Investors cut back on their holdings in the UK as a leadership contest approaches

Morning Market Overview

Welcome to today's market briefing. Japanese equities have reached new heights following Prime Minister Sanae Takaichi's decisive election win, sparking optimism for political stability in the world's fourth-largest economy. Meanwhile, the FTSE is poised for a positive start as investors anticipate a rebound after recent tech sector volatility.

Amid growing speculation over Labour Party leadership, many investors are reducing their positions in the UK. Mizuho, a major Japanese bank operating in London, has expressed diminished confidence in British government bonds, citing the potential for renewed political instability. Matt Amis of Aberdeen also noted a reduction in exposure due to concerns about a possible shift to more left-leaning policies if Sir Keir Starmer is replaced.

Prime Minister Starmer is currently under intense scrutiny, particularly following the appointment of Lord Mandelson as ambassador to the US despite his controversial associations. This has led to increased volatility in government borrowing costs, with 10-year gilt yields peaking at 4.6% before easing slightly after public support from cabinet members. The pound has also weakened, dropping about 0.3% against the euro to €1.148.

Key Developments

- Bond Market Reaction: Mizuho analysts anticipate continued pressure on long-term UK bonds until political uncertainties are resolved. Investors are wary of potential policy changes from any new Labour leadership, especially if Angela Rayner, known for advocating higher public spending, takes charge.

- Market Sentiment: Lloyd Harris of Premier Miton warns that a government led by Rayner could unsettle the gilt market, citing her support for increased welfare and workers’ rights. Shabana Mahmood is viewed as the candidate likely to cause the least market disruption.

- Leadership Turmoil: The resignation of Morgan McSweeney, Starmer’s chief of staff, has further unsettled markets, causing a temporary spike in borrowing costs and a dip in the pound.

Market Close and Sector Highlights

UK and European stocks ended the day higher ahead of key US jobs data and earnings reports. The FTSE 100 finished nearly unchanged at 10,382, with mining companies leading gains. France’s CAC rose 0.5%, and Germany’s DAX climbed 1.2%.

London markets have shifted towards defensive sectors following a sell-off in technology shares. Miners and defense companies saw increased interest, while lenders affected by the car finance scandal experienced declines. NatWest shares remained under pressure as the bank transitions back to private ownership and pursues growth strategies, including the acquisition of Evelyn Partners.

Currency and Commodity Movements

- Silver: The precious metal surged 7% to $82.77 an ounce as the dollar weakened, following a sharp drop after Kevin Warsh’s nomination to lead the Federal Reserve eased inflation concerns.

- Currency Markets: The dollar index fell 0.7%. The euro and yen both gained against the dollar, while sterling rose 0.3% against the greenback but struggled elsewhere.

Political Uncertainty and Economic Risks

Economists warn that ongoing political instability could push the UK towards recession. Martin Beck of WPI Strategy cautions that a leadership change could trigger rapid market repricing, higher gilt yields, and a weaker pound. Kallum Pickering of Peel Hunt expects a sell-off in gilts if Starmer steps down, as markets price in the risk of a leftward policy shift.

Higher borrowing costs could lead to increased mortgage rates and more expensive business loans, compounding challenges for an already fragile investment climate.

Investor Sentiment and Predictions

- Prediction Markets: Traders on Polymarket now assign a 77% probability that Starmer will leave office by year-end, up from 66% before McSweeney’s resignation. Angela Rayner is currently favored as his likely successor.

- Bond Market Concerns: Analysts warn that a left-leaning Labour government could exacerbate the so-called “moron premium,” raising UK borrowing costs and putting pressure on sterling and equities.

Corporate News

- NatWest Acquisition: NatWest has completed its largest deal in nearly two decades, acquiring wealth manager Evelyn Partners for £2.7bn. The move aims to enhance financial planning and investment services for its 20 million customers.

- Blackstone Cuts Ties: Private equity firm Blackstone has ended its relationship with Global Counsel, the lobbying firm founded by Lord Mandelson, following the Jeffrey Epstein scandal.

- Novo Nordisk Shares Surge: Shares in Novo Nordisk soared after Hims & Hers withdrew plans for a $49 weight loss pill, reinforcing Novo Nordisk’s market position.

Asian Markets and Tech Stocks

Asian technology shares rallied as concerns over an AI-driven sell-off eased. Samsung rose nearly 3%, SoftBank gained 6%, TSMC advanced 2%, and SK Hynix surged close to 6%. The Nikkei jumped over 4.4%, with Hong Kong’s Hang Seng and South Korea’s Kopsi also posting strong gains. Bitcoin rebounded above $70,000 after last week’s decline.

Top 5 Stories to Start Your Day

- AI Bubble Warning: Bank of England Governor cautions about complacency and potential overvaluation in artificial intelligence markets.

- Potential Economic Fallout: Analysis suggests removing Starmer could push Britain towards economic instability, with markets expecting more left-leaning, high-spending leadership.

- Epstein Scandal: A German countess with NHS ties maintained a long-term correspondence with Jeffrey Epstein.

- Ocado Job Cuts: The company considers eliminating 1,000 positions after losing key North American contracts.

- Barclays Restructuring: Barclays plans to reduce costs by £2bn through job cuts and offshoring, including moving copywriting roles to India.

Thank You for Reading

That concludes today’s market update. Stay tuned for further developments as the political and economic landscape continues to evolve.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

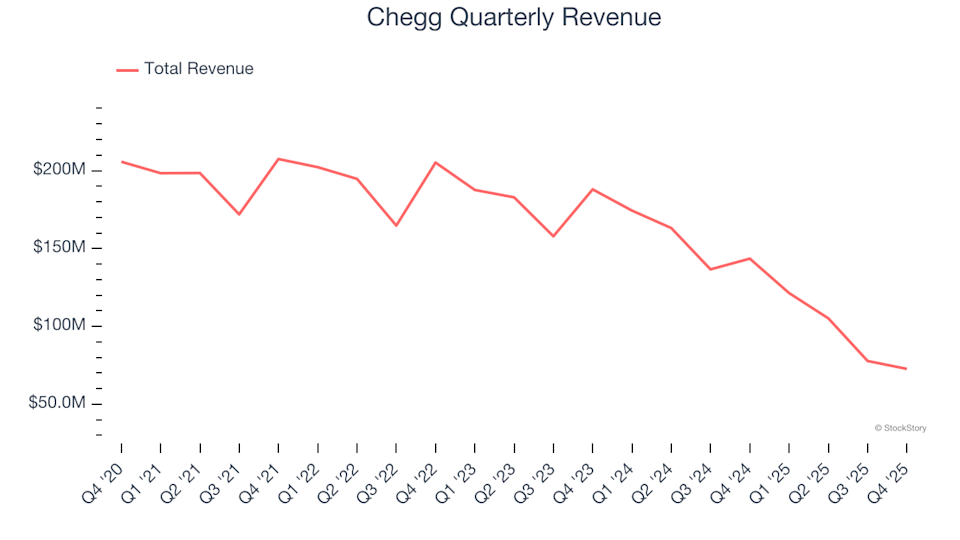

Chegg (NYSE:CHGG) Surpasses Q4 CY2025 Projections

Starbucks introduces new menu options in an effort to boost its growth

Oracle (ORCL) Shares Rise, Here’s the Reason

CrowdStrike (CRWD) Shares Are Rising: Key Information You Should Be Aware Of