Will Tariffs Remain a Major Headwind for General Motors in 2026?

Tariffs remain a real cost headwind for the U.S. legacy automaker General Motors GM. The company seems to be managing the impact better than expected.

In 2025, GM incurred $3.1 billion in gross tariff costs, which was below its original forecast of $3.5-$4.5 billion. Through the third quarter, the company had incurred $2.4 billion. Another $700 million came in the fourth quarter.The better-than-expected outcome was driven by execution and some favorable policy changes, including a lower tariff rate for Korea. Management had taken a conservative approach earlier in the year, given the uncertain trade environment. In the end, costs came in below the projected range.

General Motors offset more than 40% of its gross tariff costs in 2025. The offsets came from pricing actions, footprint adjustments and internal cost reductions, which helped protect margins despite trade pressure.

Tariffs will remain a concern in 2026. GM expects gross tariff costs in the $3-$4 billion range this year. The figure is slightly higher than 2025 due to an additional quarter of exposure. The first-quarter impact is expected to be between $750 million and $1 billion, with costs remaining somewhat lumpy due to supply-chain timing.

The company expects to sustain its mitigation efforts. Pricing discipline, manufacturing adjustments and efficiency measures should continue to offset a meaningful portion of the costs.

General Motors is also taking longer-term steps. The company is increasing U.S. vehicle production and investing in supply-chain resiliency. While these actions create some near-term pressure, they are expected to expand capacity for high-margin trucks and SUVs and further reduce tariff exposure beginning in 2027.

Competitive Context: F & STLA

Ford F also faced meaningful tariff pressure in 2025. Ford reported a roughly $2 billion net tariff headwind, including about $1 billion in unexpected costs after auto-parts tariff credits were delayed late in the year. Management described this as largely one-time. For 2026, Ford expects tariff costs to decline by about $1 billion as credits fully take effect. The company noted that some of this benefit will be offset by temporary supply-related costs.

Stellantis STLA is also exposed to trade shifts. Stellantis estimates its 2025 net tariff impact at around €1.5 billion, with €0.3 billion incurred in the first half. The 25% tariffs on imports from Canada and Mexico led to a sharp drop in U.S. shipments and pressured profits. Because Stellantis relies heavily on vehicles and parts imported from Canada and Mexico, it has faced much disruption from these policies.

The Zacks Rundown on GM Stock

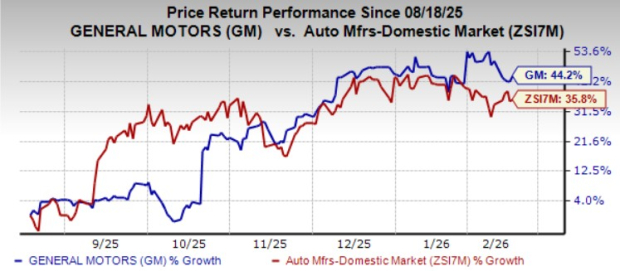

Shares of General Motors have gained 44% over the past six months, outperforming the industry.

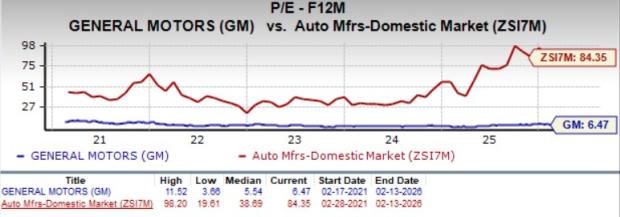

From a valuation standpoint, GM trades at a forward price-to-earnings ratio of 6.47, below the industry. It carries a Value Score of A.

See how the Zacks Consensus Estimate for GM’s earnings has been revised over the past 90 days.

General Motors currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

EUREP’s growth and the euro – expanding internationally

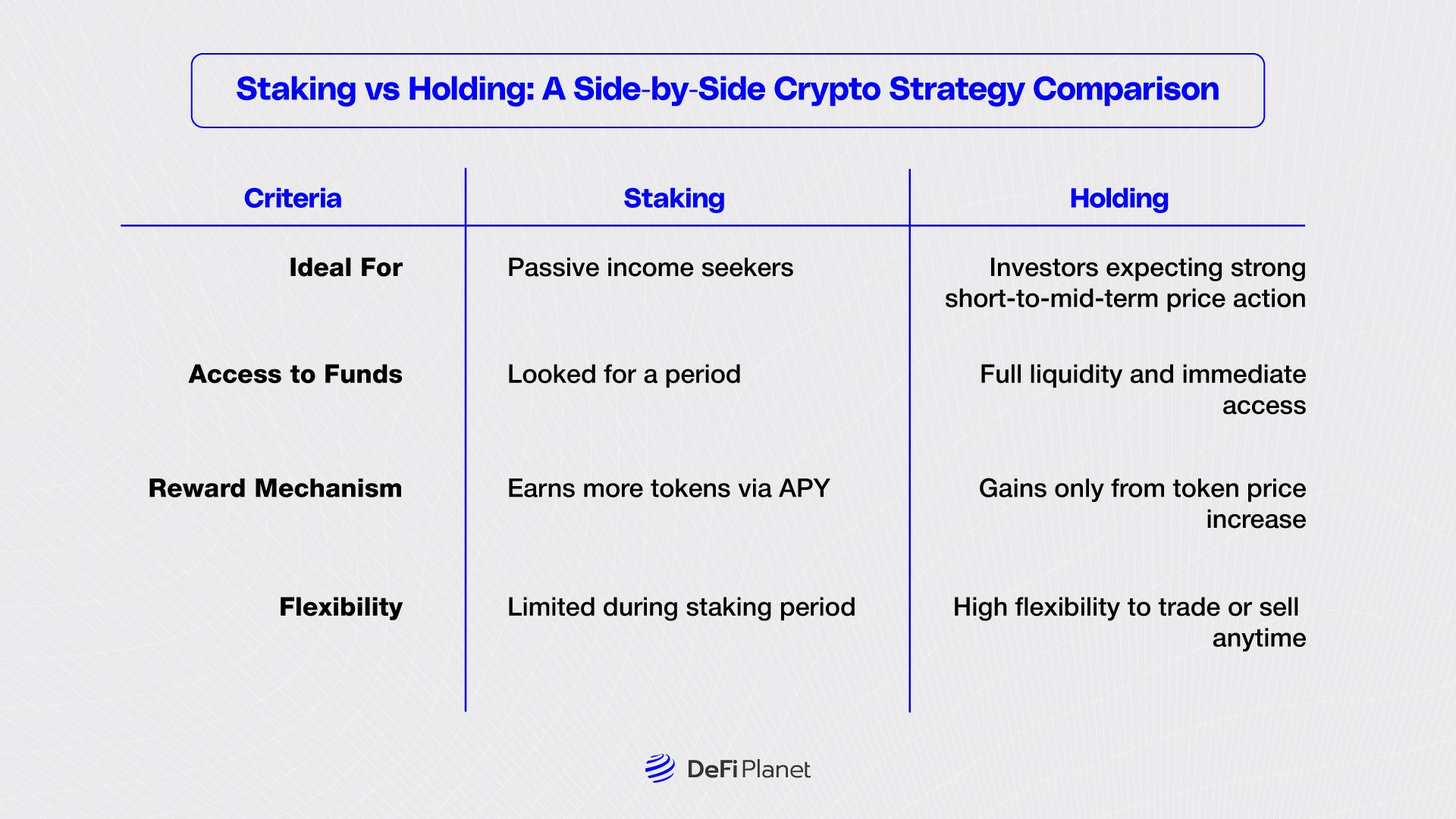

Is It Better to Stake or Hold? Evaluating Risk vs Reward in Crypto

Can Tokenized Economies Solve the Tragedy of the Commons?

Expeditors International Shares: Expert Predictions and Evaluations