CoreWeave's (CRWV) AI Boom Story Now Competes With Securities Lawsuit

CoreWeave (NASDAQ:CRWV) is one of the AI stocks currently on Wall Street’s radar.

AI-focused cloud computing company CoreWeave (NASDAQ:CRWV) received a fresh analyst update from Citizens, who reiterated its Market Outperform rating on the stock with a price target of $180.00.

The research firm characterized CRWV as a leading GPU-as-a-Service (GPUaaS) provider poised to benefit from the rising demand for AI infrastructure. This is underpinned by multi-year contracts and a revenue backlog exceeding $56 billion.

The firm believes CoreWeave is likely to continue capturing large-scale contracts as the GPUaaS total addressable market expands, fueled by accelerated adoption of generative AI and increased outsourcing by hyperscalers.

It added that potential pricing pressure, customer concentration issues, and leverage concerns are some of the several risks facing the company.

In other news, Leading securities law firm Bleichmar Fonti & Auld LLP said that a class action lawsuit has been filed against CoreWeave, Inc. (NASDAQ:CRWV) and certain senior executives, alleging securities fraud after significant stock drops resulting from the potential violations of the federal securities laws.

The cloud computing company has been working with multiple partners, including Core Scientific, with which a merger agreement was announced on July 7, 2025.

During this period, CRWV assured investors that it is well-positioned to benefit from strong demand and boasted the ability to deploy AI infrastructure at scale. However, the company overstated its capacity to meet this demand and also failed to disclose major data center construction delays.

CoreWeave, Inc. (NASDAQ:CRWV) is a cloud platform provider that provides equipment for AI and other computing purposes.

While we acknowledge the potential of CRWV as an investment, we believe certain AI stocks offer greater upside potential and carry less downside risk. If you’re looking for an extremely undervalued AI stock that also stands to benefit significantly from Trump-era tariffs and the onshoring trend, see our free report on the best short-term AI stock.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Gasoline shortages in California are leading the state to source fuel supplies from the Bahamas

US Whales Buying Bitcoin, Non-US Whales Selling – How Should This Be Interpreted? Here Are the Details

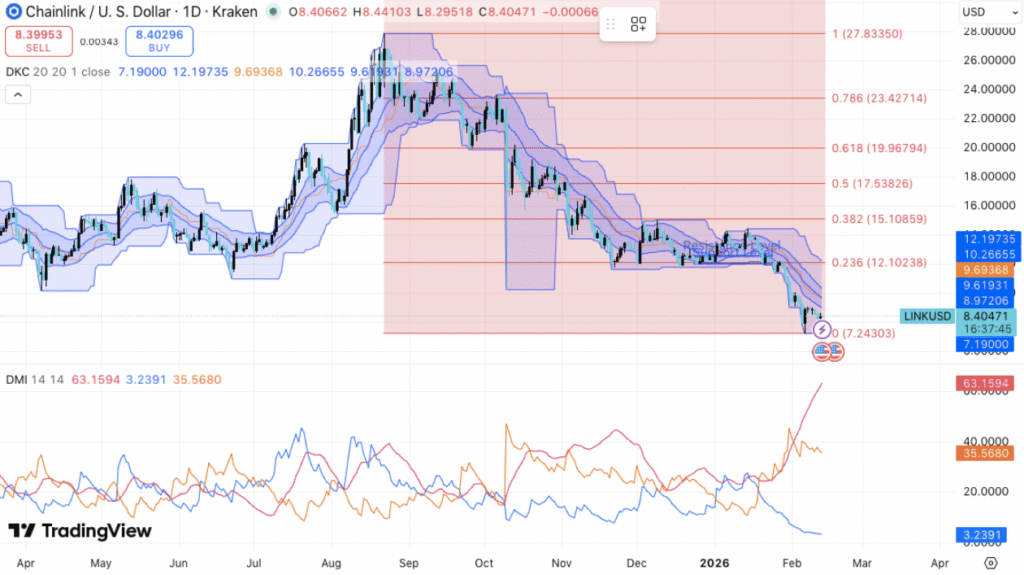

Chainlink Faces Bearish Pressure as Price Hits $7.24 Support

Prediction markets vs. insider trading: Founders admit blockchain transparency is the only defense