Amid the "SaaS Apocalypse", These 3 Names Are Boosting Buybacks

To the dismay of many investors, the rout in software stocks has yet to see a significant reprieve. The iShares Expanded Tech-Software Sector ETF (BATS: IGV), a proxy for the industry’s performance, is down nearly 22% in 2026.

Amid a period of profound weakness, several software names are taking a confidence-inspiring action: announcing share buyback authorizations. In the case of these beaten-down companies, management teams are signaling a belief that markets undervalue their shares.

DT: Keeping a Lid on 2026 Losses and Boosting Buyback Capacity

First up is observability platform provider Dynatrace (NYSE: DT). The company’s software allows customers to monitor the performance of applications that are critical to their business operations. It identifies bottlenecks and other issues in these applications, helping customers understand and rectify problems.

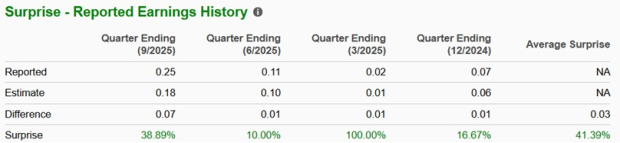

Dynatrace shares have held up better than many software names in 2026, down only about 14%. This was partly due to the firm’s latest earnings report, in which it beat estimates on sales and adjusted earnings per share (EPS).

The stock gained 7% after the results. Still, shares remain down around 40% from their 52-week high.

Notably, Dynatrace also announced a significant $1 billion share repurchase authorization. This is equal to a very large 9% of the firm’s approximately $11 billion market capitalization.

It is double the size of the firm’s previous authorization from May 2024, when Dynatrace shares were worth significantly more than they are today. The company didn’t mince words with its reasoning behind the new buyback program, saying it underscores “the view that our shares are undervalued”.

PEGA’s Buyback Capacity Soars Above 10% of Its Market Cap

Pegasystems (NASDAQ: PEGA) hasn’t been as fortunate as Dynatrace in 2026, with its shares down around 26% on the year. The tech company provides business process management (BPM) software that helps clients automate important internal workflows. Its GenAI Blueprint tool is particularly intriguing. It allows companies to easily build new tools or improve existing ones with minimal coding knowledge.

As investors worry that artificial intelligence (AI) will make coding easier and thus threaten traditional software, Pega is positioning itself to benefit from this very shift.

Despite beating estimates on sales and adjusted EPS in its latest earnings, Pegasystems shares sold off by almost 12% after the report. This came as the company’s 2026 guidance may have left investors wanting more.

Pega also announced an additional $1 billion share buyback authorization. This is equal to a whopping 13.5% of the company’s approximately $7.4 billion market capitalization.

The company wasn’t very explicit about its reasoning, simply saying, “This authorization reflects our confidence in the durability of our cash flows and our commitment to disciplined capital allocation.” Still, the size of this program in relation to the firm’s market cap suggests that it sees value in its shares.

Down 30% in 2026, SHOP Announces $2 Billion Buyback Plan

Last up is e-commerce platform Shopify (NASDAQ: SHOP). This stock has been a particularly big loser in 2026, down around 30%. The company’s tools, which allow businesses to build and operate direct-to-consumer e-commerce platforms, have seen extensive growth.

Overall, the company has seen its revenue rise by 20% or more year-over-year for 14 quarters in a row. The company also beat estimates on sales and earnings in its latest report. However, the stock still fell by over 6% in each of the following two trading days.

Alongside its earnings, the company also announced a $2 billion share buyback authorization. Although this authorization is larger in absolute terms than those of DT and PEGA, it is much smaller relative to the size of SHOP itself. It represents approximately 1.4% of the firm’s $146 billion market capitalization.

However, it is a positive signal nonetheless. This is particularly true, considering that there appears to be no record of Shopify announcing a share buyback plan in the past.

Buybacks: One Positive Indicator Amid Software’s Stumble

Despite the confidence that these firms are displaying with their buyback authorizations, investors should be keenly aware of the uphill battle the software industry is facing.

Markets are clearly very concerned about software incumbents seeing their growth limited amid the emergence of new artificial intelligence (AI) tools. It is likely that the release of such tools will only increase, potentially extending this significant headwind for the industry. Thus, investors should be highly selective if attempting to “buy the dip” in software stocks.

Where Should You Invest $1,000 Right Now?

Before you make your next trade, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis.

Our team has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and none of the big name stocks were on the list.

They believe these five stocks are the five best companies for investors to buy now...

See The Five Stocks Here

The article "Amid the "SaaS Apocalypse", These 3 Names Are Boosting Buybacks" first appeared on MarketBeat.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Crypto Institutional Investment: The Profound Shift from Speculation to Strategic Portfolio Management

Adam Back warns of ‘lynch mob’ tactics – Is Bitcoin facing fork fight?

Meta's Platfroms' New Bull: Why Billionaire Bill Ackman Is Buying

New Gold to Report Q4 Results: What's in the Cards for the Stock?