5 Key Facts to Be Aware of Before the Stock Market Starts Trading

Morning Market Overview

U.S. stock futures are edging lower as traders review the latest round of corporate earnings and anticipate important economic updates. The Census Bureau is set to publish December's retail sales figures, while Coca-Cola shares are slipping after the company missed revenue expectations for the fourth quarter. Robinhood will announce its earnings after markets close, and Spotify stock is rallying following a strong quarterly performance. Here’s a summary of today’s key developments.

Stock Futures Dip After Recent Rally

After two straight sessions of robust gains for major indexes, stock futures are modestly in the red. Dow Jones Industrial Average futures have declined by 0.2%, while S&P 500 and Nasdaq futures are both down 0.1%. Technology stocks powered Monday’s rally, especially after a period of volatility linked to the AI sector. The Dow closed at a record high yesterday, having surpassed the 50,000 mark for the first time last Friday. Bitcoin is trading at $68,500, off its overnight peak of $70,800 but still well above last week’s low near $60,000. Gold futures have slipped to $5,070 per ounce, and WTI crude oil remains steady at $64.35 per barrel. The yield on the 10-year Treasury note has eased to 4.17%, down from 4.20% the previous day and approaching a four-week low.

Holiday Retail Sales Data on the Horizon

Investors are awaiting several significant economic reports today, including the delayed release of December’s retail sales at 8:30 a.m. ET. This data will shed light on consumer spending during the holiday season, especially as inflation continues to be a concern. Additional reports due this morning include the NFIB small business optimism index, the import price index for December, and the fourth-quarter employment cost index. Later this week, attention will turn to the January jobs report and a fresh reading on consumer price inflation, both closely watched by the Federal Reserve as it weighs future interest rate decisions.

Coca-Cola Shares Slide After Revenue Miss

Coca-Cola (KO) stock is under pressure after the company’s latest earnings failed to meet Wall Street’s expectations. The beverage leader reported $11.8 billion in revenue, falling short of forecasts, though adjusted earnings per share reached 58 cents—just a penny above analyst projections. Prior to the report, analysts noted that Coca-Cola’s high valuation could pose a challenge. The stock had recently closed at a record high above $79 as investors shifted toward defensive consumer staples amid tech sector volatility, but shares have since dropped 4% to around $75 in premarket trading. The company is also preparing for a leadership change, with COO Henrique Braun set to take over as CEO from James Quincey at the end of March.

Robinhood to Announce Earnings After Market Close

Robinhood (HOOD), the retail trading platform, will release its fourth-quarter earnings after today’s closing bell. The company’s stock has experienced recent volatility, largely due to its increasing involvement in cryptocurrency and its ties to bitcoin, though shares have rebounded somewhat in recent days. Analysts are forecasting record revenue of $1.34 billion and earnings of 62 cents per share. Robinhood has expanded beyond its core stock trading business, venturing into cryptocurrencies, credit cards, and prediction markets. Ahead of the earnings release, Robinhood shares are down about 1% in premarket trading.

Spotify Shares Jump on Strong Quarterly Results

Spotify Technology (SPOT) stock is surging after the streaming service reported better-than-expected fourth-quarter results. Revenue reached 4.53 billion euros ($5.39 billion), slightly above estimates, while earnings per share of 4.43 euros, along with 751 million monthly active users and 290 million premium subscribers, all surpassed analyst expectations. Co-CEO Alex Norström highlighted that Spotify achieved its largest-ever quarterly increase in monthly active users, adding 38 million new listeners. The stock is up more than 8% in premarket trading, rebounding after a nearly 30% decline earlier this year.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Maxi Doge : Le projet qui bouscule le Meme Supercycle 2026

South Korean AI company Wrtn plans to expand into the US and is eyeing a potential IPO as soon as 2028

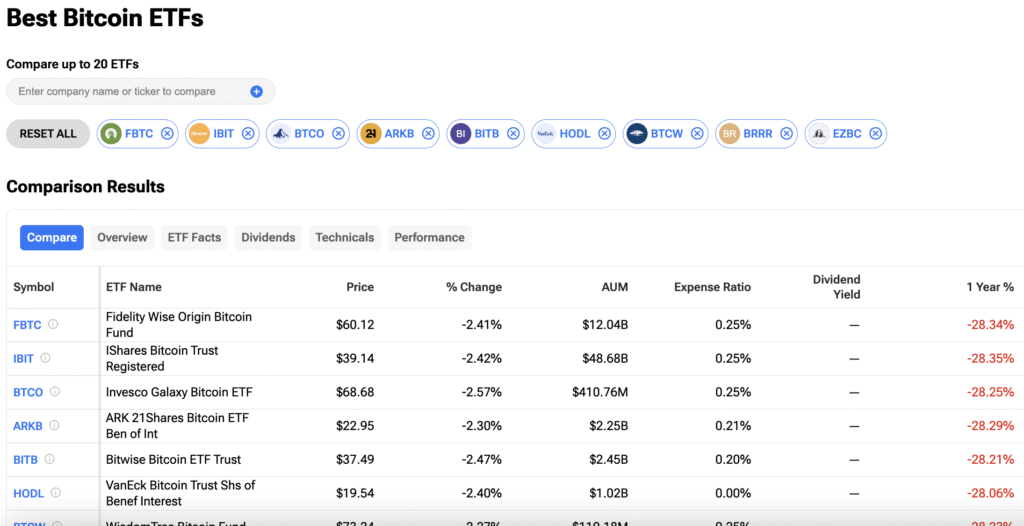

Bitcoin ETFs Record $616 Million in Back-to-Back Gains as Diamond Hand Holders Refuse to Sell