Banks take tougher position on stablecoin regulations in White House dispute while major crypto legislation stays stalled

US Banks Intensify Opposition to Crypto Industry Amid Legislative Stalemate

This week, American banks took a firmer position in their ongoing dispute with the cryptocurrency sector, contributing to the delay of significant legislation in Congress.

During a private session organized by the White House's crypto council, representatives from the banking industry circulated a proposal advocating for a ban on companies or organizations offering interest payments to customers on their stablecoin holdings.

This proposal became the focal point of a meeting held on Tuesday, which, according to a source with knowledge of the discussions, is a primary reason for the current impasse preventing the Clarity Act from advancing in Congress.

Attendees at the White House meeting included policy experts from leading banks such as JPMorgan Chase, Bank of America, Citigroup, Wells Fargo, Goldman Sachs, and PNC, as well as representatives from Coinbase and various banking and crypto trade groups.

Last year, President Trump enacted the GENIUS Act, establishing the first federal regulatory framework for stablecoins tied to the US dollar. However, disagreements over whether crypto platforms should be permitted to pay "yield" or interest on stablecoin balances have stalled the Clarity Act, a bill the Trump administration aimed to pass before the midterm elections. Stablecoins are digital assets whose value is anchored to the US dollar, gold, or other traditional currencies and assets.

A U.S. Capitol Police officer patrols the East Front of the U.S. Capitol, February 6, 2026, in Washington. (AP Photo/Rahmat Gul) · ASSOCIATED PRESS

Details of the Proposed Ban

The document states that "no individual or entity may offer any financial or non-financial incentives to stablecoin holders related to the purchase, use, ownership, custody, or retention of payment stablecoins."

It suggests only "very limited" exceptions to this rule, cautioning that allowing such incentives could trigger a withdrawal of deposits, potentially harming lending to local communities. The proposal also calls for regulatory enforcement, including the power to impose fines on violators and a mandated review of payment stablecoins two years after the law's implementation.

Banking Associations Call for Balanced Innovation

In a joint statement released Tuesday evening, the American Bankers Association, Bank Policy Institute, and Independent Community Bankers Association emphasized the need for policies that support financial innovation while maintaining stability and safeguarding the deposits that underpin local lending and economic growth.

Crypto Industry Responds to Ongoing Negotiations

Summer Mersinger, CEO of the Blockchain Association, expressed optimism after the meeting, noting, "We are pleased with the progress as all parties continue to work constructively toward resolving outstanding concerns."

Ji Hun Kim, CEO of the Crypto Council for Innovation, also described the discussions as productive.

Implications for Banks and Crypto Platforms

Banks view the possibility of paying interest on stablecoin balances as a significant threat to their deposit base, especially for regional and community banks, potentially limiting their lending capacity.

This dispute is just one of several crypto-related issues raised by the banking sector in recent months. Regulators from the Trump administration are also working to streamline the process for crypto companies to obtain banking charters and access the Federal Reserve's payment infrastructure.

For the crypto industry, resolving these issues is seen as essential for the broader adoption of stablecoins, one of the sector's most widely used products. The push for a solution extends beyond the White House's crypto council.

Treasury Secretary Scott Bessent told Fox Business Network's Maria Bartiromo, “To ensure crypto remains a viable digital asset, passing the Clarity Act is essential.”

The Senate Banking Committee has postponed its review of the stalled bill twice since January, with the latest delay occurring shortly after Coinbase CEO Brian Armstrong rejected the most recent draft due to unresolved compromises.

Bessent further commented, “A few holdouts have argued that no legislation is better than a bill they disagree with, but both banks and other crypto firms are united in opposition to this stance.”

David Hollerith reports on the financial industry, covering major banks, regional lenders, private equity, and the cryptocurrency market.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Crypto Institutional Investment: The Profound Shift from Speculation to Strategic Portfolio Management

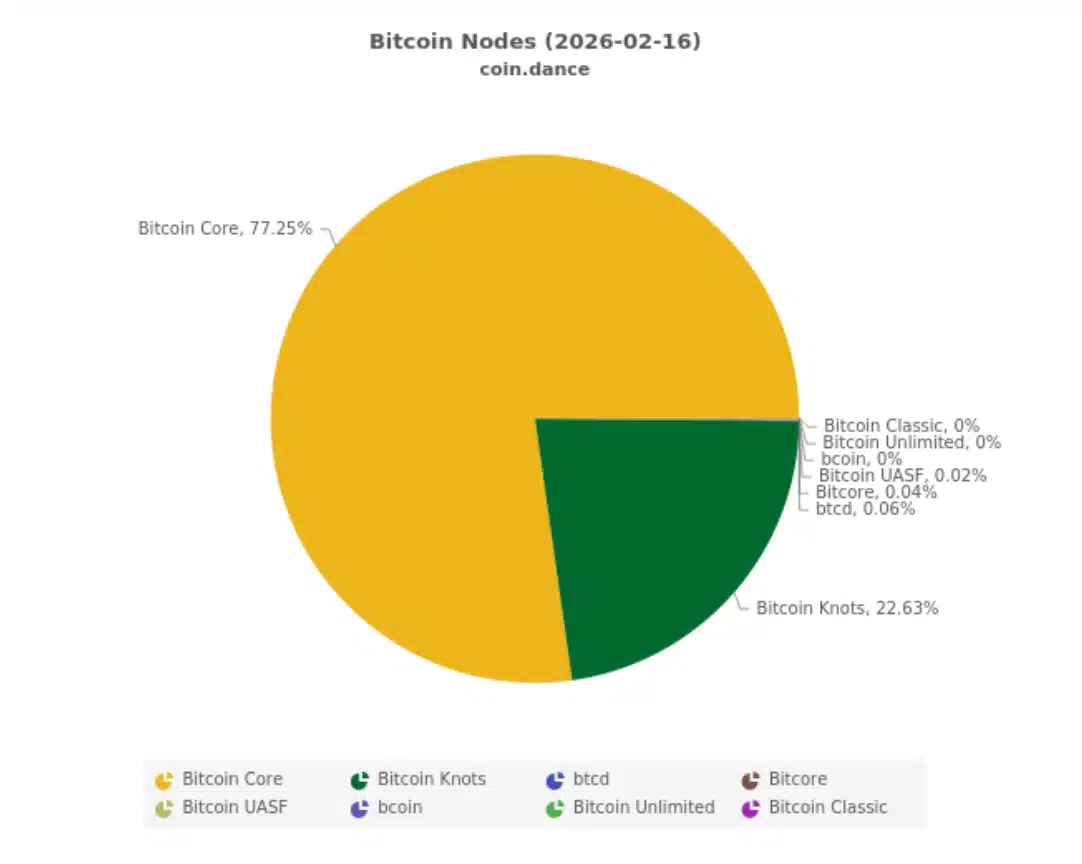

Adam Back warns of ‘lynch mob’ tactics – Is Bitcoin facing fork fight?

Meta's Platfroms' New Bull: Why Billionaire Bill Ackman Is Buying

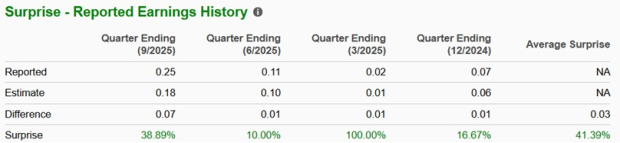

New Gold to Report Q4 Results: What's in the Cards for the Stock?