Tom Lee’s BitMine Adds Another $42 Million in Ethereum Despite Crypto Winter

By:BeInCrypto

BitMine, the largest corporate holder of Ethereum, has capitalized on the digital assets recent price volatility to expand its treasury holdings. On February 7, blockchain analysis platform Lookonchain reported the transaction, citing data from Arkham Intelligence. The firm acquired approximately 20,000 ETH for a total capital outlay of $41.98 million. BitMine Chair Defends Aggressive Buying Amid Crash Notably, this latest tranche moves the firm significantly closer to its long-term objective of controlling 5% of Ethereums total circulating supply. Data from Strategic ETH Reserve shows it has achieved over 70% of that goal with its 4.29 million ETH holdings. Meanwhile, BitMines latest ETH purchase comes at a moment of extreme market fragility. Ethereum prices have collapsed roughly 31% over the past 30 days, trading around $2,117 as of press time. Over the past week, the asset traded for as low as $1,824, its lowest level since May 2025. Still, BitMine remain committed to the crypto token, with the firms chairman Tom Lee arguing that Ethereum is the future of finance. Consequently, Lee has dismissed concerns regarding the firms deepening unrealized losses. In a recent statement, Lee argued that the current volatility is a feature, not a bug. According to him, Ethereum has weathered drawdowns of 60% or worse on seven occasions since 2018.

2/Since 2018, $ETH has seen a drawdown of -60% or worse 7 times in 8 yearsThis is basically every year in 2025, $ETH decline -64% pic.twitter.com/9q4LzD32Hc Thomas (Tom) Lee (not drummer) FSInsight.com (@fundstrat) February 6, 2026

So, despite the Crypto Winter optics exacerbated by the nomination of Kevin Warsh to the Federal Reserve and geopolitical tensions following the Greenland incident, the Ethereum networks fundamental usage remains robust. Moreover, BitMine has been evolving beyond a simple buy-and-hold treasury strategy. To outperform the cycle and mitigate the drag of falling spot prices, the company is pivoting toward what it describes as accretive acquisitions and high-risk capital deployment. This includes publicized moonshot allocations into smaller-cap tokens like Orbs and investments in media outlets like Mr Beast. Additionally, BitMine continues to leverage its massive stack for yield, staking nearly 3 million ETH. These efforts are designed to offset the heavy pressure of a macro environment that has turned sharply risk-off.

0

0

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

PoolX: Earn new token airdrops

Lock your assets and earn 10%+ APR

Lock now!

You may also like

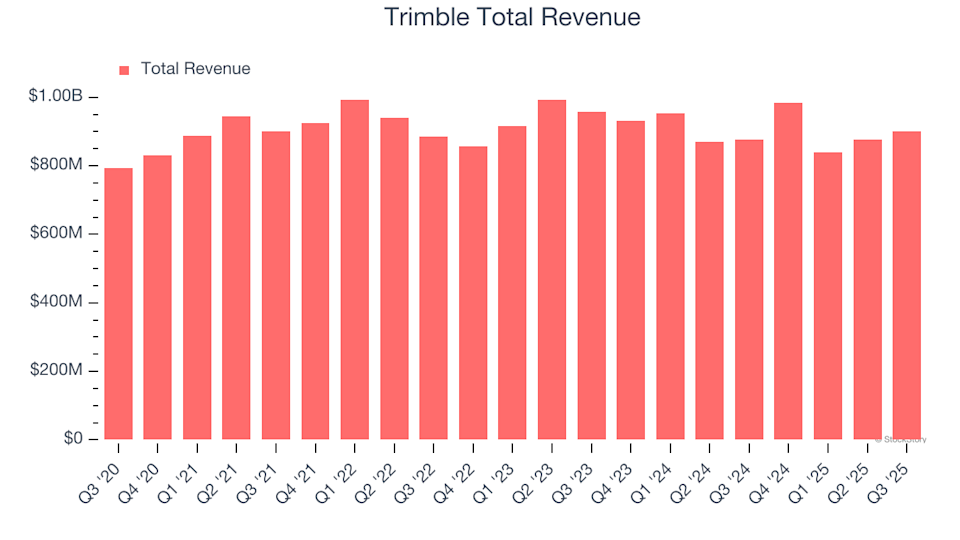

Trimble (TRMB) Set to Announce Earnings Tomorrow: What You Should Know

101 finance•2026/02/09 03:21

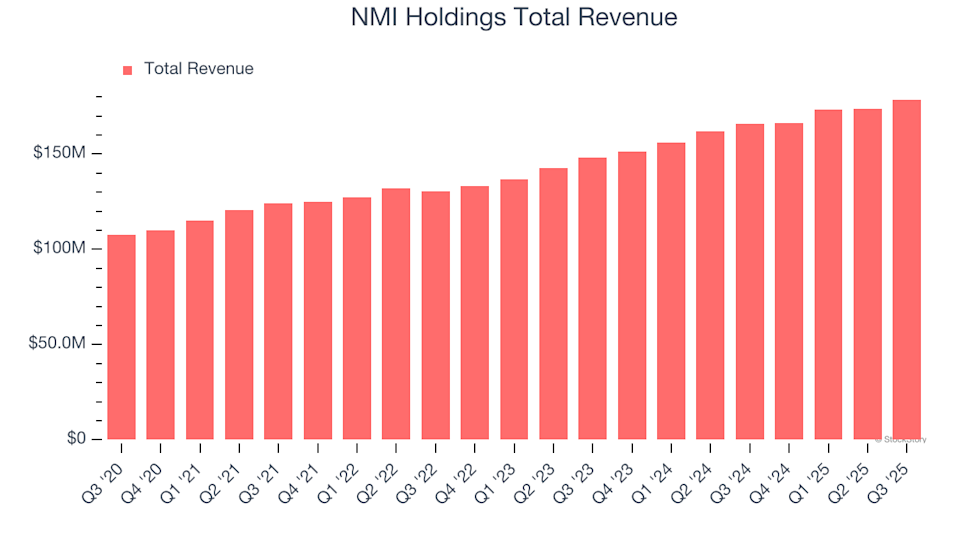

NMI Holdings (NMIH) Q4 Earnings Preview: Key Points to Watch

101 finance•2026/02/09 03:21

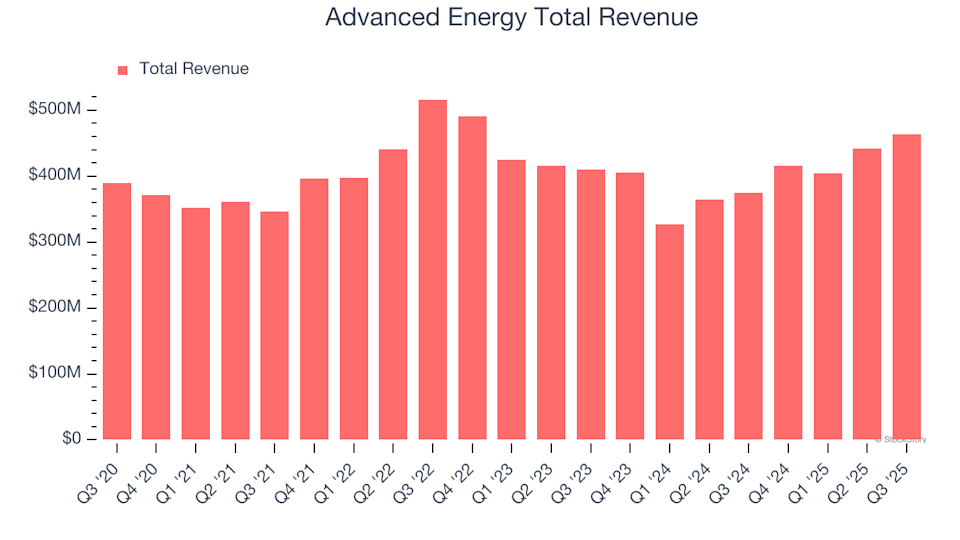

Earnings To Watch: Advanced Energy (AEIS) Will Announce Q4 Results Tomorrow

101 finance•2026/02/09 03:21

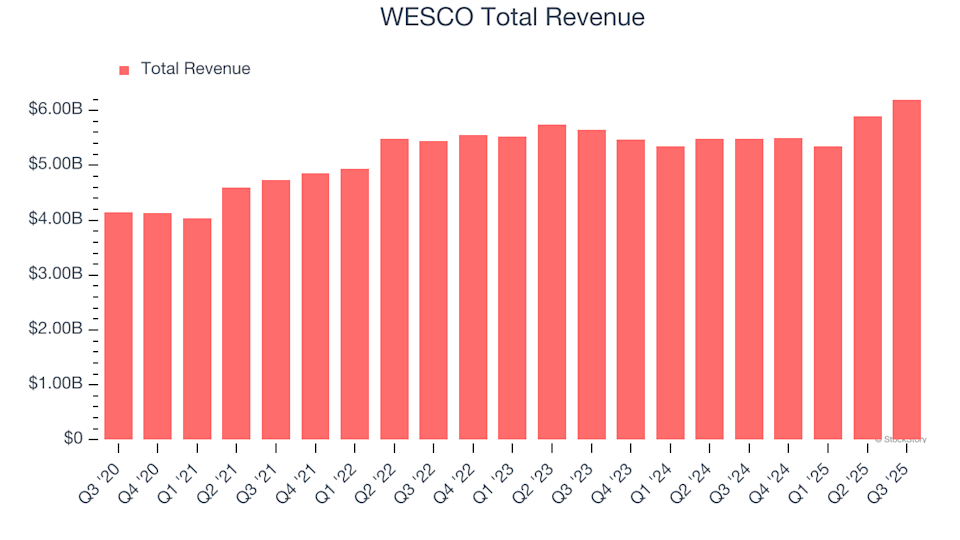

WESCO Earnings: Key Points to Watch for WCC

101 finance•2026/02/09 03:21

Trending news

MoreCrypto prices

MoreBitcoin

BTC

$70,813.7

+2.21%

Ethereum

ETH

$2,084.14

-0.13%

Tether USDt

USDT

$0.9993

-0.01%

XRP

XRP

$1.44

+1.15%

BNB

BNB

$641.39

-0.70%

USDC

USDC

$0.9996

-0.04%

Solana

SOL

$87.04

-0.23%

TRON

TRX

$0.2783

+0.29%

Dogecoin

DOGE

$0.09663

-0.83%

Bitcoin Cash

BCH

$526.49

+0.78%

How to buy BTC

Bitget lists BTC – Buy or sell BTC quickly on Bitget!

Trade now

Become a trader now?A welcome pack worth 6200 USDT for new users!

Sign up now