C3.ai Broadens Partner Strategy: Can Telecom Accelerate Revenues?

C3.ai’s AI partnership with Vonage, part of Ericsson (“ERIC”), to develop a network-enabled, agentic AI field-services solution highlights the company’s broader strategy of scaling growth through its partner ecosystem and targeted, industry-specific applications. The collaboration introduces C3 AI Field Services, a module within the C3 AI Asset Performance Suite, designed for mission-critical operations performed beyond the enterprise edge, where workers rely on reliable connectivity and real-time intelligence in remote or demanding environments.

The joint solution addresses persistent challenges in the global field-service market, including complex equipment maintenance, fragmented data systems, workforce skill gaps and delayed troubleshooting. By integrating C3.ai’s enterprise AI capabilities with Vonage’s communications and network APIs, the platform enables mobile AI agents to deliver real-time guidance, troubleshooting support, and voice- and video-based collaboration with remote experts. These capabilities are intended to improve first-time fix rates, safety compliance and workforce productivity, while reducing downtime across distributed operations.

The announcement also reinforces the central role of partnerships in C3.ai’s go-to-market strategy. During the second-quarter fiscal 2026 earnings call, management noted that 89% of quarterly bookings were closed with or through partners, underscoring how ecosystem relationships are accelerating adoption. The company emphasized that rapidly demonstrating economic value remains a key priority for driving faster sales conversion, and collaborations such as the Vonage partnership — supported by Ericsson’s broader telecom ecosystem — could expand distribution channels and help translate enterprise AI deployments into more scalable and recurring revenue growth over time.

Overall, the Vonage partnership reinforces C3.ai’s partner-led strategy and expands AI into telecom-enabled field operations. If adoption scales, such integrations could meaningfully support recurring revenue growth and improve long-term visibility.

Competitive Landscape for C3.AI

Unisys Corporation UIS is targeting the opportunity through enterprise workflow automation, with a focus on deploying agentic AI across IT services and support functions. Its Service Experience Accelerator combines generative and agentic AI with knowledge management to automate service desk operations, preserve institutional knowledge and enhance response times. The company is prioritizing domain-specific, mission-critical use cases where dependable AI agents can drive cost savings and operational efficiency.

Snowflake Inc. SNOW is a cloud-based data platform used for storing, managing, and analyzing large amounts of data, enabling organizations to power analytics, build data applications, and perform AI/ML workloads in a unified environment. AI capabilities are increasingly shaping bookings and customer engagement, with revenue growth driven primarily by sustained usage across existing workloads rather than one-time conversion events. Strong retention rates and expanding AI adoption continue to support this consumption-based model, although revenue realization remains closely linked to customer utilization patterns.

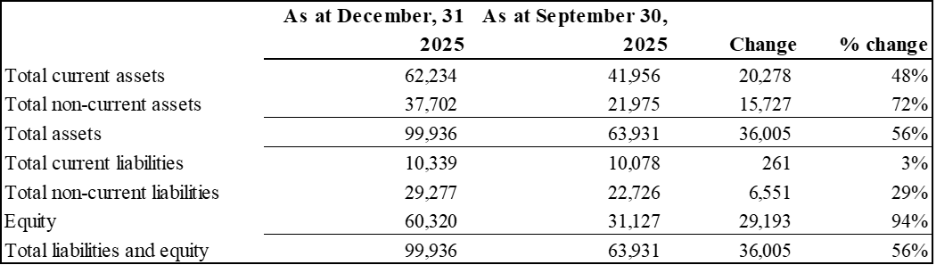

AI’s Price Performance, Valuation & Estimates

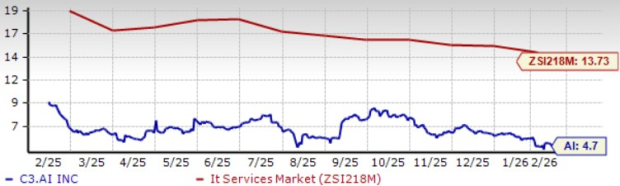

Shares of C3.ai have declined 23.1% in the past three months compared with the industry’s fall of 14.9%.

AI Three-Month Price Performance

Image Source: Zacks Investment Research

From a valuation standpoint, AI trades at a forward price-to-sales ratio of 4.7, significantly below the industry’s average of 13.73.

Image Source: Zacks Investment Research

The Zacks Consensus Estimate for AI’s fiscal 2026 earnings per share (EPS) implies a year-over-year downtick of 141.7%. However, the loss per share has narrowed in the past 30 days.

Image Source: Zacks Investment Research

AI stock currently has a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

OKYO Pharma Announces Public Offering of Ordinary Shares

Electrovaya Reports Fiscal Year Q1 2026 Results