Dynatrace (NYSE:DT) surpasses Q4 CY2025 revenue expectations, shares surge 10%

Dynatrace Surpasses Expectations in Q4 CY2025

Dynatrace (NYSE:DT), a leader in cloud observability, delivered fourth-quarter results for CY2025 that exceeded Wall Street’s revenue forecasts. The company reported $515.5 million in sales, marking an 18.2% increase compared to the same period last year. Looking ahead, Dynatrace projects next quarter’s revenue to reach $520.5 million at the midpoint, which is 1.2% higher than analysts anticipated. Adjusted earnings per share came in at $0.44, beating consensus estimates by 7.2%.

Should You Consider Investing in Dynatrace?

Highlights from Dynatrace’s Q4 CY2025 Performance

- Total Revenue: $515.5 million, surpassing analyst expectations of $505.9 million (18.2% year-over-year growth, 1.9% above forecast)

- Adjusted EPS: $0.44, outperforming the $0.41 consensus (7.2% above estimates)

- Adjusted Operating Income: $153.4 million, compared to $146.2 million expected (29.8% margin, 4.9% beat)

- Q1 CY2026 Revenue Outlook: $520.5 million at the midpoint, ahead of the $514.3 million analyst estimate

- Full-Year Adjusted EPS Guidance: Raised to $1.68 at the midpoint, reflecting a 3.1% increase

- Operating Margin: 14.1%, up from 10.9% in the prior year’s quarter

- Free Cash Flow Margin: 5.3%, consistent with the previous quarter

- Annual Recurring Revenue (ARR): $1.97 billion, representing 19.7% year-over-year growth

- Billings: $560.1 million at quarter’s end, a 26.4% annual increase

- Market Cap: $10.16 billion

“Our third quarter results exceeded the upper end of our guidance for both growth and profitability. We’ve achieved double-digit net new ARR growth for three straight quarters, highlighting the increasing adoption of Dynatrace as a comprehensive observability solution,” commented Rick McConnell, CEO of Dynatrace.

About Dynatrace

Dynatrace (NYSE:DT) operates an AI-driven platform that processes over 30 trillion IT performance data points daily. The company empowers organizations to monitor, secure, and optimize their applications and IT infrastructure across cloud environments.

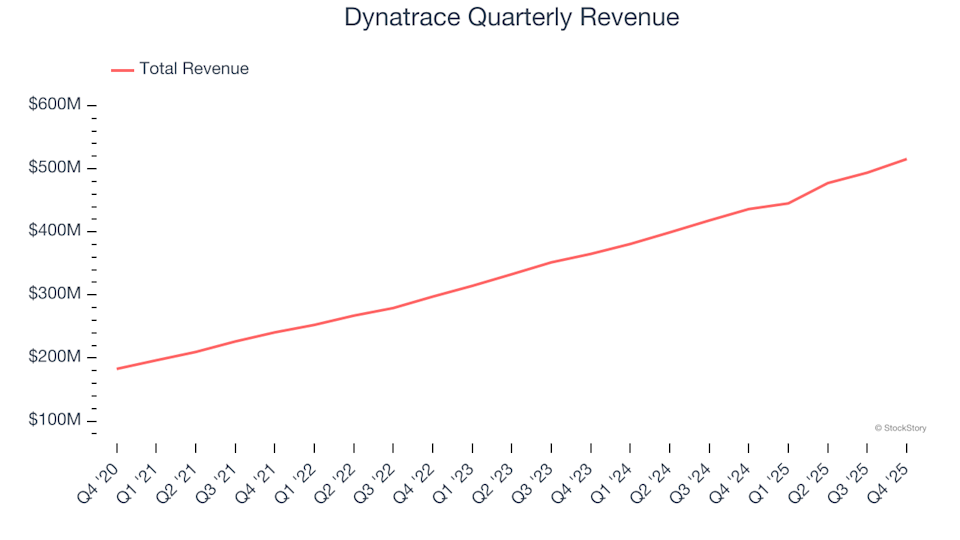

Examining Revenue Growth

Assessing a company’s long-term revenue trajectory offers valuable insight into its business quality. While any company can post strong results for a quarter or two, sustained growth over several years is more telling. Over the past five years, Dynatrace has achieved a robust 24.1% compound annual growth rate in sales, outpacing the average software company and demonstrating strong customer demand.

Although we prioritize long-term growth, it’s important to note that recent innovations or industry shifts can influence short-term trends. Dynatrace’s annualized revenue growth rate over the past two years stands at 19%, slightly below its five-year average, but still indicative of healthy demand for its offerings.

Recent Revenue Performance

This quarter, Dynatrace posted an 18.2% year-over-year increase in revenue, reaching $515.5 million—1.9% above Wall Street’s projections. Management anticipates a 16.9% year-over-year sales increase for the next quarter.

Looking further out, analysts expect revenue to grow by 14% over the next year, which is a slowdown compared to recent years. While this suggests some potential challenges in demand, Dynatrace continues to perform well in other key financial areas.

As software continues to transform industries worldwide, the need for tools that support software developers—such as those for monitoring cloud infrastructure or ensuring seamless content delivery—remains strong.

Annual Recurring Revenue (ARR)

ARR, which represents the next 12 months of contracted software subscription revenue, is a key metric for SaaS companies due to its predictability and high margins. In Q4, Dynatrace’s ARR reached $1.97 billion, with an average year-over-year growth rate of 17.7% over the past four quarters. This aligns with the company’s overall sales growth and demonstrates its ability to maintain strong customer relationships and secure long-term contracts—factors that enhance business stability and valuation.

Customer Acquisition Efficiency

The customer acquisition cost (CAC) payback period indicates how quickly a company recoups its investment in acquiring new customers. This quarter, Dynatrace reported a CAC payback period of 36.8 months, reflecting efficient customer acquisition and providing flexibility to ramp up sales and marketing efforts to drive further growth.

Summary of Dynatrace’s Q4 Results

Dynatrace’s updated full-year EPS guidance exceeded analyst expectations, and its outlook for the next quarter’s EPS also surpassed Wall Street’s forecasts. The company’s strong quarterly performance was reflected in a 10% jump in its share price to $37.09 immediately after the results were announced.

While Dynatrace delivered an impressive quarter, investors should weigh these results alongside the company’s long-term fundamentals and valuation before making investment decisions.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Nagel: In which situations can the inflation rate be considered excessively low?

Factbox-Massive IPOs on the horizon as Wall Street expects a record year for public offerings

Strategy Acquires Additional Bitcoin While $50 Billion BTC Reserve Stays in the Red

White House prepares for a disappointing January employment report