- BERA lost key $0.706 support, increasing risk of deeper decline.

- ADX shows a strong bearish trend with weakening on-chain activity.

- Failure to reclaim resistance could trigger 45% drop toward $0.35.

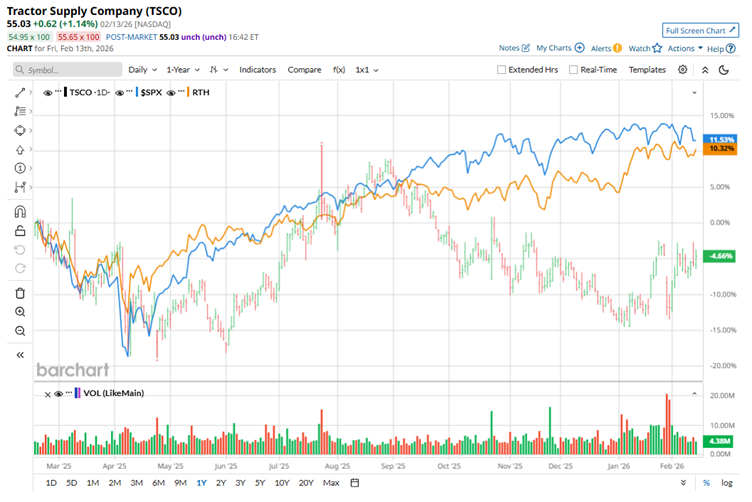

Berachain — BERA, shocked the market after posting a massive 315% rally in a short period. That surge attracted strong speculative interest and heavy trading activity. However, momentum has now reversed. Price has declined for two consecutive days, shifting short-term sentiment. BERA currently trades near $0.655 after losing more than 18% within 24 hours. At the same time, trading volume dropped 75% to $331 million, signaling reduced participation and fading enthusiasm.

Key Levels Now Decide BERA’s Next Move

The daily chart shows a clear downward structure taking shape. Recent selling pressure pushed price below the $0.706 support level, handing control to sellers. That breakdown marks a critical shift in momentum. If price fails to reclaim that level soon, analysts project a potential 45% decline toward $0.35. Such a move would erase a significant portion of the recent rally and reinforce bearish dominance.

For bulls to regain control, the price of BERA must close above $0.777 on the daily timeframe. Without that breakout, downward pressure likely persists. The Average Directional Index currently reads 33.65, which sits above the key threshold of 25. This reading confirms strong trend strength. Unfortunately for buyers, the prevailing trend favors sellers at this stage.

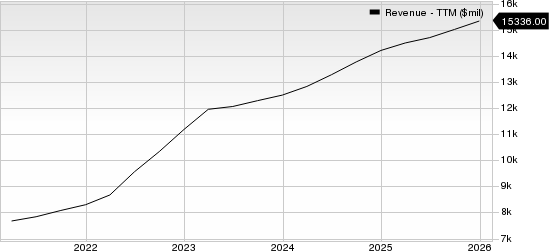

On-chain data further supports the cautious outlook. DeFiLlama reports declines in Total Value Locked, chain revenue, and decentralized exchange volume over the past three days. Falling user activity often signals weakening ecosystem confidence. When participation shrinks alongside technical breakdowns, downside risk increases. Lower trading volume also suggests that many traders have stepped aside after the rally cooled.

Mixed Sentiment Adds More Uncertainty

Despite the bearish technical setup, derivatives data reveals mixed positioning among traders. Some participants appear to accumulate, while others aggressively build short exposure. Spot flow data shows more than $644,000 leaving exchanges within 24 hours. Such outflows can indicate accumulation, as investors sometimes move tokens into private storage to hold long term. At the same time, leverage data paints a different picture.

Around the $0.708 level, traders opened approximately $3.71 million in short positions. This area now serves as strong resistance. Heavy short exposure reflects notable bearish conviction. On the downside, the $0.64 level provides near-term support. Traders placed roughly $641,000 in long positions there, suggesting some confidence in short-term stabilization. The struggle between buyers and sellers now centers around these price zones.

If price drops below $0.64, losses could accelerate quickly. If bulls reclaim $0.706, selling pressure may ease. For now, the broader structure remains fragile. Strong trend strength, weakening on-chain metrics, and divided sentiment create uncertainty. Unless buyers act decisively, a further 45% decline remains a realistic possibility under current market conditions.