Benzinga's 'Stock Whisper' Index: 5 Stocks Investors Secretly Monitor But Don't Talk About Yet

Each week, Benzinga’s Stock Whisper Index uses a combination of proprietary data and pattern recognition to showcase five stocks that are just under the surface and deserve attention.

Investors are constantly on the hunt for undervalued, under-followed and emerging stocks. With countless methods available to retail traders, the challenge often lies in sifting through the abundance of information to uncover new opportunities and understand why certain stocks should be of interest.

Here’s a look at the Benzinga Stock Whisper Index for the week ending February 13:

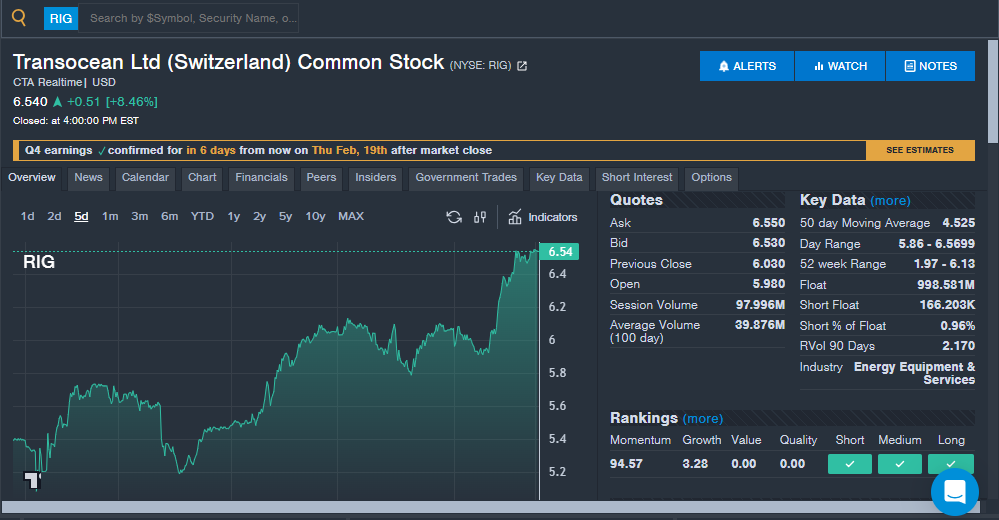

Transocean Ltd (NYSE:RIG): The offshore drilling company saw strong interest from readers during the week with shares at 52-week highs and nearing five-year highs. Transocean recently reported $184 million in new contracts that will commence in the first quarter of 2027. The company is set to report fourth-quarter financial results on Thursday with analysts expecting 8 cents per share in earnings and $1.04 billion in revenue. The company has beaten analyst estimates for earnings per share in two straight quarters and beaten analyst estimates for revenue in three straight quarters. BTIG recently maintained a Buy rating and raised the price target from $6 to $10.

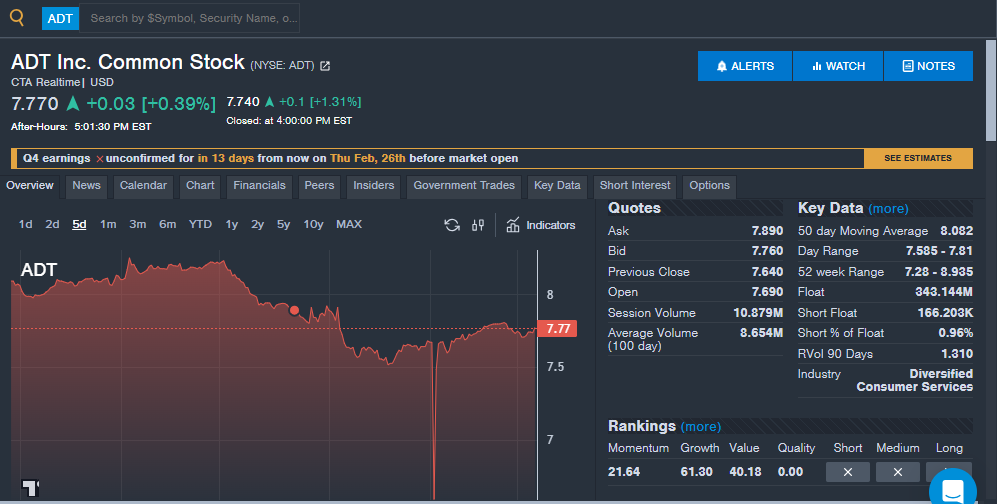

ADT Inc (NYSE:ADT): The security and smart home company saw strong interest from investors during the week with a recent announcement that shares will be added to the S&P SmallCap 600. ADT CEO Jim DeVries said the index inclusion is an "important milestone" and could highlight the company's recurring revenue progress. ADT is set to report fourth-quarter financial results later this month. The company has beaten earnings per share estimates in five straight quarters and in nine of the last 10 quarters overall. The company has beaten revenue estimates in five straight quarters and in six of the last 10 quarters overall. The stock could be one to watch ahead of the recent index inclusion and upcoming earnings.

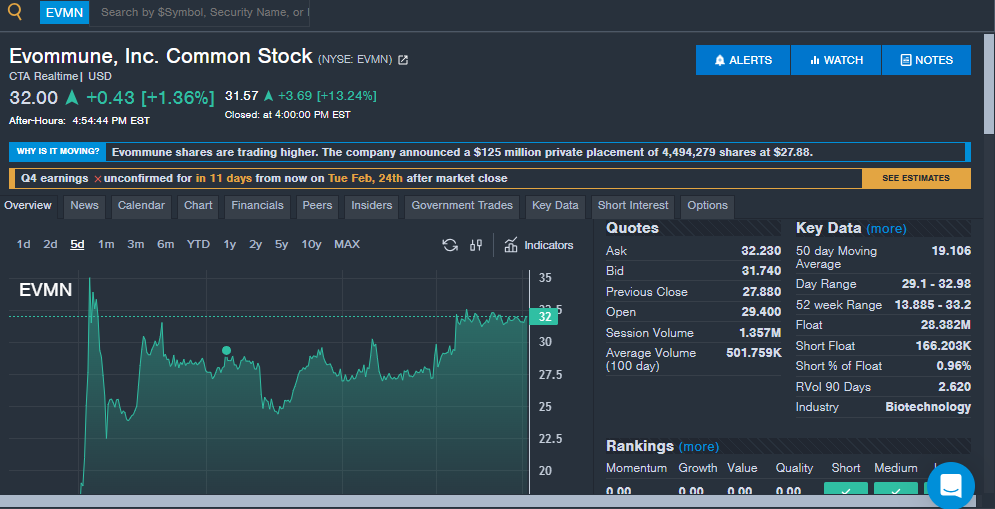

Evommune Inc (NYSE:EVMN): The clinical stage biotechnology stock saw shares trade higher during the week after announcing positive top-line results from the EVO301 Phase 2a trial to treat atopic dermatitis. The trial met primary efficacy endpoints and could help the stock gain a bigger spotlight into more trials. Evommune plans to advance EVO301 to a Phase 2b trial and also explore additional treatments like ulcerative colitis. Analysts have increased attention on the stock with HC Wainwright maintaining a Buy rating and raising the price target from $35 to $65. Oppenheimer also recently initiated coverage with an Outperform rating and $42 price target. The company also completed a $125 million private placement for stock at $27.88 per share.

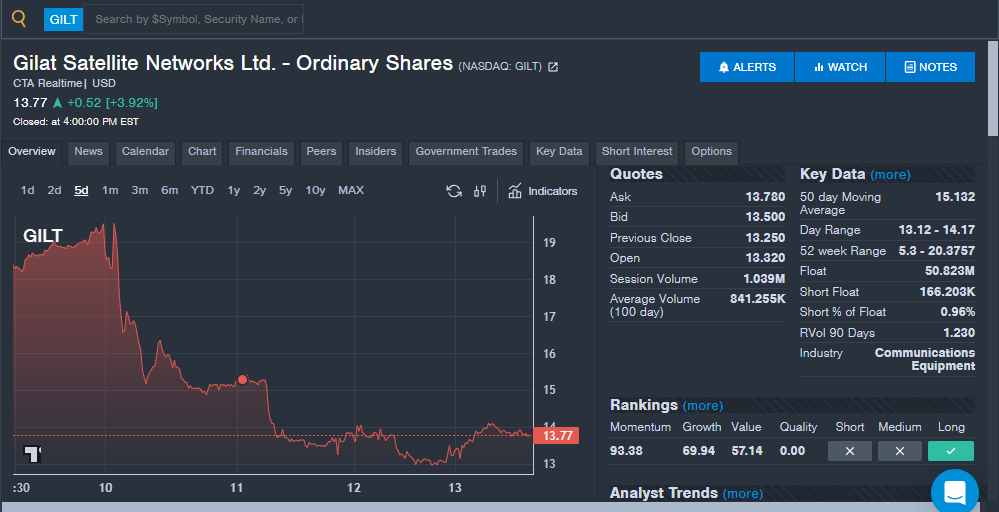

Gilat Satellite Networks (NASDAQ:GILT): The satellite company saw strong interest from Benzinga readers during the week, which comes after quarterly earnings were reported and several recent contract wins were announced. The company reported quarterly results on Feb. 10 with earnings per share and revenue each beating analyst estimates. Gilat also announced a $16 million order for the European Ministry of Defense and a $10 million order for the ground infrastructure for LEO Constellation. Needham maintained a Buy rating on the stock with a $20 price target.

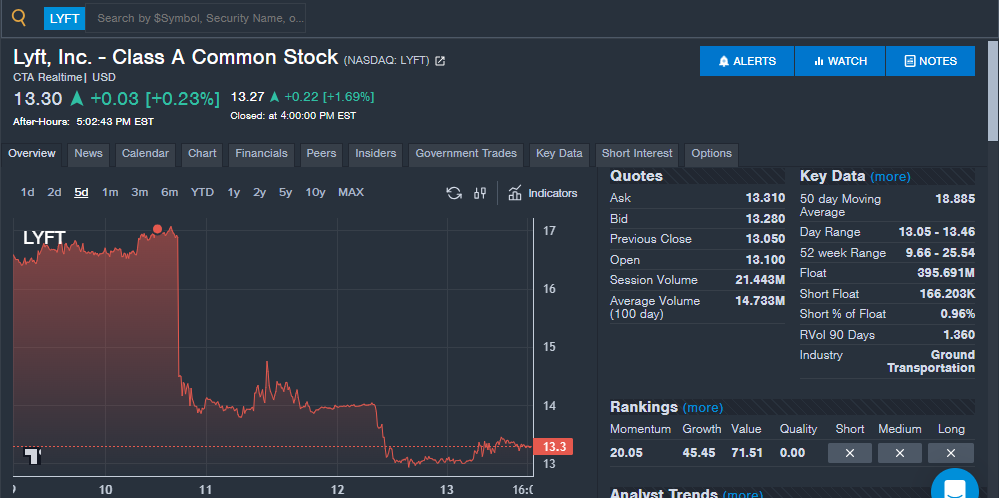

Lyft Inc (NASDAQ:LYFT): The ride share company saw strong interest from investors during the week after shares fell on the heels of quarterly results. The company reported an earnings per share beat and missed analyst estimates for revenue. Analysts questioned the company's guidance on profits and future guidance with price targets cut after financial results. Lyft CEO David Risher defended the company during an appearance on "Squawk Box" Wednesday.

"What do they want? Tell me about it! … Look, I don't know," Risher said.

The CEO highlighted the company's record bookings, record profits and record cash flow in the quarter. Risher also highlighted the company's future bet on autonomous vehicles and the growth of Lyft from a ride-hail app to a fleet management company. Lyft stock could be closely monitored going forward as investors and analysts try to judge the company on the balance between growth and profits.

Stay tuned for next week’s report, and follow Benzinga Pro for all the latest headlines and top market-moving stories here.

Read the latest Stock Whisper Index reports here:

- January 16

- January 23

- January 30

- February 6

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Kevin O'Leary wins $2.8 million defamation judgment against crypto influencer Ben 'BitBoy' Armstrong

AAVE Signals Bullish Reversal – Strong Protocol Fundamentals Drive a Major 2026 Breakout

Bitcoin Approaches Pivotal Price Levels as Market Cycle Patterns Resurface

Geopolitical Tensions Push Bitcoin Below Key Support as Israel-Iran Concerns Rise