Strategic Partnership And Strong Earnings Boost Maplebear (CART) Stock

On February 10, Maplebear Inc. (NASDAQ:CART) entered into a strategic partnership with Toast (NYSE:TOST), a comprehensive digital platform serving the hospitality industry. The partnership is aimed at expanding its presence among U.S. restaurants and retailers. The agreement will allow Toast’s retail customers to connect their in-store inventory directly to the Instacart marketplace. This will help create new sales opportunities and expand their online reach. By integrating SKU data and inventory systems, Instacart intends to keep online product availability closely aligned with the store stock and enhance catalog accuracy.

The partnership also strengthens Maplebear Inc.’s (NASDAQ:CART) business, its B2B same-day delivery platform, which will serve as a supply partner for Toast-powered restaurants. Operators can order essential items, such as fresh ingredients and pantry staples, with delivery within an hour. Additionally, a pilot launch is planned early this year, followed by a nationwide rollout expected later in 2026.

Ryan Hamburger, Vice President of Commercial Partnerships at Instacart, commented:

”This partnership brings together two platforms that play complementary roles in how retailers and restaurants operate and grow. We’re looking forward to expanding our breadth of retailers by welcoming Toast’s retail partners to the Instacart Marketplace and giving Toast restaurants access to our marketplace via Instacart Business for a fast and flexible way to source produce and other essentials to meet last-minute needs.”

Separately, Benchmark lowered its price target on Maplebear Inc. (NASDAQ:CART) on the same day. Analyst Mark Zgutowicz of Benchmark reaffirmed his Buy rating on the stock while lowering the firm’s price target from $60 to $53. Despite reducing its price target, the firm still holds a favorable outlook.

Maplebear Inc. (NASDAQ:CART) operates as Instacart. It provides online grocery shopping services to households across North America. The company offers its services through its website and mobile application. In addition to grocery shopping services, it also provides software-as-a-service solutions and advertising services. Maplebear is based in San Francisco, California.

While we acknowledge the potential of CART as an investment, we believe certain AI stocks offer greater upside potential and carry less downside risk. If you’re looking for an extremely undervalued AI stock that also stands to benefit significantly from Trump-era tariffs and the onshoring trend, see our free report on the

best short-term AI stock .

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

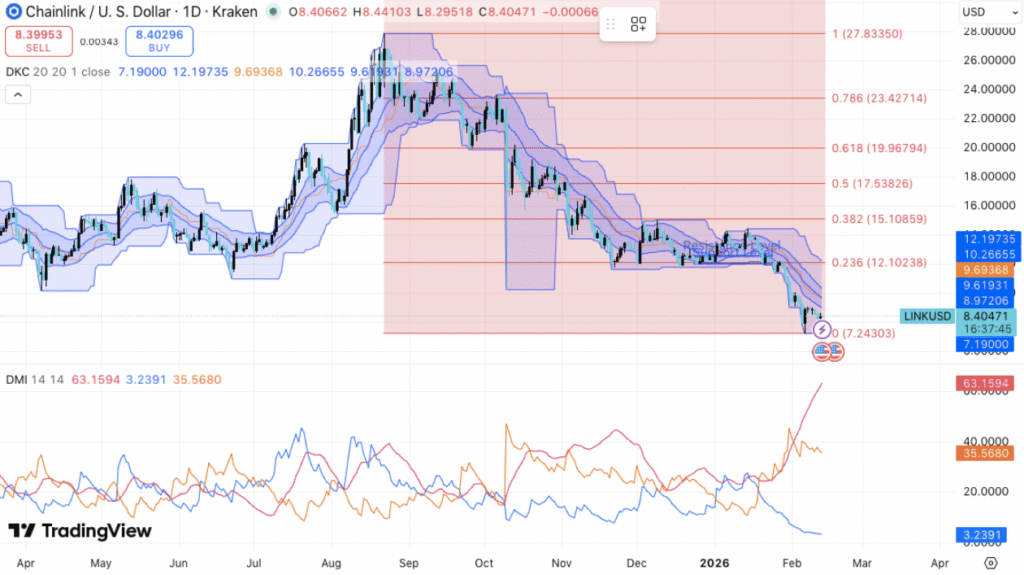

Chainlink Faces Bearish Pressure as Price Hits $7.24 Support

Prediction markets vs. insider trading: Founders admit blockchain transparency is the only defense

Altcoins Experiencing a Surge in Trading Volume in South Korea Revealed – XRP at the Top, Here’s the Full List

Her divorce was messy. Cryptocurrency turned into her saving grace.