Software shares surge as Wall Street rejects 'catastrophic outlook' for the sector

Software Stocks Recover as Analysts Downplay AI Threats

On Monday, software stocks saw a notable rebound after Wall Street analysts reassured investors, countering concerns that artificial intelligence could undermine the industry’s core business models.

Oracle shares surged by 10% following an upgrade from DA Davidson’s Gil Luria, who shifted his rating from Neutral to Buy. Luria expressed confidence in Oracle’s recent partnership with OpenAI and dismissed worries that AI advancements would negatively impact Oracle’s software operations.

“Software is far from obsolete,” Luria commented, emphasizing his belief that businesses will continue to invest in Oracle’s offerings and that these products remain essential.

Despite Monday’s rally, Oracle’s stock remains about 20% lower for the year, reflecting broader challenges across the software sector.

The Tech-Software Sector ETF, which tracks major players such as Microsoft and Palantir, has also declined 20% year-to-date amid fears that AI could automate tasks traditionally managed by enterprise software, potentially disrupting established revenue streams. However, the ETF gained 3% on Monday.

Analysts Push Back Against “Armageddon” Narrative

Over the weekend, Dan Ives, a senior equity research analyst at Wedbush Securities, added Salesforce and ServiceNow to the firm’s AI 30 List. In his note, Ives described the recent pessimism surrounding software stocks as exaggerated.

- Salesforce shares have dropped about 26% since the start of the year.

- ServiceNow has seen its stock fall by 32% over the same period.

Ives argued that the market is overestimating the short-term risks for software companies, suggesting that most customers will not rush to adopt AI at the expense of data security and operational complexity.

ServiceNow’s stock has declined 32% this year, largely due to investor worries that AI could replace many functions currently performed by software. (Photo illustration by Cheng Xin/Getty Images)

Company Perspectives and Market Outlook

During Monday.com’s recent earnings call, company leaders echoed the sentiment that customers remain interested in their products, even as they explore how best to integrate new technologies. Monday.com’s stock fell 20% after issuing a revenue forecast that fell short of expectations for both the current quarter and the full year.

“For many clients, the most effective way to utilize these technologies is to build on the systems they already use, where their data, context, and workflows are established,” explained Eran Zinman, Monday.com’s co-founder and co-CEO.

Victoria Fernandez, chief market strategist at Crossmark Global Investments, noted that while AI and software companies can coexist, the key question is how much pricing power software firms will retain as AI adoption grows.

“There may be opportunities to invest in companies that have experienced significant declines but maintain strong financial positions,” Fernandez said.

Further Reading

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

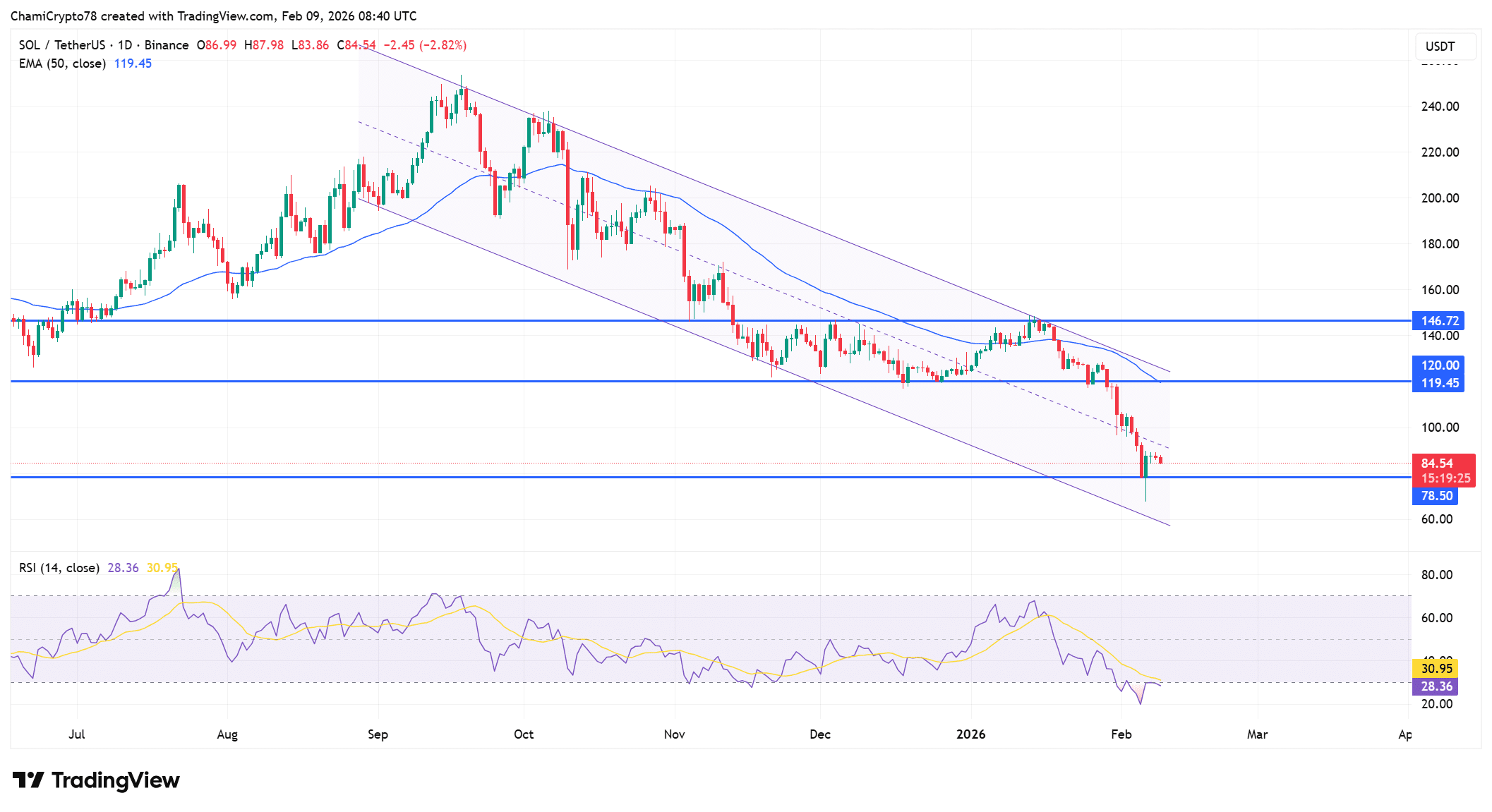

Solana bulls absorb despite falling prices – Can SOL hold $78.5?

BlockDAG $0.00025 Final Private Sale Opens, Delivering Day-One Liquidity Amid Aave and Dogecoin Market Weakness