Why Shares of Arthur J. Gallagher (AJG) Are Down Today

Recent Developments Affecting Arthur J. Gallagher

Arthur J. Gallagher (NYSE:AJG), a leading insurance brokerage, experienced a sharp decline of 9.4% in its share price during the afternoon trading session. This drop followed OpenAI’s introduction of specialized insurance applications within its ChatGPT App Library, which directly challenges the conventional brokerage business model.

These new AI-powered tools, developed in partnership with Insurify and Tuio, enable users to compare and purchase insurance policies without relying on traditional brokers. This advancement has raised concerns among investors about the potential for AI to replace human intermediaries, especially as artificial intelligence becomes capable of handling complex risk assessments that were once the domain of industry professionals. As these technologies expand into more specialized commercial insurance markets, the traditional high-commission earnings of established brokers could be at risk.

By the end of the trading day, Arthur J. Gallagher’s stock closed at $217.76, marking a 9.9% decrease from its previous closing price.

Market reactions to news can sometimes be exaggerated, and significant price declines may offer attractive entry points for investors interested in quality companies. Considering this, is now a good opportunity to invest in Arthur J. Gallagher?

Market Perspective

Historically, Arthur J. Gallagher’s stock has shown limited volatility, with only four instances of price swings greater than 5% over the past year. In this context, the recent decline signals that investors view the latest developments as significant, though it may not fundamentally alter the company’s long-term outlook.

The last notable price movement occurred 13 days ago, when shares fell 4.7% after news broke about a U.S. government proposal to keep Medicare payment rates nearly flat in 2027, which negatively impacted health insurance stocks across the board.

The Centers for Medicare & Medicaid Services proposed a minimal 0.09% increase in payment rates for private Medicare Advantage plans for 2027, falling well short of market expectations. This announcement led to a widespread sell-off among major insurers, including Humana, UnitedHealth, and CVS Health. Arthur J. Gallagher, which provides and sources Medicare-related products such as Medicare Advantage plans, was also affected as investor concerns spread throughout the sector.

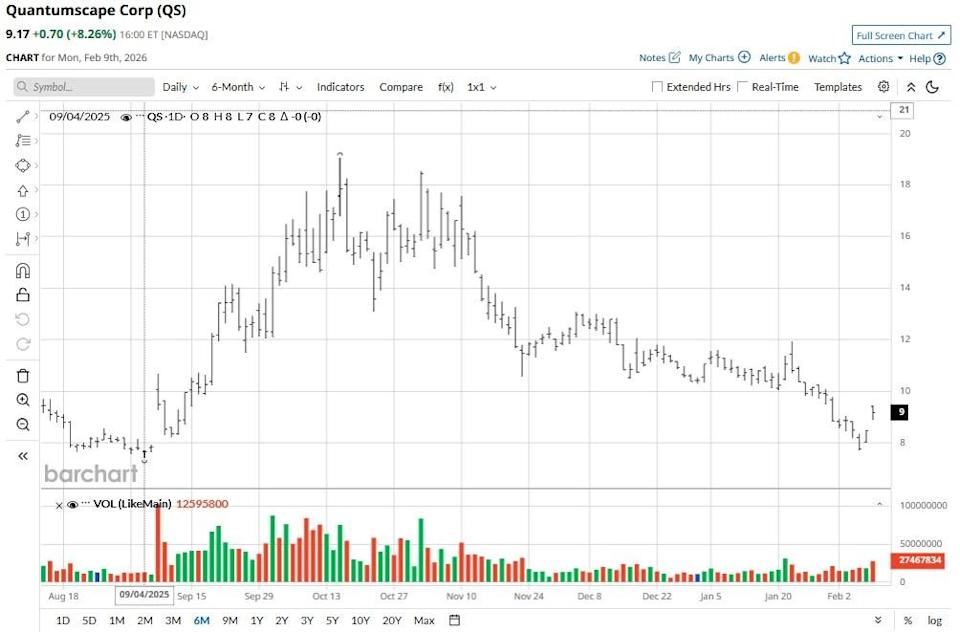

Since the start of the year, Arthur J. Gallagher’s stock has declined by 14.2%. Currently trading at $219.68 per share, it sits 37% below its 52-week high of $348.77 reached in June 2025. For perspective, an investor who purchased $1,000 worth of Arthur J. Gallagher shares five years ago would now see their investment grow to $1,879.

Looking Ahead: The Rise of AI in Enterprise Software

The 1999 book Gorilla Game accurately foresaw the dominance of Microsoft and Apple in the tech sector by focusing on early identification of platform leaders. Today, a similar trend is emerging as enterprise software companies that integrate generative AI are poised to become industry giants.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Toto Finance Bot Goes live on Moltbook for M2M Markets

Silvercorp: Fiscal Third Quarter Earnings Overview