbase (COIN) will report Thursday amid ongoing crypto market swings and regulatory uncertainty. Additional perspectives will come from Cloudflare (NET) and Gilead Sciences (GILD) on Tuesday, and Agnico Eagle Mines (AEM) on Thursday, offering views on cloud infrastructure, pharmaceuticals, and gold mining. The breadth of these reports will help investors gauge which digital business models are maintaining momentum and which may be slowing as the year unfolds.

5. Friday’s CPI: The Inflation Watch Continues

The January Consumer Price Index, due Friday morning, is one of the most anticipated data releases of early 2026. Investors will be watching both headline and core inflation numbers to determine whether December’s elevated reading was a one-off or the start of a new upward trend. Key areas of focus include energy, housing, and especially services inflation, which has proven stubbornly high. The close timing of the CPI report after the jobs data could trigger sharp market moves, particularly if both reports point to persistent economic strength. A strong inflation print following robust employment numbers could unsettle rate-sensitive sectors and complicate policy decisions for the incoming Fed chair. Conversely, signs of easing inflation and a softer labor market may provide relief for risk assets. Bond auctions mid-week will further illuminate how fixed income markets are pricing inflation and growth risks.

Wishing you a successful week ahead. For more insights, be sure to check out my daily options commentary.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Japan’s Nikkei surpasses 56,000 for the first time. Authorities issue caution over possible yen intervention.

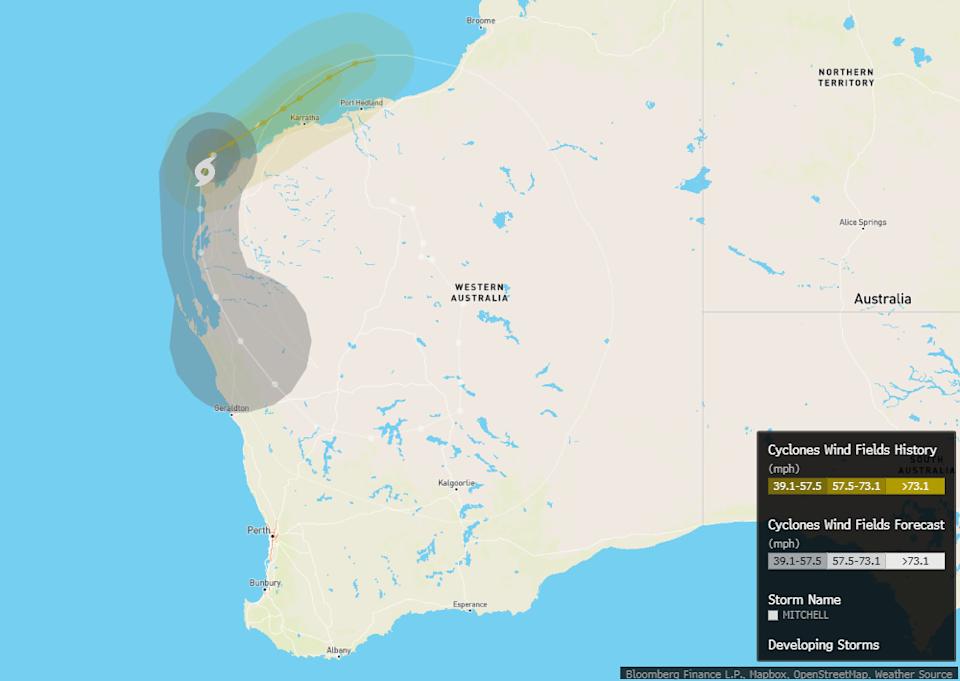

Major Australian iron ore port resumes operations as cyclone threat diminishes

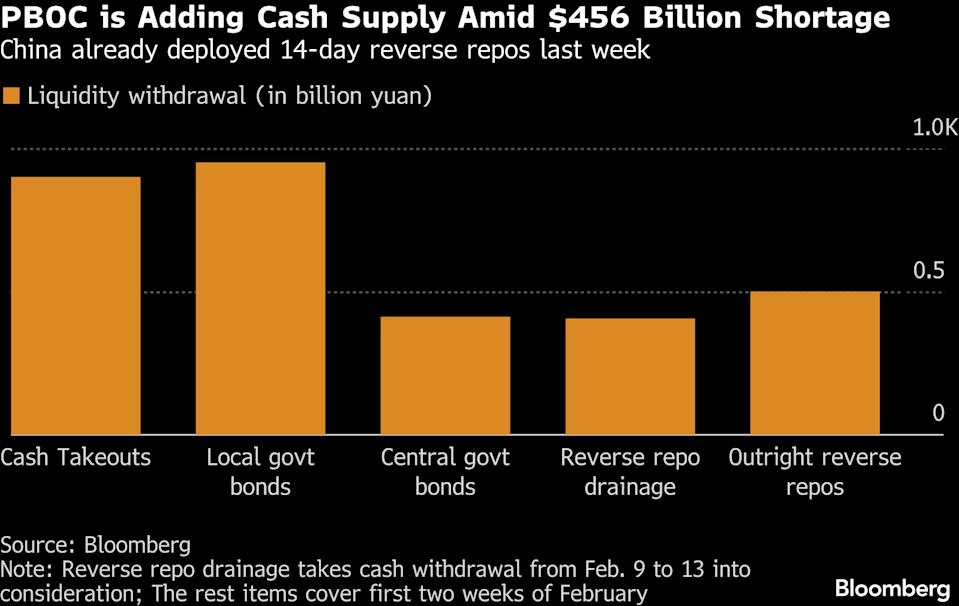

China Injects Funds to Address a $456 Billion Liquidity Gap

Oil Prices Fall as Lower Supply Threats Follow Eased Middle East Tensions