Spyre Therapeutics (SYRE) Set POC Readout Priorities for 2026

Spyre Therapeutics (NASDAQ:SYRE) is one of the 17 biotechnology stocks with more than 50% upside.

As of the close of play on February 12, consensus sentiment around Spyre Therapeutics (NASDAQ:SYRE) was strongly bullish. The stock had received coverage from 7 analysts, all of whom assigned Buy ratings. It has a projected median 1-year price target of $57.86, offering an upside of more than 66%.

On January 22, Spyre Therapeutics (NASDAQ:SYRE) announced plans for 2026, where it will prioritize six POC readouts. The company mentioned that its SKYLINE ulcerative colitis trial has seen SPY001 enrollment complete ahead of schedule, accelerating Part A readouts to sometime in the second quarter. The SKYWAY basket trial on rheumatoid arthritis, psoriatic arthritis, and axial spondyloarthritis remains on track for fourth-quarter readouts in 2026. Financially, $783 million in pro forma cash, cash equivalents, and marketable securities as of September 30, 2025, provides a runway through the second half of 2028. The company also appointed Kate Tansey Chevlen as Chief Commercial Officer, who is a seasoned biopharma commercial leader.

Spyre Therapeutics (NASDAQ:SYRE) is a clinical-stage biotechnology company developing advanced antibody therapeutics for patients with inflammatory bowel disease (IBD). The company focuses on next-gen cures for conditions such as ulcerative colitis and Crohn’s disease. Its current pipeline includes SPY001, SPY002, SPY003, and some combination therapies.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Crypto Institutional Investment: The Profound Shift from Speculation to Strategic Portfolio Management

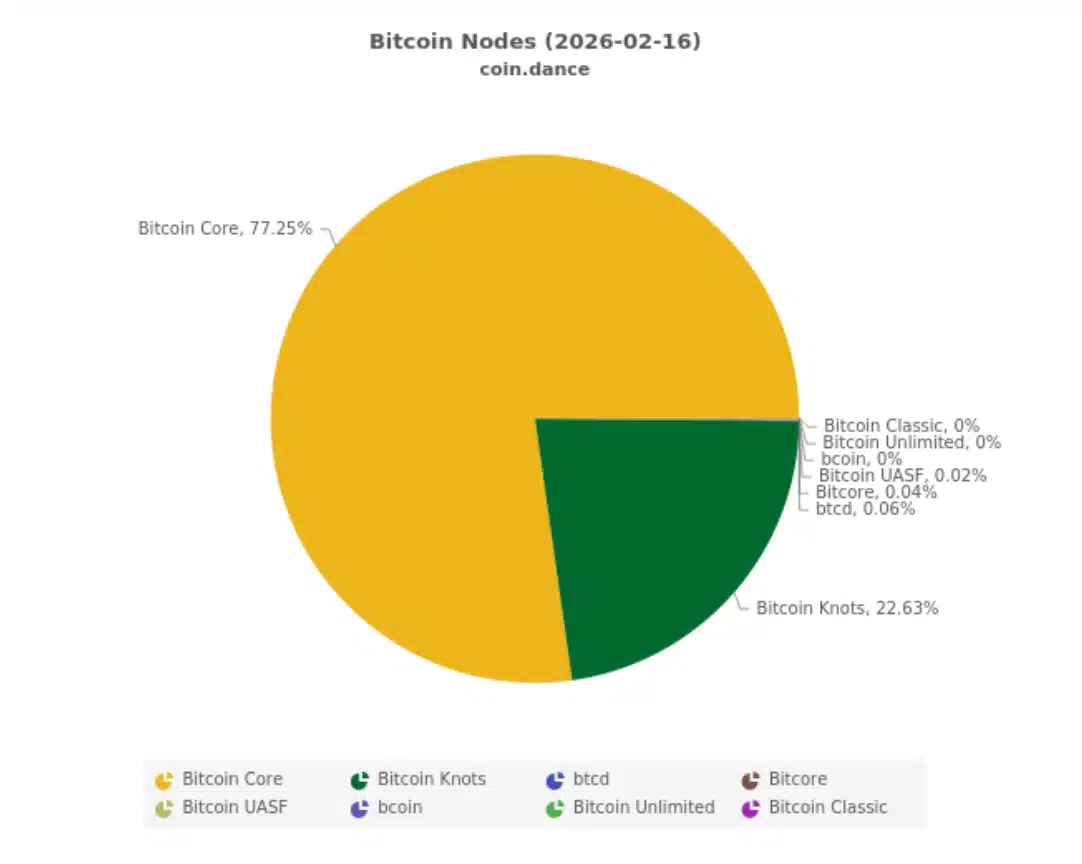

Adam Back warns of ‘lynch mob’ tactics – Is Bitcoin facing fork fight?

Meta's Platfroms' New Bull: Why Billionaire Bill Ackman Is Buying

New Gold to Report Q4 Results: What's in the Cards for the Stock?