US Treasury Bonds: When the University of Tokyo Tightens Its US Treasury Exposure

Since the beginning of the year, US Treasuries have been moving in a rather tangled manner. In fact, there are some downward factors for US Treasury yields, such as JOLTS/ADP coming in below expectations, or US stock market volatility and corrections. In a bull market, this would be enough to push yields down by 20 basis points.

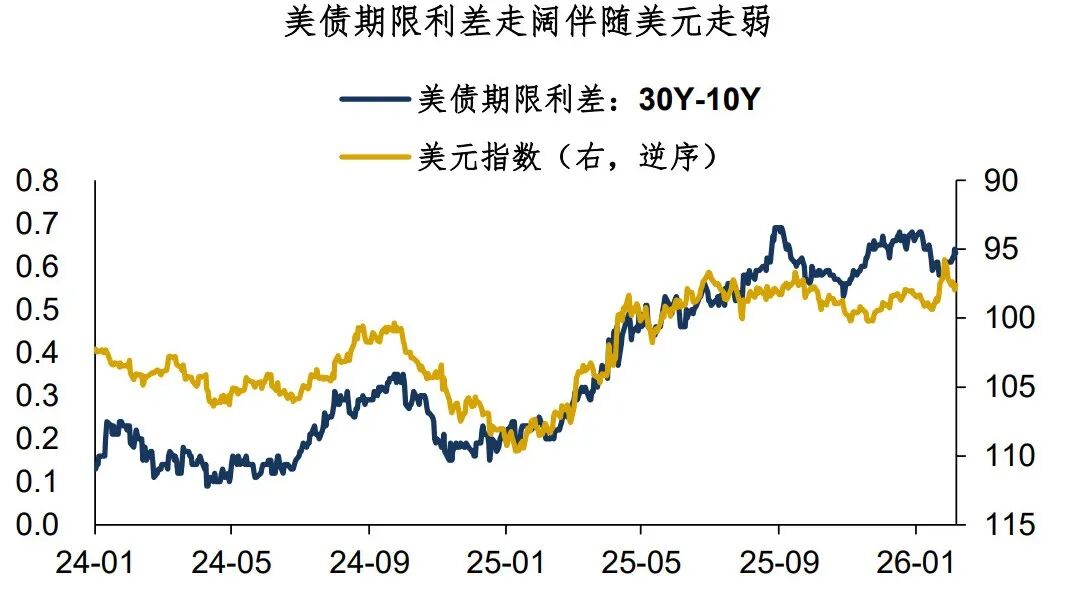

However, in reality, US Treasury yields have not declined.The 10-year US Treasury yield has hovered around 4.2% for two months, and the 30-10Y and 10-2Y yield spreads seem to be further widening. Essentially, US Treasury investments are facing some risk factors beyond the fundamentals, which increases investment risk and difficulty (refer to "Dollar: Europe Sells Bonds, Financial Nuclear Bomb").

Regarding US Treasuries at this stage, the essential question is: Under the influence of geopolitical risks, has Real Money actually flowed out of US Treasuries?Previously, Bank of America had a cross-border capital flow report, but that series of reports has been discontinued this year... A relatively good proxy data source is EPFR. According to the data, since the beginning of the year, foreign funds have had a net purchase of $5.6 billion in US Treasuries. Considering the significant positive carry of US Treasuries, this net purchase is clearly not much, so it cannot be ruled out that some Real Money is indeed flowing out of US Treasuries.

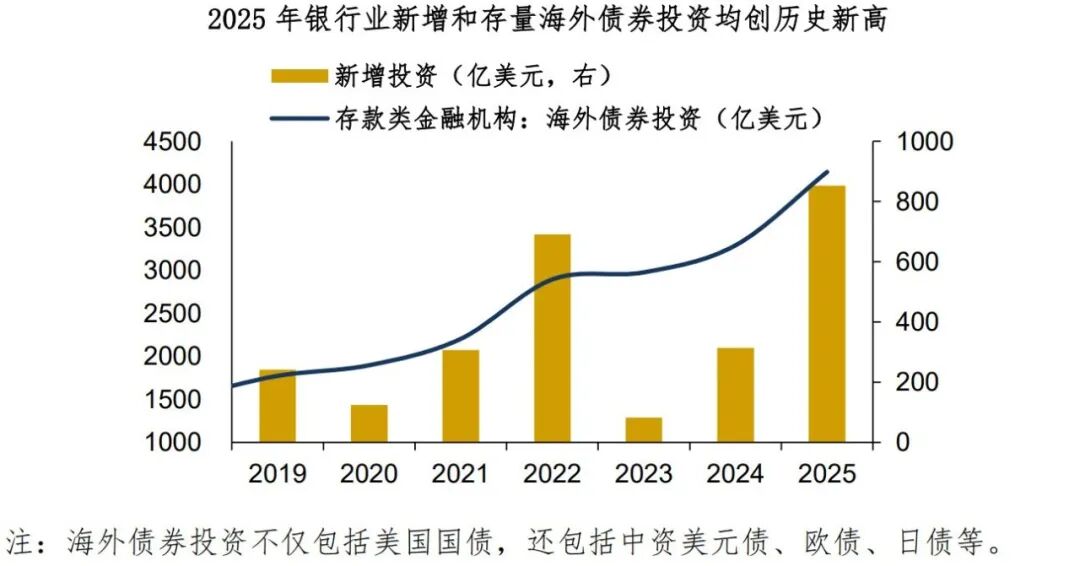

During yesterday's trading session, multiple foreign media reported that the Ministry of Finance plans to guide banks to control their US Treasury exposure.Why provide window guidance on financial institutions' US Treasury investments? Essentially, it's because too much has been bought.According to the foreign exchange credit balance sheet disclosed by Yumin, in 2025, China's banking sector will add $80 billion in overseas bond investments, bringing the total to $410 billion, both hitting record highs.

In the author's opinion, overseas investment is definitely the general direction, but investment targets should focus more on diversification and dispersion to avoid potential country-specific risks. When the national team as a whole is reducing its holdings of US Treasuries, yet financial institutions are still charging ahead, it is definitely risky...

Undoubtedly, tightening US Treasury investment exposure by the Ministry of Finance is bearish for the entire dollar system.The negative impact on the dollar is greater than that on US Treasuries, and in the long run, this is bullish for precious metals. Rumor has it that Trump will visit China in April. Negotiations will happen, and some achievements or "Trump-style wins" cannot be ruled out. However, a global Bipolar System is likely to remain a major trend.

Today's summary:

1. Since the beginning of the year, US Treasuries have been quite volatile, and US Treasury investments face some risk factors beyond the fundamentals;

2. Regarding US Treasuries at this stage, the key question is: Under geopolitical risks, has Real Money actually flowed out of US Treasuries? According to EPFR data, even though US Treasuries have a positive carry, net foreign capital inflows are limited, so it cannot be ruled out that some Real Money is flowing out of US Treasuries;

3. Why does the Ministry of Finance provide window guidance for financial institutions' US Treasury investments? Essentially, it's because too much has been bought. In the author's view, overseas investment is the general direction, but investment targets should focus more on diversification and dispersion to avoid potential country-specific risks.Undoubtedly, tightening US Treasury investment exposure by the Ministry of Finance is bearish for the entire dollar system.It is rumored that Trump will visit China in April. Negotiations will happen, but a global Bipolar System is likely to remain the major trend.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

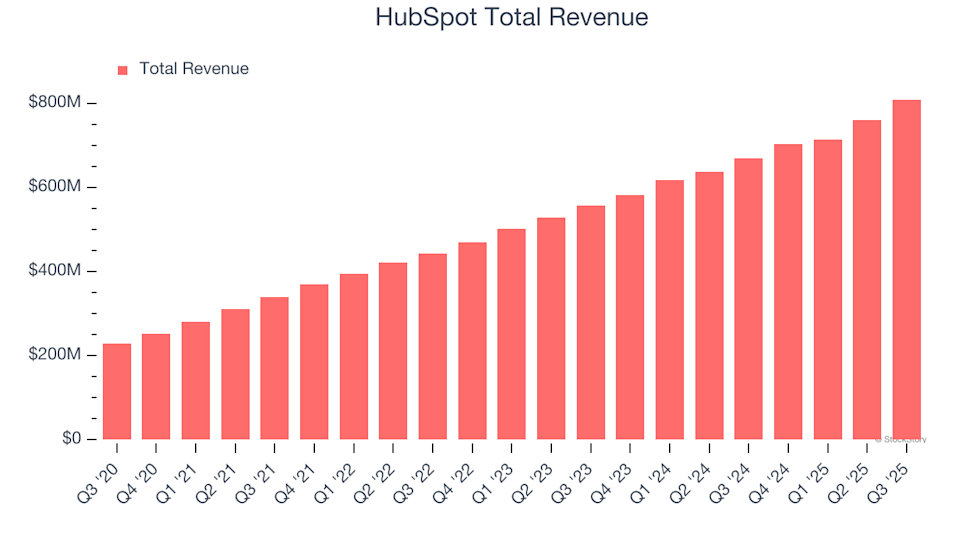

HubSpot (HUBS) Q4 Results: What You Should Know

Target plans to increase investment in its stores and eliminate 500 positions as the new CEO assumes leadership

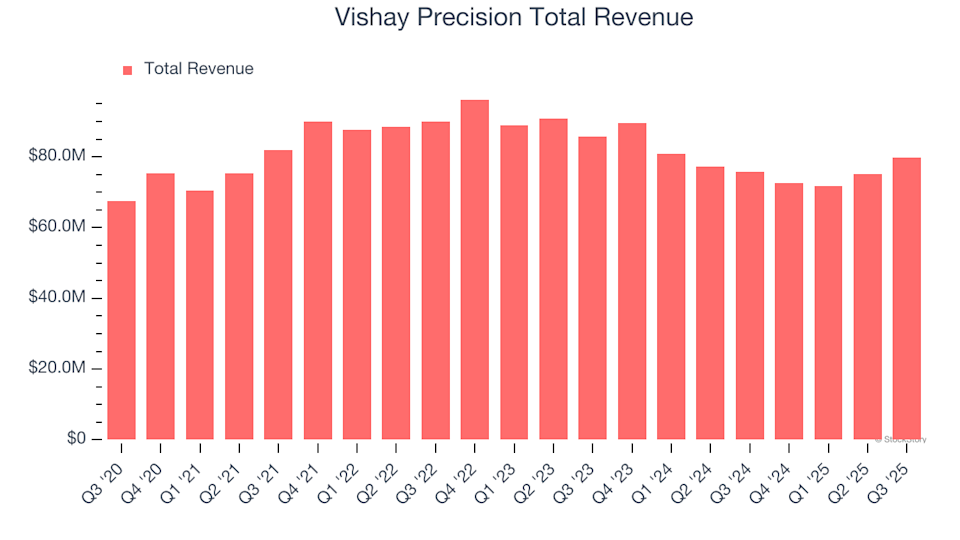

What Are the Anticipated Outcomes for Vishay Precision (VPG) in Q4 Earnings

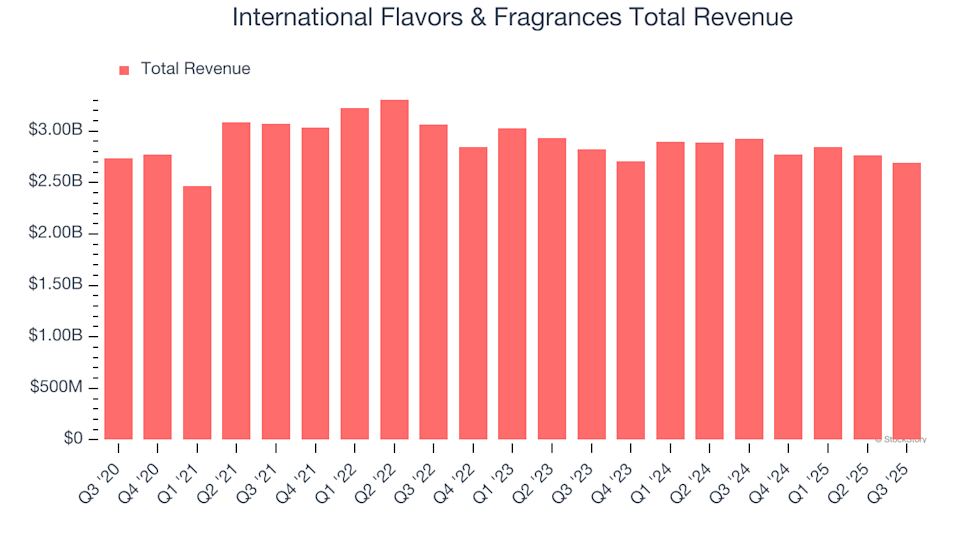

International Flavors & Fragrances (IFF) Q4 Earnings Report Preview: Key Points to Watch