Norwegian Cruise Line Holdings Enters Into Agreement With Fincantieri for Three New Cruise Ships

Agreements include one ship for each brand, Norwegian Cruise Line, Oceania Cruises and Regent Seven Seas Cruises, strengthening long-term fleet growth through 2037

MIAMI, Feb. 16, 2026 (GLOBE NEWSWIRE) -- Norwegian Cruise Line Holdings Ltd. (NYSE: NCLH), a leading global cruise company operating Norwegian Cruise Line, Oceania Cruises, and Regent Seven Seas Cruises, today announced that it has entered into an agreement with Fincantieri for the design and construction of three new cruise ships, further advancing the company’s long-term fleet development strategy across its brands.

The order includes one ship for each of the Company’s three award-winning brands—Norwegian Cruise Line, Oceania Cruises, and Regent Seven Seas Cruises—with one vessel to be built as a sister ship to Oceania Sonata, one as a sister ship to Seven Seas Prestige, and one as a sister ship to the previously announced Norwegian Cruise Line newbuilds order. All three ships will be built at Fincantieri’s shipyards in Italy and delivered between 2036 and 2037.

“Together with Fincantieri, a trusted partner for decades, we continue to advance a disciplined approach to fleet growth that builds on the strength of our brands, defines the future of cruising and elevates the guest experience for years to come,” said John W. Chidsey, President and Chief Executive Officer of NCLH. “This agreement secures access to valuable shipyard capacity through the end of 2037, supporting our long-term growth while maintaining financial discipline and driving sustainable shareholder value.”

This new ship order supports the Company’s long-term growth pipeline and competitive position with modest initial capital outlays, allowing it to remain focused on strengthening the balance sheet and reducing leverage. The agreement is not expected to have a material impact on near-term leverage or cashflow, as pre-delivery payment obligations are immaterial until the ship is delivered. Consistent with past practice, the Company expects to utilize Export Credit Agency financing to fund the majority of the vessels’ cost upon delivery.

Following this agreement, NCLH now has a total of 17 newbuilds on order; with Norwegian Cruise Line totaling eight newbuilds through 2037, five newbuilds for Oceania Cruises to be delivered through 2037 and four newbuilds to be delivered through 2036 for Regent Seven Seas Cruises. This newbuild pipeline supports an expected 4 percent compound annual growth rate (CAGR) from 2026 through 2037, consistent with the company’s measured approach to expanding its fleet while investing in next-generation ships.

A detailed summary of the Company’s newbuild pipeline is provided in the table below.

| YEAR | BRAND | DETAIL | GROSS TONS

1

|

BERTHS

1

|

| Q1 2026 | Norwegian Cruise Line | Norwegian Luna | ~156,000 | ~3,565 |

| Q4 2026 | Regent Seven Seas | Seven Seas Prestige | ~77,000 | ~822 |

| 2027 | Norwegian Cruise Line | Norwegian Aura

2

|

~170,000 | ~3,880 |

| 2027 | Oceania Cruises | Oceania Sonata | ~86,000 | ~1,390 |

| 2028 | Norwegian Cruise Line | Next Generation “Methanol-Ready” Norwegian Prima Class

2

|

~170,000 | ~3,880 |

| 2029 | Oceania Cruises | Oceania Arietta | ~86,000 | ~1,390 |

| 2030 | Norwegian Cruise Line | New Class 1 | ~227,000 | ~5,000 |

| 2030 | Regent Seven Seas | Seven Seas Prestige Class 2 | ~77,000 | ~822 |

| 2032 | Oceania Cruises | Sonata Class 3

3

|

~86,000 | ~1,390 |

| 2032 | Norwegian Cruise Line | New Class 2 | ~227,000 | ~5,000 |

| 2033 | Regent Seven Seas | Seven Seas Prestige Class 3

4

|

~77,000 | ~822 |

| 2034 | Norwegian Cruise Line | New Class 3

5

|

~227,000 | ~5,000 |

| 2035 | Oceania Cruises | Sonata Class 4

3

|

~86,000 | ~1,390 |

| 2036 | Norwegian Cruise Line | New Class 4

5

|

~227,000 | ~5,000 |

| 2036 | Regent Seven Seas | Seven Seas Prestige Class 4

6

|

~77,000 | ~822 |

| 2037 | Norwegian Cruise Line | New Class 5

6

|

~227,000 | ~5,000 |

| 2037 | Oceania Cruises | Sonata Class 5

6

|

~86,000 | ~1,390 |

- Berths and gross tons are preliminary and subject to change as we approach delivery.

- Designs for the final two Prima Class ships have been lengthened and reconfigured to accommodate the use of green methanol as a future fuel source. Additional modifications will be needed to fully enable the use of green methanol.

- Contact is effective but not yet financed.

- Contract subject to financing.

- Contract is effective and financing is being negotiated.

- Binding memorandum of understanding subject to contract execution and financing.

About Norwegian Cruise Line Holdings

Norwegian Cruise Line Holdings Ltd. (NYSE: NCLH) is a leading global cruise company that operates Norwegian Cruise Line, Oceania Cruises and Regent Seven Seas Cruises. With a combined fleet of 34 ships and more than 71,000 berths, NCLH offers itineraries to approximately 700 destinations worldwide. NCLH expects to add 17 additional ships across its three brands through 2037, which will add approximately 46,600 berths to its fleet.

Cautionary Statement Concerning Forward-Looking Statements

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

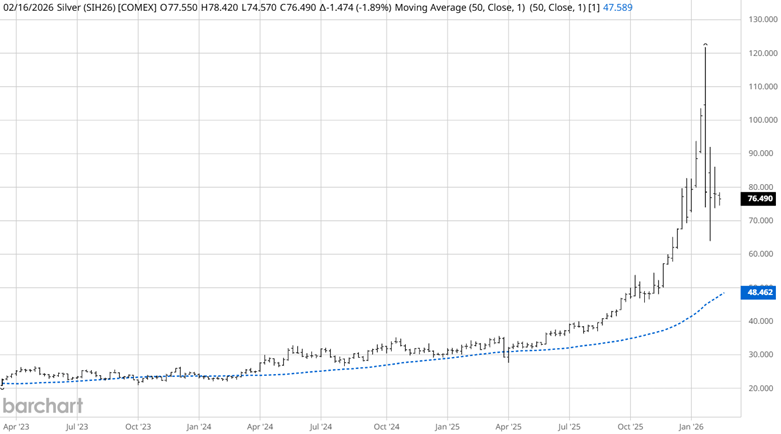

Speculators Became Enthusiastic—But the Market Remained Unmoved: Silver’s Performance Post-Valentine’s Day

Hyatt executive chairman resigns amid connections to Epstein

Oracle's Emotion-Driven Sell-Off Sets Up Generational Opportunity

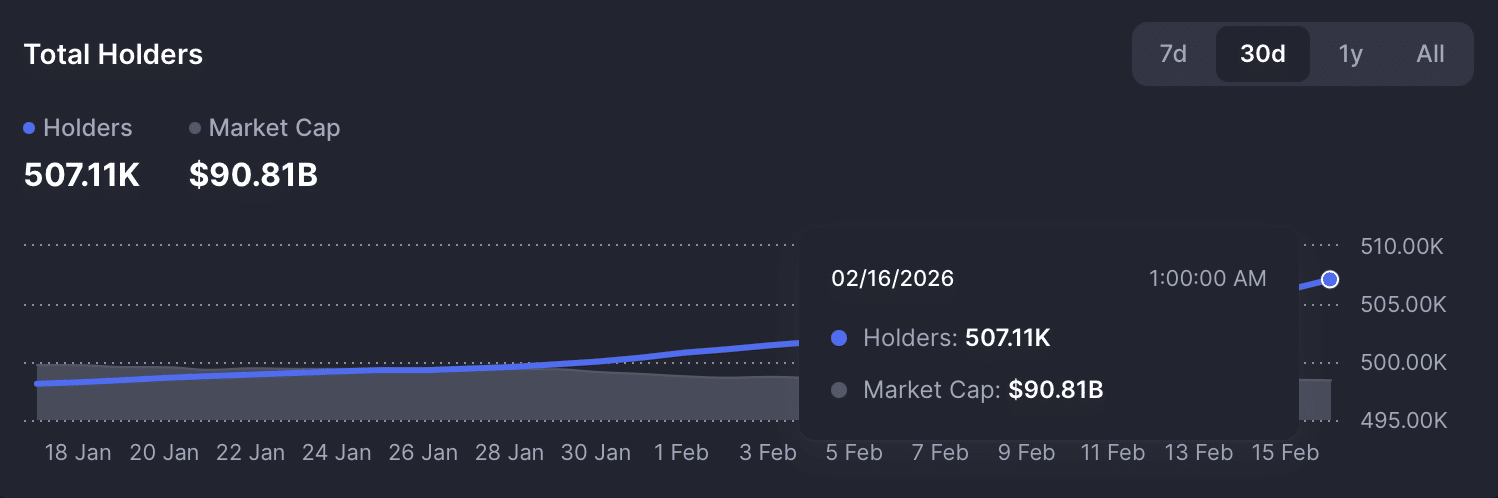

XRP holders hit new high, but THIS keeps pressure on price