MACOM Technology Solutions Holdings (MTSI) Surged Following Strong Results

Aristotle Capital Boston, LLC, an investment advisor, released its fourth-quarter investor letter for “Small Cap Equity Fund”. U.S. small-cap equities reported modest gains in the fourth quarter of 2025. The quarter started as a continuation of the post-Liberation Day risk-on market environment, while it ended on a strong note, driven by a positive macroeconomic backdrop. Attractive valuations, earnings recovery, broadening of the market, and a shift from mega-cap stocks supported small caps in the quarter. The Aristotle Small Cap Equity Fund (Class I-2) returned 1.96% in Q4 2025, trailing the 2.19% total return of the Russell 2000 Index. Security selection supported overall performance, while allocation effects detracted from performance. Please review the Strategy’s top five holdings to gain insights into their key selections for 2025.

In its fourth-quarter 2025 investor letter, Aristotle Small Cap Equity Fund highlighted MACOM Technology Solutions Holdings, Inc. (NASDAQ:MTSI) as one of its leading contributors. MACOM Technology Solutions Holdings, Inc. (NASDAQ:MTSI) is a technology company that provides analog semiconductor solutions across the radio frequency (RF), microwave, millimeter wave, and lightwave spectrum. On February 13, 2026, MACOM Technology Solutions Holdings, Inc. (NASDAQ:MTSI) stock closed at $244.16 per share. One-month return of MACOM Technology Solutions Holdings, Inc. (NASDAQ:MTSI) was 10.64%, and its shares are up 98.31% over the past twelve months. MACOM Technology Solutions Holdings, Inc. (NASDAQ:MTSI) has a market capitalization of $18.315 billion.

Aristotle Small Cap Equity Fund stated the following regarding MACOM Technology Solutions Holdings, Inc. (NASDAQ:MTSI) in its fourth quarter 2025 investor letter:

"MACOM Technology Solutions Holdings, Inc. (NASDAQ:MTSI) is a designer and manufacturer of high-performance semiconductor products. The stock benefitted from strong quarterly results beating analyst expectations. We maintain our position, as we believe the company’s meaningful exposure to growing demand from Data Center and 5G end market applications along with the integration of recent acquisitions and domestic manufacturing footprint should continue to drive shareholder value."

MACOM Technology Solutions Holdings, Inc. (NASDAQ:MTSI) is not on our list of 30 Most Popular Stocks Among Hedge Funds. According to our database, 35 hedge fund portfolios held MACOM Technology Solutions Holdings, Inc. (NASDAQ:MTSI) at the end of the third quarter, up from 34 in the previous quarter. MACOM Technology Solutions Holdings, Inc. (NASDAQ:MTSI) delivered $271.6 million in revenue for the first quarter of fiscal 2026, an increase of 24.5% YoY. While we acknowledge the potential of MACOM Technology Solutions Holdings, Inc. (NASDAQ:MTSI) as an investment, we believe certain AI stocks offer greater upside potential and carry less downside risk. If you're looking for an extremely undervalued AI stock that also stands to benefit significantly from Trump-era tariffs and the onshoring trend, see our free report on the best short-term AI stock.

In another article, we covered MACOM Technology Solutions Holdings, Inc. (NASDAQ:MTSI) and shared a bullish thesis on the company. In addition, please check out our hedge fund investor letters Q4 2025 page for more investor letters from hedge funds and other leading investors.

READ NEXT: The Best and Worst Dow Stocks for the Next 12 Months and 10 Unstoppable Stocks That Could Double Your Money.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Klarna Set to Report Q4 Earnings: Key Factors Investors Should Watch

Phinia (PHIN) Upgraded to Strong Buy: Here's What You Should Know

Q2 Holdings (QTWO) Upgraded to Strong Buy: Here's What You Should Know

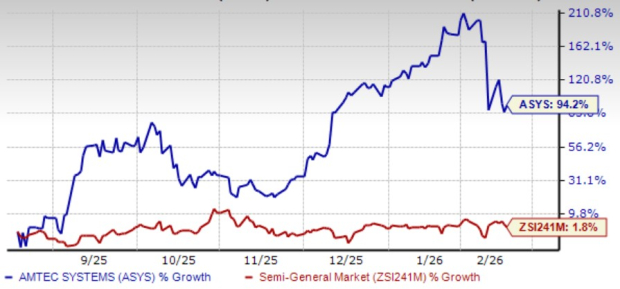

Amtech's Weak SFS Demand Continues: Is Profit Growth at Risk?