Bitcoin, Ethereum, XRP, Dogecoin Slide On High Selling Pressure: Analyst Sees 'Adam & Eve' Pattern That Could Push Bitcoin To $79,000

Leading cryptocurrencies fell on Sunday, but stock futures rose as consumer inflation eased to an 8-month low.

| Bitcoin (CRYPTO: BTC) | -1.24% | $68,673.86 |

| Ethereum (CRYPTO: ETH) |

-4.83% | $1,966.09 |

| XRP (CRYPTO: XRP) | -3.46% | $1.47 |

| Solana (CRYPTO: SOL) | -2.14% | $86.05 |

| Dogecoin (CRYPTO: DOGE) | -8.45% | $0.1022 |

Crypto Market Faces Selling Pressure

Bitcoin slid into the $68,000 region, while the trading volume for the apex cryptocurrency jumped 11% over the past day.

Ethereum also faced significant selling pressure, as the second-largest cryptocurrency fell below $2,000 amid an 80% spike in 24-hour trading volume. Dogecoin plunged more than 8%.

Roughly $325 million was liquidated from the market in the last 24 hours, with $240 million in bullish long bets wiped out.

Bitcoin’s open interest fell 2.69% over the past 24 hours, aligning with the drop in spot price. That said, the majority of retail and whale investors on Binance remained long on the cryptocurrency.

The "Extreme Fear" sentiment persisted in the market.

Top Gainers (24 Hours)

| Cryptocurrency (Market Cap>$100 M) | Gains +/- | Price (Recorded at 8:25 p.m. ET) |

| Beercoin2 (BEER2) | +187.60% | $0.0000005108 |

| SKPANAX (SKX) | +84.56% | $0.3507 |

| World of Dypians (WOD) | +77.56% | $0.02957 |

The global cryptocurrency market capitalization stood at $2.28 trillion, following a drop of 1.07% over the past 24 hours.

Stock Futures Gain, Gold Trades Down

Stock futures ticked higher overnight on Sunday. The Dow Jones Industrial Average Futures rose 37 points, or 0.07%, as of 7:42 p.m. EDT. Futures tied to the S&P 500 gained 0.18%, while Nasdaq 100 Futures added 0.13%.

According to the CPI data released Friday, the annual rate of consumer inflation slowed to 2.4% in January, missing economists’ expectations of 2.5% and marking the lowest inflation print since May 2025.

Meanwhile, the odds of a 25-basis-point cut at the Federal Reserve's March meeting remained modest at 9.8%.

Spot gold traded down 0.41% at $5,021 per ounce, after rallying on Friday following the softer inflation print.

The New York Stock Exchange and Nasdaq will be closed on Monday for Presidents’ Day.

Is $79,000 In Line For Bitcoin?

Popular cryptocurrency analyst and trader Ali Martinez highlighted a potential Adam & Eve double bottom pattern on Bitcoin’s 1-hour chart.

The Adam and Eve is a reversal pattern that can appear in both uptrends and downtrends, characterized by a double top or double bottom formation.

"A break above $71,500 could open the door to $79,000," the analyst predicted.

Bitcoin $BTC appears to be forming an Adam & Eve pattern.

— Ali Charts (@alicharts) February 15, 2026

A break above $71,500 could open the door to $79,000.

Michaël van de Poppe, another widely followed chartist, noted Bitcoin's "classic correction" on Sunday, with the CME gap at $69,000.

"Probably we’ll stay around this level until Monday open and then we’re back up towards the highs," the analyst predicted.

CME gaps are price gaps that appear on the CME Bitcoin futures market owing to discrepancies in closing and opening prices.

#Bitcoin has a classic correction on Sunday.

— Michaël van de Poppe (@CryptoMichNL) February 15, 2026

Why?

Because the CME gap is at $69K.

Probably we'll stay around this level until Monday open and then we're back up towards the highs.

Still, the #Altcoins are acting stronger.

Photo: Memory Stockphoto / Shutterstock

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Aave founder pitches $50T ‘abundance asset’ boom to drive DeFi

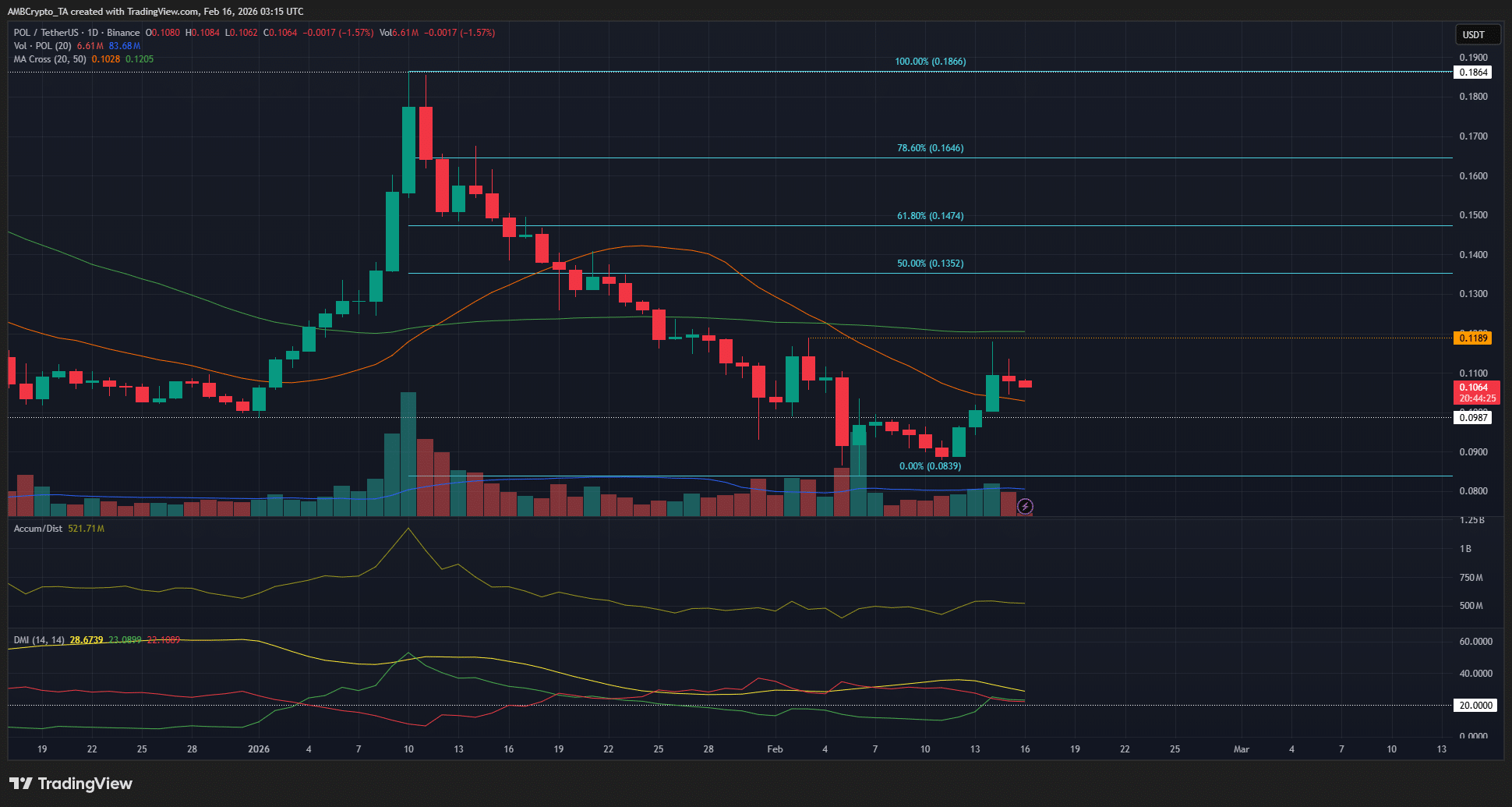

Polygon’s high-volume rally ends in a sweep – $0.135 remains target ONLY IF…

ECB: The upcoming action will be an increase

Bitcoin Price Prediction: Can BTC Reclaim $72,000 This Week?