Dutch banking giant ING is ramping up its crypto-related services, joining a growing list of global financial powerhouses that now offer digital asset products to clients. Despite a recent slump in the crypto markets, the prospect of long-term profits continues to draw major banks deeper into the sector. The latest strategic move comes from ING’s subsidiary in Germany, signaling the bank’s commitment to meeting evolving customer demand.

Strategic Alliances Broaden Crypto Market Access

Teaming up with American asset managers Bitwise and VanEck, ING Germany has significantly widened the range of crypto investment solutions available to its clients. Products from 21Shares, WisdomTree, and BlackRock were already accessible on ING platforms. Now, investment products—specifically ETPs (Exchange Traded Products) and ETNs (Exchange Traded Notes)—from Bitwise and VanEck have been added to the selection. The growing volatility in cryptocurrencies, far from deterring financial institutions, has increased their appetite for these offerings even as prices see major swings.

Aimed at attracting both seasoned investors and newcomers, ING Germany is offering a promotional campaign starting in February. Customers placing orders of at least 1,000 euros for Bitwise ETPs will not be charged transaction fees. Trades below this amount will incur only a $4.60 commission. The deal covers the full Bitwise portfolio, including Bitwise Core Bitcoin ETP (BTC1), Bitwise MSCI Digital Assets Select 20 ETP (DA20), and Bitwise Physical Ethereum ETP (ZETH), seeking to lower barriers and expand adoption among German retail clients.

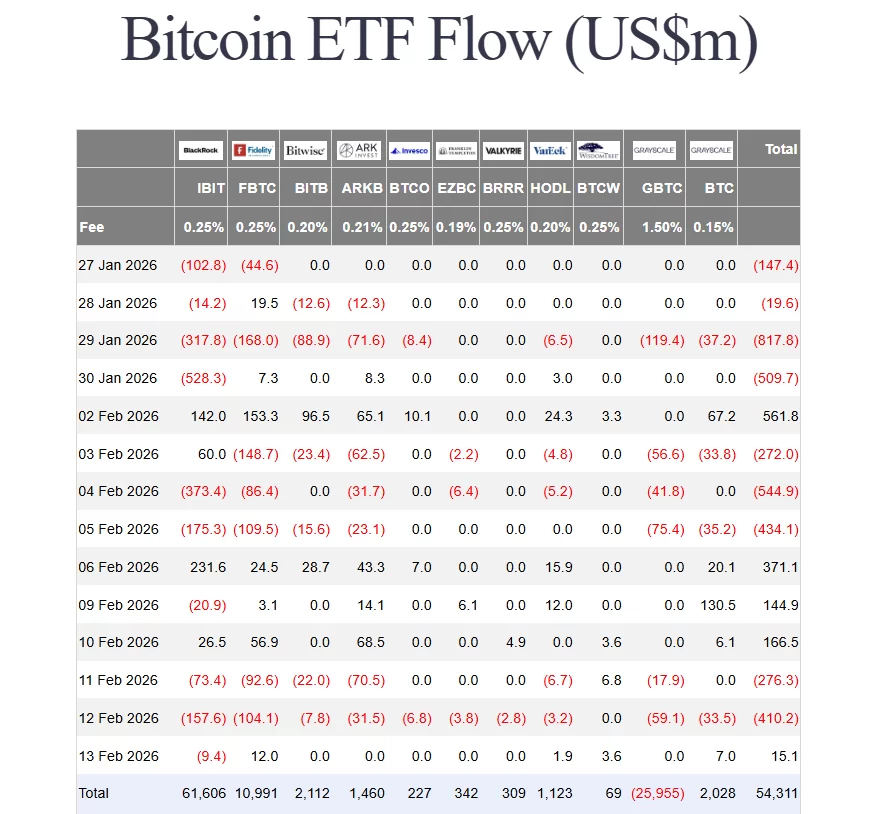

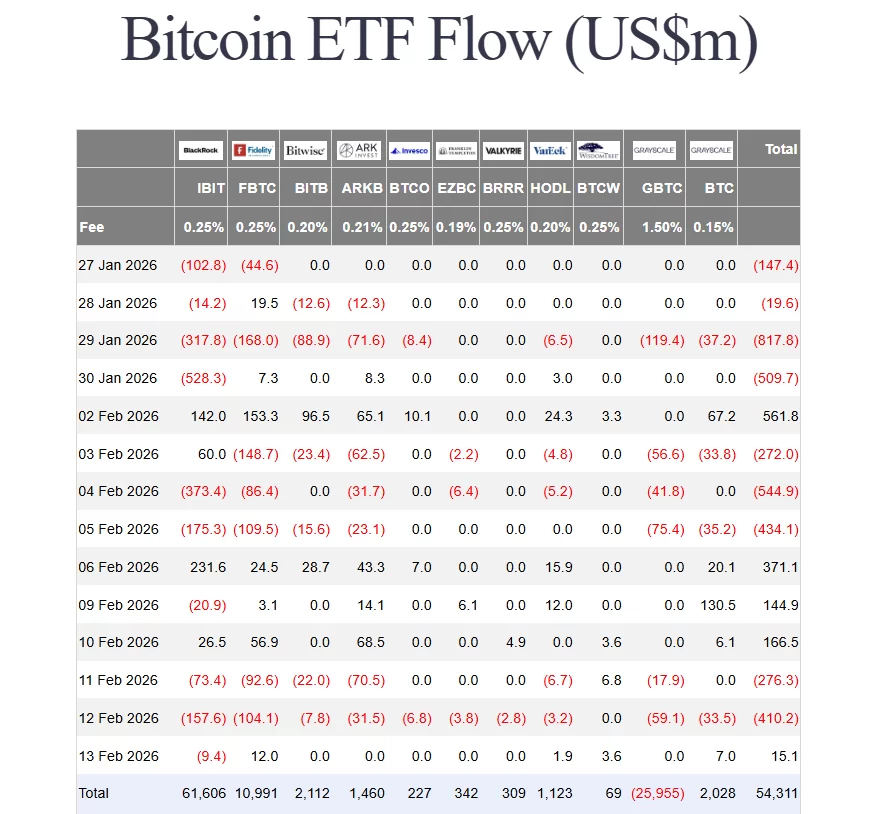

Crypto Investment Products Face Mixed Flows

BlackRock has emerged as the leading player in the ETF space, generating the highest revenues from its Bitcoin ETF product. Even traditional holdouts like Vanguard, typically cautious about digital assets, are reconsidering their approach. For financial firms, the priority remains growing their bottom line, and delivering alternative investment options that clients demand is becoming essential to that end.

Although crypto investment products had a relatively strong showing in January, recent selloffs have reversed gains, bringing net inflows to 2026-year lows. In the past two weeks alone, nearly $3.5 billion has flowed out of these funds. This past week, while Bitcoin ETFs saw brief net inflows over several days, heavier selling ultimately led to a net outflow of approximately $300 million.

Nevertheless, the series of strong crypto ETF inflows that began with their 2024 launch proved more resilient than anticipated. Even with intermittent outflows, this early momentum has sustained broader confidence in crypto ETFs, showing that recent setbacks have not significantly dented overall trust in these products.

Market-watchers note that if Warsh, a major central banking figure, adopts a less hawkish stance than expected, it could reinvigorate interest in cryptocurrencies. Waning macroeconomic risks might compound the allure of digital assets, positioning banks and asset managers to enable their clients to capitalize on new opportunities in turbulent markets.

“Should macroeconomic headwinds ease, major asset managers and banks will be eager to facilitate profitable moves for their clients,” the report emphasized.

As the competitive landscape shifts, ING’s latest initiatives reflect a broader trend of banks responding decisively to the rising demand for digital asset solutions. While global financial markets remain unpredictable, the willingness of institutions to innovate signals a steady integration of crypto products in mainstream finance.