NetApp Stock Forecast: Are Analysts Optimistic or Pessimistic?

Overview of NetApp, Inc.

Headquartered in San Jose, California, NetApp, Inc. (NTAP) stands as a prominent provider of data management and cloud storage solutions. The company specializes in supporting organizations operating across hybrid and multi-cloud infrastructures. With a market valuation of $20.3 billion, NetApp delivers a comprehensive suite of storage hardware, software, and services aimed at advancing digital transformation for businesses worldwide.

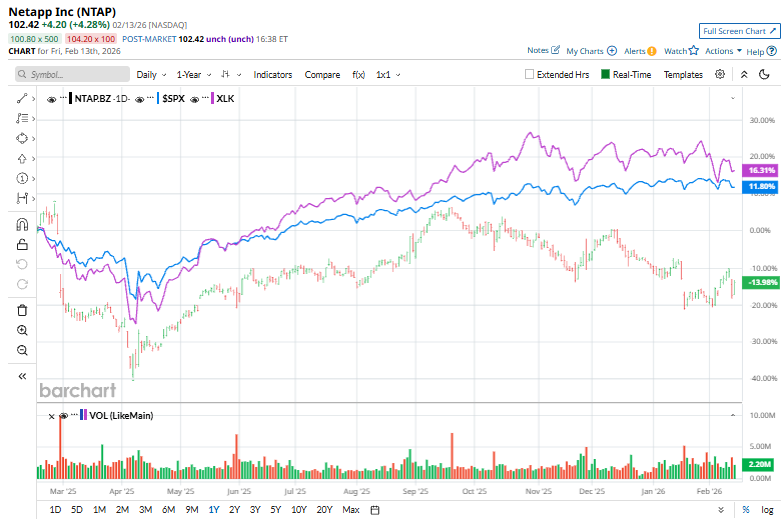

Stock Performance Comparison

Over the past year, NetApp's stock performance has significantly underperformed the broader market, dropping 13% while the S&P 500 Index ($SPX) advanced by 11.8%. In 2026, NTAP shares have slipped 4.4%, whereas the S&P 500 has experienced only a slight decline.

Related Market News from Barchart

Looking more closely, NetApp has also lagged behind the State Street Technology Select Sector SPDR Fund (XLK), which saw a 16.7% increase over the last year and a 3.1% decrease so far this year.

Recent Market Movements

On February 13, NetApp shares climbed 4.7% after U.S. inflation data for January came in lower than anticipated. This development strengthened expectations for several Federal Reserve rate cuts later in the year. The outlook for reduced borrowing costs and a more robust economy lifted equities broadly, with technology and infrastructure companies like NetApp benefiting from the positive sentiment.

Analyst Expectations and Ratings

For the fiscal year ending April 2026, analysts project that NetApp’s diluted earnings per share will rise by 10.2% to $6.38. The company’s track record for earnings surprises is mixed, having matched or exceeded analyst forecasts in three of the last four quarters, but falling short once.

Among the 21 analysts tracking NTAP, the consensus rating is “Moderate Buy,” which includes eight “Strong Buy” recommendations, twelve “Hold” ratings, and one “Strong Sell.”

Shifts in Analyst Sentiment

This analyst breakdown is slightly less optimistic than it was two months ago, when there were seven “Strong Buy” endorsements.

Analyst opinions on NetApp diverged in January. On January 20, Erik Woodring of Morgan Stanley downgraded the stock from “Equal-Weight” to “Underweight” and reduced the price target from $117 to $89, citing survey results that indicated the slowest growth in hardware budgets in 15 years and heightened sensitivity to cost inflation. Conversely, on January 13, Katherine Murphy of Goldman Sachs initiated coverage with a “Buy” rating and set a price target of $128, emphasizing NetApp’s strong position in the rapidly growing all-flash storage sector.

Price Target and Disclosure

The average analyst price target for NetApp stands at $122.94, suggesting a potential upside of 20% from current levels.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

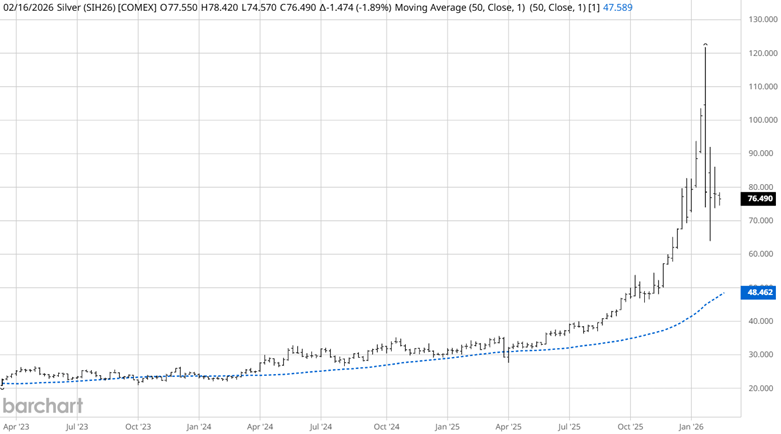

Speculators Became Enthusiastic—But the Market Remained Unmoved: Silver’s Performance Post-Valentine’s Day

Hyatt executive chairman resigns amid connections to Epstein

Oracle's Emotion-Driven Sell-Off Sets Up Generational Opportunity

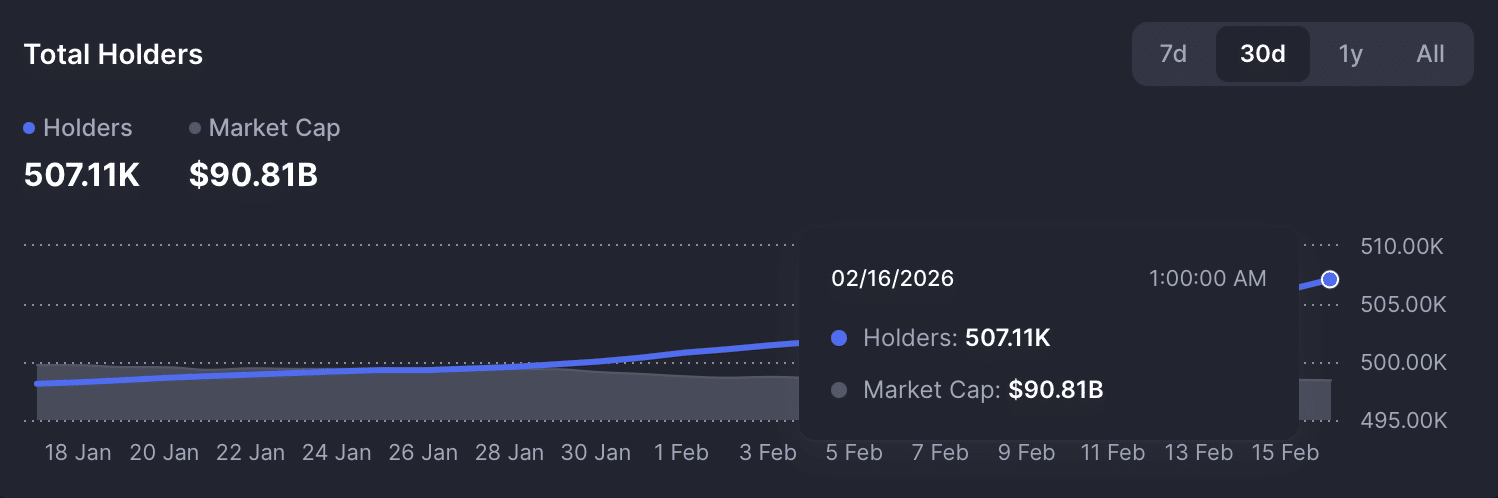

XRP holders hit new high, but THIS keeps pressure on price