Here is Why Nokia Oyj (NOK) is Highly Favored by Hedge Funds

Nokia Oyj (NYSE:NOK) is one of the 11 best communication equipment stocks according to hedge funds.

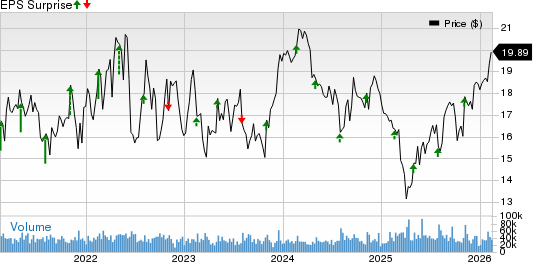

As of February 9 closing, consensus sentiment for Nokia Oyj (NYSE:NOK) remained moderately bullish. The stock had been covered by 7 analysts, receiving 5 Buy ratings and 1 Hold rating. With 1 Sell call, the stock has a projected median 1-year price target of $7.18.

On February 10, Nokia Oyj (NYSE:NOK) announced the transfer of 2,622,652 shares to participants in its equity-based incentive plans. This transfer relates to the board’s resolution to settle commitments related to the incentive plan, as previously announced on October 2, 2025. Following this, the company now holds 139,291,855 of its shares.

On February 2, Sandeep Deshpande of J.P. Morgan reiterated his Overweight rating on Nokia Oyj (NYSE:NOK). In the process, the analyst also raised the price target on the stock from $8 to $8.20, which leads to an upside potential of 16% at the current level.

Nokia Oyj (NYSE:NOK) is a Finland-based B2B technology innovation company that delivers mobile, fixed, and cloud network solutions. It operates through two primary segments, i.e., Network Infrastructure and Mobile Networks, focusing on network infrastructure, AI-powered connectivity, and technology licensing services. The company delivers a mix of optical, IP, fixed networks, radio, and core networking solutions.

While we acknowledge the potential of NOK as an investment, we believe certain AI stocks offer greater upside potential and carry less downside risk. If you’re looking for an extremely undervalued AI stock that also stands to benefit significantly from Trump-era tariffs and the onshoring trend, see our free report on the best short-term AI stock.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Is Allied Gold's Higher Gold Production a Catalyst for Future Growth?

4 Construction Stocks Poised to Deliver an Earnings Beat This Season

Host Hotels Gears Up to Report Q4 Earnings: Key Factors to Consider

US economic performance remains strong, even as many Americans remain doubtful