Third of employers plan to reduce recruitment due to Labour’s proposed changes to workers’ rights

Concerns Grow Over Labour's Employment Law Changes

Recent changes to workers' rights introduced by Labour have prompted more than a third of business leaders to reconsider their hiring plans, making the job market more challenging for candidates than it has been in years.

According to a survey, approximately 37% of employers intend to scale back on hiring permanent employees due to the new Employment Rights Act, which Sir Keir Starmer has called a landmark improvement for workers' protections.

The Chartered Institute of Personnel and Development (CIPD) surveyed over 2,000 employers and found that three-quarters believe the new legislation will drive up recruitment expenses. The research also predicts a further slowdown in hiring activity.

The Employment Rights Act now requires companies to provide statutory sick pay from the first day of illness and has shortened the qualifying period for protection against unfair dismissal from two years to just six months.

Additionally, the updated rules have made it easier for trade unions to organize industrial action and gain access to workplaces.

The CIPD notes that employer confidence is low and hiring intentions are at their weakest point since records began in 2014, outside of the pandemic period. Many business leaders are worried that increased employment costs could further dampen recruitment and job creation.

There are also fears that the new regulations could have unintended consequences, such as encouraging companies to rely more heavily on temporary workers and contractors, potentially reducing job security for many employees.

Ben Willmott, CIPD’s head of public policy, commented, “With business confidence already subdued and hiring intentions weak, our findings indicate that these measures could further restrict job opportunities.”

Most employers also anticipate a rise in workplace disputes, as employees may be more likely to file formal complaints under the strengthened legal protections.

These developments come amid warnings from economists that the UK’s unemployment rate could climb to 5.4% in 2026, the highest in over a decade. The most recent data, covering September to November last year, shows unemployment at 5.1%, a level not seen since 2020. Updated figures are expected soon from the Office for National Statistics.

Hiring has faced additional challenges since Labour took office, with measures such as increased employer National Insurance contributions and a higher minimum wage introduced by Rachel Reeves.

UK businesses are now contending with one of the world’s highest minimum wage rates, which is putting pressure on hiring and slowing economic growth.

Separate analysis by KPMG forecasts that the UK economy will expand by just 1% this year, slightly trailing the eurozone’s projected 1.1% growth. While UK jobseekers are experiencing a difficult employment landscape, KPMG notes that the eurozone is benefiting from robust labour markets and strong wage increases.

Hiring Outlook: Private vs Public Sector

The CIPD’s research reveals that only 57% of private sector employers plan to recruit in the next quarter, marking a record low outside the pandemic. In contrast, 70% of public sector organizations expect to hire during the same period.

Despite this, the public sector is projected to see the largest reduction in workforce numbers, with the net employment balance dropping to -11, indicating more employers expect to cut staff than add new positions in the coming months.

Furthermore, the number of new hires entering the Civil Service fell by 30% in the year leading up to March 2025, representing the steepest decline in 14 years.

The Government has been approached for a response to these findings.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Generational Entry for Cardano if Bull Market Starts Here—Technical Analyst

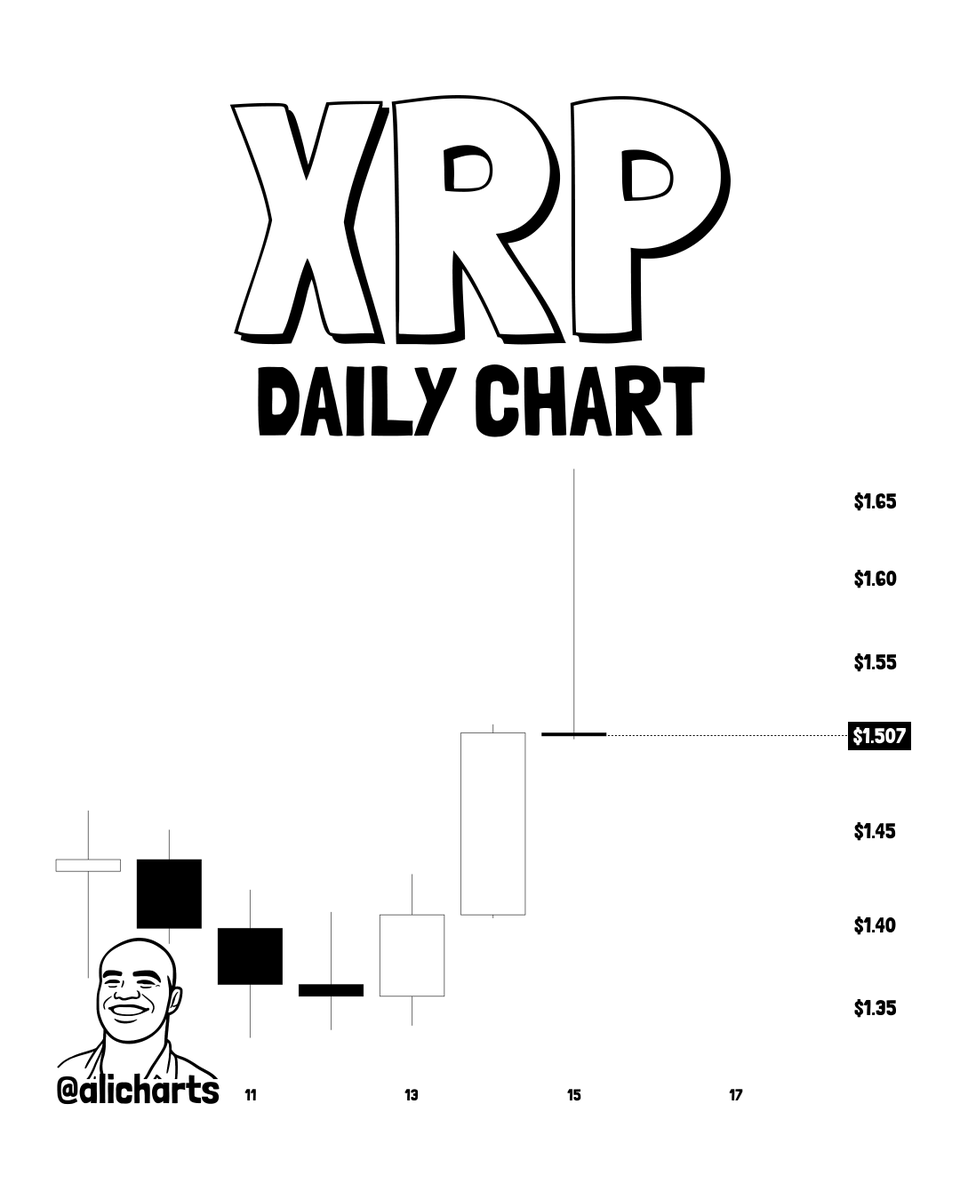

XRP wipes out over $11 billion in a day as major crash signal pops

If Shiba Inu Returns to Its Previous ATH, Here’s What $1,000 or $5,000 in SHIB Today Could Become

Bitcoin faces quantum scrutiny as leveraged shorts eye liquidation risk zone