Here's Why Praetorian Capital Favors St. Joe (JOE)

Praetorian Capital, an investment management company, released its fourth-quarter 2025 investor letter. A copy of the letter can be downloaded here. The Fund appreciated by 0.21% net of fees in the fourth quarter, bringing its 2025 returns to 12.39% net of fees. The Fund has compounded capital at an annualized net rate of 37.12% since its inception on January 01, 2019. Due to the Fund’s concentrated portfolio construction and focus on asymmetric opportunities, it will be volatile from quarter to quarter. In Q4, its core portfolio generated modest returns; however, the Event-Driven book detracted from performance. While the core portfolio positions appreciated in 2025, the Event-Driven book posted modestly positive returns. The firm primarily invests in real assets outside tech investments and believes that policymakers ignore real economic growth. In the changing landscape, the portfolio chose to capitalize on segments like brokers, exchanges, and other market intermediaries. Please review the Strategy’s top five holdings to gain insights into their key selections for 2025.

In its fourth-quarter 2025 investor letter, Praetorian Capital highlighted stocks like The St. Joe Company (NYSE:JOE). The St. Joe Company (NYSE:JOE) is a real estate development, asset management, and operating company. On February 13, 2026, The St. Joe Company (NYSE:JOE) stock closed at $70.18 per share. One-month return of The St. Joe Company (NYSE:JOE) was 7.33%, and its shares are up 46.79% over the past twelve months. The St. Joe Company (NYSE:JOE) has a market capitalization of $4.06 billion.

Praetorian Capital stated the following regarding The St. Joe Company (NYSE:JOE) in its fourth quarter 2025 investor letter:

"The St. Joe Company (NYSE:JOE) owns approximately 167,000 acres in the Florida Panhandle. It has been widely known that JOE traded for a tiny fraction of its liquidation value for years, but without a catalyst, it was always perceived to be “dead money.”

Over the past few years, the population of the Panhandle has hit a critical mass where the Panhandle now has a center of gravity that is attracting people who want to live in one of the prettiest places in the country, with zero state income taxes and few of the problems of large cities.

The oddity of the current disdain for so-called “value investments” is that many of them are growing quite fast. I believe that JOE may grow revenue at a rapid rate for the foreseeable future, with earnings growing at a much faster clip. Meanwhile, I believe the shares trade at an attractive multiple on Adjusted Funds from Operations (AFFO), while substantial asset value is tossed in for free…”

The St. Joe Company (NYSE:JOE) is not on our list of 30 Most Popular Stocks Among Hedge Funds. According to our database, 28 hedge fund portfolios held The St. Joe Company (NYSE:JOE) at the end of the third quarter, up from 26 in the previous quarter. While we acknowledge the potential of The St. Joe Company (NYSE:JOE) as an investment, we believe certain AI stocks offer greater upside potential and carry less downside risk. If you're looking for an extremely undervalued AI stock that also stands to benefit significantly from Trump-era tariffs and the onshoring trend, see our free report on the best short-term AI stock.

In another article, we covered The St. Joe Company (NYSE:JOE) and shared a bullish thesis on the company. In its Q3 2025, investor letter, Praetorian Capital shared a positive outlook on The St. Joe Company (NYSE:JOE). In addition, please check out our hedge fund investor letters Q4 2025 page for more investor letters from hedge funds and other leading investors.

READ NEXT: The Best and Worst Dow Stocks for the Next 12 Months and 10 Unstoppable Stocks That Could Double Your Money.

Disclosure: None. This article is originally published at Insider Monkey.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Klarna Set to Report Q4 Earnings: Key Factors Investors Should Watch

Phinia (PHIN) Upgraded to Strong Buy: Here's What You Should Know

Q2 Holdings (QTWO) Upgraded to Strong Buy: Here's What You Should Know

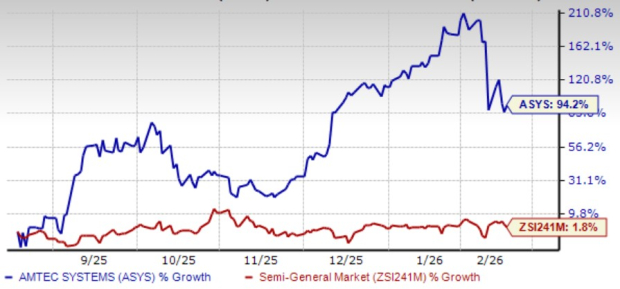

Amtech's Weak SFS Demand Continues: Is Profit Growth at Risk?