AI Spending Shock Triggers Big Tech Selloff And Small-Cap Revival

After a long mega-cap tech-dominated leadership, the market has entered 2026 on less stable ground. SP 500

Surging AI capital expenditures are driving investor jitters, raising questions on future margins even as industry giants such as Amazon tout operational efficiencies and cost reductions.

Still, the sheer scale of spending and the accounting complexity behind it often only amplify the anxiety. A recent audit disclosure about Meta highlighted a $27 billion data center project kept off the balance sheet through a joint venture. According to WSJ, Ernst & Young, the auditor, called the judgment "especially challenging." The situation raised questions about how much leverage and infrastructure risk sit outside reported numbers.

With tech giants pouring tens of billions into AI models, chips, and data centers, investors are starting to wonder whether the disruptors themselves are now exposed to a different kind of disruption: margin compression driven by relentless capital spending.

Small-Cap Opportunity

That skepticism is one reason capital is rotating into smaller companies, particularly those positioned as enablers of the AI build-out rather than the headline developers. Franklin Templeton argues that the opportunity may lie with suppliers and adopters rather than the megacap leaders.

"During the gold rush, it's a good time to be in the pick and shovel business," the firm said in a recent report.

Its small-cap teams are focusing on companies that produce semiconductor components, power infrastructure, and engineering services tied to data-center expansion. Many of these firms have already been benefiting from the spending wave, yet still trade at relatively modest valuations compared with the largest tech names.

At the same time, Franklin Templeton sees a second group of smaller companies using AI internally to drive productivity and margin gains. The firm believes the market may soon "shift away from some of the mega-cap companies that provide AI to the many companies that can commercialize AI applications," a dynamic that could broaden leadership beyond the familiar technology giants. After years of underperformance, small caps may finally have a structural catalyst.

AI-Resilient Group

Even within large-cap software, however, not everyone is convinced that AI will wipe out incumbents. JPMorgan argues that the recent selloff has been too indiscriminate and has created opportunities in what it calls "AI-resilient" names.

In a recent note, the bank's strategist, quoting a positioning flush and overly bearish outlook, argued that "the balance of risks is increasingly skewed towards a rebound."

The bank points to companies such as Microsoft and CrowdStrike as examples of businesses with strong moats, high switching costs, and long-term contracts that limit near-term disruption. Additionally, among the broader group of 19 resilient firms, it singled out smaller companies such as Q2 Holdings and JFrog as potential winners.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

SPY vs. Global Stocks: These Charts Are Flashing A Rare Warning Signal

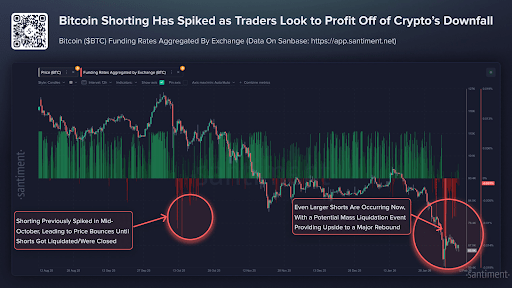

Extreme Bitcoin Shorts Could Predict A Bottom, Here’s The Significance

Bayse Markets Integrates Solana Network – A Major Leap Forward for Cross-Asset Trading

SHIB Tests $0.0000067 as Bearish Pressure Persists