NVO Crashes 21% in a Month: Is This an Indication to Sell the Stock?

Novo Nordisk NVO shares have plunged 20.5% in the past month. The massive sell-off of the stock was primarily driven by a weaker-than-expected 2026 financial outlook issued by the company, despite its fourth-quarter 2025 results beating both earnings and sales estimates.

Novo Nordisk is a dominant player in the cardiometabolic space, led by its blockbuster semaglutide-based (GLP-1) drugs, Ozempic (for type II diabetes [T2D]) and Wegovy (for obesity), which generated DKK 206.2 billion in 2025, including DKK 53.7 billion in the fourth quarter. However, sales momentum has slowed in the past year amid intensifying competition from Eli Lilly LLY, widespread compounded semaglutide use in the United States, pricing pressure and foreign-exchange headwinds.

While legal actions and tighter FDA oversight may curb compounded alternatives, Novo Nordisk’s structural growth challenges remain unresolved, as is evident from its 2026 outlook.

Although headline sales and operating profit will benefit from a one-off $4.2 billion reversal of U.S. 340B rebate provisions, NVO excluded this gain from its new non-IFRS adjusted metrics, exposing the weakness in the core business. On an adjusted basis, Novo Nordisk expects sales and operating profit to decline 5-13% at CER in 2026, with further FX headwinds in DKK terms. Even on a reported basis, guidance implies roughly flat sales and only modest operating profit growth, highlighting the limited core momentum once non-recurring benefits are stripped out.

Growth in International Operations, driven by broader GLP-1 adoption and Wegovy roll-outs, is expected to be offset by rising competition, pricing pressure and semaglutide exclusivity losses. In the United States — Novo Nordisk’s most important market — slowing prescriptions, reduced Medicaid obesity coverage and lower realized prices under access initiatives and the MFN agreement weigh on expectations. At the same time, stepped-up R&D and commercial spending are set to pressure margins, with no repeat of the favorable gross-to-net adjustments that boosted 2025 results.

The disappointing 2026 guidance has largely wiped out the optimism that followed the approval and launch of oral Wegovy — the first GLP-1 therapy in pill form for weight management. While the oral formulation initially raised hopes of a meaningful new growth driver, investors now appear unconvinced that it can offset Novo Nordisk’s weakening near-term outlook or materially strengthen its competitive position.

Eli Lilly had launched Zepbound for obesity in December 2023, much later than NVO launched Wegovy injection a couple of years before. Still, Zepbound managed to capture much higher market share than Wegovy and surpassed the latter’s sales in 2025. If history repeats itself, Lilly may be able to close the gap fast once its GLP-1 oral pill, orforglipron, currently under review, is approved by the FDA later in 2026.

With slowing demand, intensifying competition, pricing pressure, rising costs and limited near-term catalysts, Novo Nordisk’s growth outlook is deteriorating across multiple fronts. Let’s dig deeper and understand the company’s strengths and weaknesses to understand how to play the stock.

Semaglutide — Still NVO’s Primary Top-Line Driver

Novo Nordisk’s success in recent years has been driven by the sales of Ozempic and Rybelsus (oral) for T2D, and Wegovy for obesity. The company boasts one of the industry's broadest diabetes and obesity care portfolios.

Ozempic and Wegovy are the major revenue drivers. Novo Nordisk is expanding access to Wegovy through broader distribution and partnerships with major U.S. pharmacies, telehealth providers, and proprietary and third-party platforms to ensure patients can obtain authentic, FDA-approved treatments. If successful, this strategy, along with a legal crackdown, could help mitigate the compounded alternatives problem.

Novo Nordisk is expanding semaglutide's reach through new indications. Wegovy injection is now approved for reducing major cardiovascular events, easing HFpEF symptoms, and relieving osteoarthritis-related knee pain in obesity.

Rybelsus’ label in the United States and the EU has been expanded to include cardiovascular benefits in diabetes patients. A 7.2 mg Wegovy dose, showing up to 25% weight loss in the STEP UP study, is under review in the United States and the EU. Label expansion is also being sought for Ozempic in treating peripheral artery disease in the United States and the EU.

Eli Lilly is Novo Nordisk’s fierce competitor in the diabetes/obesity space. Despite being on the market for a shorter period, LLY’s tirzepatide-based injections, Mounjaro (T2D) and Zepbound (obesity), have become its key top-line drivers, eating away market share from NVO. Following strong fourth-quarter results, Lilly announced a bullish outlook for 2026. In 2025, Mounjaro and Zepbound generated combined sales of $36.5 billion, comprising around 56% of LLY’s total revenues.

NVO Expands Footprint in Rare Diseases and Liver Care

Beyond its GLP-1 portfolio, Novo Nordisk is broadening its presence in rare diseases. The company has submitted a regulatory filing seeking approval for Mim8 in hemophilia A in the United States. NVO has also secured both EU and U.S. approvals for Alhemo to treat hemophilia A and B, with or without inhibitors.

The FDA has also granted accelerated approval to Wegovy as the first GLP-1 therapy to treat noncirrhotic metabolic dysfunction-associated steatohepatitis with moderate-to-advanced liver fibrosis. This marked a significant milestone in liver care by offering patients a treatment that can both halt disease activity and reverse liver damage.

NVO Focuses on Next-Generation Drugs for Obesity

Novo Nordisk is also developing several next-generation obesity candidates in its pipeline, especially targeting the lucrative U.S. market. Apart from CagriSema, currently awaiting FDA evaluation, NVO is gearing up to launch a dedicated late-stage program evaluating cagrilintide as a monotherapy for obesity.

Novo Nordisk is also gearing up to advance another next-generation candidate, amycretin, for weight management into late-stage development. The phase III program on amycretin is planned to be initiated during the first quarter of 2026. The company is also developing oral monlunabant in a mid-stage obesity study. It recently signed a $2.2 billion deal with Septerna for developing and commercializing oral small-molecule medicines for treating obesity, diabetes and other cardiometabolic diseases.

NVO’s Stock Price, Valuation & Estimates

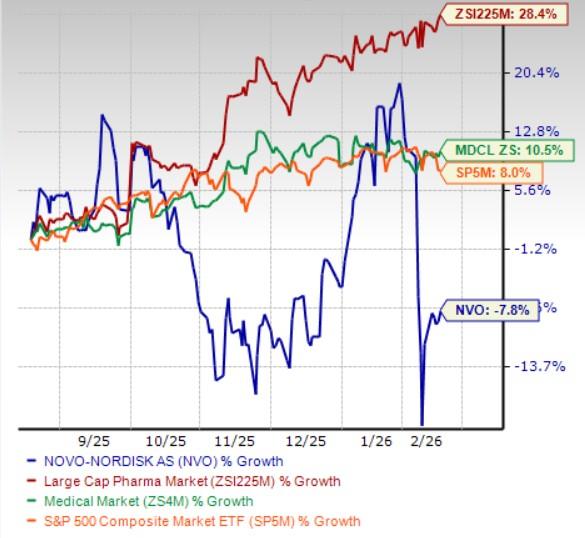

In the past six months, Novo Nordisk shares have lost 7.8% against the industry’s 28.4% growth. The company has also underperformed the sector and the S&P 500 during the same time frame, as seen in the chart below.

NVO Stock Underperforms the Industry, Sector & the S&P 500

Novo Nordisk is trading at a discount to the industry, as seen in the chart below. Going by the price/earnings ratio, the company’s shares currently trade at 14.76 forward earnings, which is lower than 18.83 for the industry. The stock is trading much below its five-year mean of 29.25.

NVO Stock Valuation

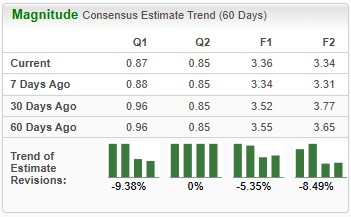

Earnings estimates for 2026 have deteriorated from $3.55 to $3.36 per share over the past 60 days. During the same time frame, Novo Nordisk’s 2027 earnings estimates have declined from $3.65 to $3.34.

NVO Estimate Movement

Here’s How to Play NVO Stock

Given the weakening near-term outlook for Novo Nordisk, currently carrying a Zacks Rank #5 (Strong Sell), investors may be better off reducing exposure in the short term. The company’s disappointing 2026 guidance signals slowing core growth, margin pressure from rising R&D and commercial spending, and limited earnings support once one-off accounting benefits are excluded. At the same time, competitive intensity is rising rapidly — particularly from Eli Lilly — while pricing pressure, slower U.S. prescriptions and reduced reimbursement coverage are weighing on demand. The fact that weak guidance has already erased much of the enthusiasm around oral Wegovy suggests sentiment may remain fragile, increasing the risk of further volatility and downside in the coming quarters.

The medium-to-long-term risk profile also appears increasingly unfavorable. Novo Nordisk’s heavy reliance on the semaglutide franchise leaves it exposed to market share erosion, exclusivity losses and intensifying innovation-driven competition, while pipeline investments may take years to translate into meaningful revenues. Continued estimate downgrades, slowing growth across key markets and an uncertain competitive trajectory in obesity and diabetes raise concerns about the sustainability of earnings expansion. Even though NVO shares are trading cheaper, the discount reflects deteriorating fundamentals rather than an attractive entry point.

Competition in the obesity treatment market is intensifying as the space attracts new contenders beyond leaders Eli Lilly and Novo Nordisk. Smaller biotech firms, like Viking Therapeutics VKTX, are advancing GLP-1–based therapies to challenge the incumbents. Viking Therapeutics is developing its dual GIPR/GLP-1 RA, VK2735, both as oral and subcutaneous formulations for the treatment of obesity. Until clearer signs of durable growth, competitive stabilization and margin recovery emerge, reducing exposure in NVO stock across short, medium and long-term horizons appears to be the more prudent strategy.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Digital Asset Funds Post Fourth Straight Week of Outflows as U.S. Investors Pull $403M

Hayden Davis of LIBRA token fame returns as a meme trader

Paradigm reframes Bitcoin mining as grid asset, not energy drain

Crypto Trading Won’t Be Available on Elon Musk’s X for Now, According to Product Chief