- BNB could gain from regulatory clarity and Binance ecosystem expansion.

- XRP moves forward without lawsuits, boosting institutional adoption prospects.

- SPX6900 rides strong momentum and anti establishment community appeal.

Regulation shaped crypto market for years. Court battles and enforcement actions slowed growth. Now legal pressure has eased for key players. That shift could unlock fresh momentum in 2026. Investors often search for projects with clear direction and strong ecosystems. Binance Coin, XRP, and SPX6900 each offer a different angle. One ties directly to a major exchange. Another targets global payments. The third rides cultural rebellion.

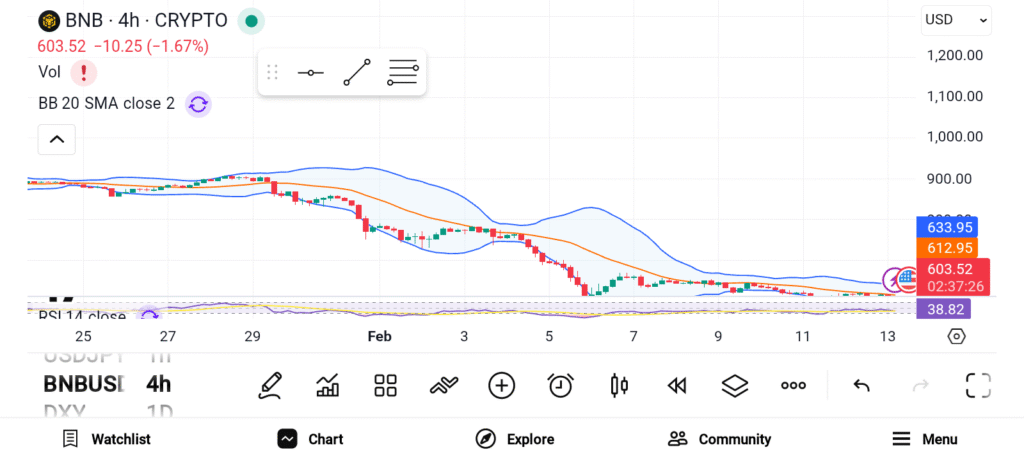

Binance Coin (BNB)

Source: Trading View

Source: Trading View

Binance Coin connects directly to Binance operations. As the native asset of BNB Chain, BNB powers network activity. Users rely on BNB for transaction fees and staking. The token also grants exchange perks. Traders receive discounted trading fees when holding BNB. Stakers can access higher reward tiers. Binance continues expanding services across regions. Regulatory clarity removes a heavy cloud over growth plans. With legal uncertainty reduced, Binance can scale products more freely. Expanded services often increase token demand. BNB already ranks among the largest cryptocurrencies by market value. Strong exchange activity could push valuation higher in 2026.

Ripple (XRP)

Source: Trading View

Source: Trading View

Ripple Labs finally moved forward without an ongoing SEC lawsuit. Years of legal pressure limited growth potential. Now XRP operates in a cleaner environment. That shift strengthens investor confidence. Ripple designed XRP as a bridge for cross border payments. Financial institutions use the network to move funds efficiently. Banks value speed and lower costs. XRP aims to solve both challenges. After the recent election cycle, XRP prices surged sharply. Market value expanded by billions in weeks. That rally proved strong speculative power. With legal barriers removed, institutional adoption could accelerate. Many traders watched from the sidelines during the lawsuit. Fresh capital may enter as risk perception falls. XRP stands in a stronger position heading into 2026.

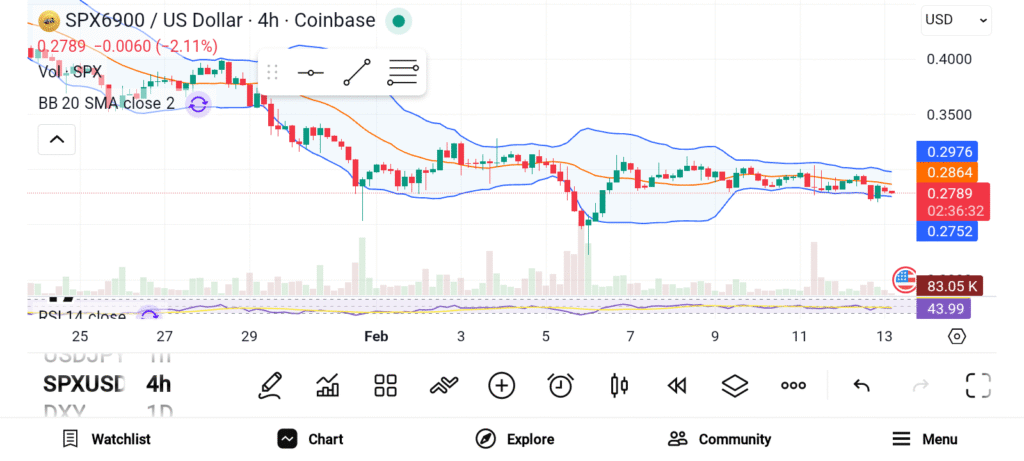

SPX6900 (SPX)

Source: Trading View

Source: Trading View

SPX6900 takes a very different path. This meme coin promotes a bold anti establishment message. Younger investors often connect with that theme. Economic pressure fuels demand for alternative assets. While major coins dipped during recent pullbacks, SPX climbed. Weekly gains reached double digits. Monthly growth crossed triple digits. That performance signals strong community support. SPX6900 leans on culture and sentiment. Traditional valuation models rarely apply here. Price momentum depends on narrative strength. In speculative phases, narrative can drive rapid appreciation. For risk tolerant investors, SPX offers high upside potential. Volatility will likely remain intense. Strong community engagement could sustain momentum into 2026.

BNB benefits from clearer regulation and strong exchange integration. XRP gains freedom after years of legal pressure. SPX6900 taps into cultural frustration and speculative energy. Each project carries different risk and reward potential for 2026.