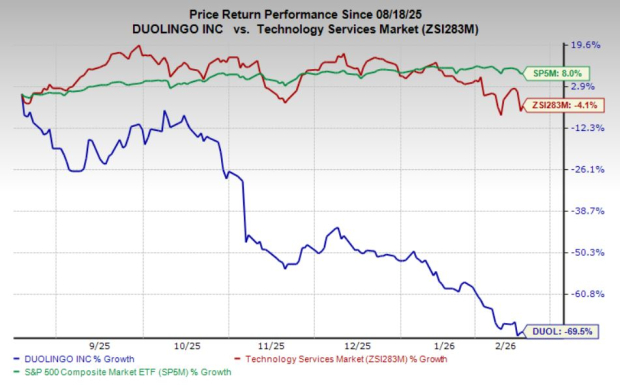

DUOL Stock Declines 70% in 6 Months: Should You Buy, Hold, or Sell?

Duolingo, Inc. DUOL has been facing heavy selling pressure, sliding 70% over the past six months. This sharp decline stands out when compared to the broader industry, which fell a meager 4% in the same period, and the Zacks S&P 500 composite, which has advanced 8%.

This pullback raises the question: Is Duolingo setting up for a recovery, or could further weakness be ahead? Let's find the answers.

AI Replication Risk: Feature Parity is Not the Real Issue

Advances in artificial intelligence could allow competitors to build a language-learning app comparable to Duolingo with relative ease. AI can already generate lessons, simulate conversations, and personalize exercises at scale. Over time, it may replicate nearly every visible feature users interact with today.

However, the core question is not whether AI can reproduce the interface, but whether it can replicate the behavioral engine underneath it. Duolingo has spent years refining engagement loops that resemble social platforms more than traditional educational software. Streak mechanics, gamified rewards, push reminders and incremental difficulty adjustments are deeply embedded into its framework. These are not superficial design elements; they are the foundation of user retention.

Equally important is the company’s historical dataset. Years of longitudinal learning behavior, including error patterns, retention cycles, pacing habits and engagement triggers, form a compounding data advantage. A newly created AI competitor would begin without this reservoir of user-specific learning curves. In education technology, personalization improves with time, and time cannot be instantly replicated.

Data Advantage vs. Market Valuation

While the business holds meaningful strategic advantages, the stock’s valuation tells a different story. Despite a correction of around 80% from prior highs, the shares continue to trade at a premium relative to industry norms. Its forward 12-month P/E ratio of 27.13X remains far above the industry’s 21.85X. This elevated multiple suggests the stock is still trading at a substantial premium relative to peers. When a valuation stays this stretched even after a meaningful correction, it raises the risk of further downside. Until the multiple compresses closer to industry levels, DUOL may continue to face pressure as investors reassess how much premium future growth truly deserves.

This dynamic becomes more concerning when compared to broader digital learning and skill development players such as Coursera COUR and Chegg CHGG. Coursera operates at the intersection of higher education and workforce upskilling, with enterprise and university partnerships offering diversification beyond direct-to-consumer subscriptions. Chegg, although challenged in recent quarters, still represents a large installed base in academic support services.

Coursera’s institutional relationships provide structural demand that differs from consumer-driven language learning cycles. Chegg, on the other hand, illustrates how quickly AI disruption narratives can pressure education platforms when monetization visibility weakens. In that context, Duolingo’s premium valuation appears increasingly sensitive to execution risks.

Strategic Shift: Growth Over Monetization

Another source of concern lies in management’s recent strategic direction. The company has signaled a greater emphasis on improving teaching quality and prioritizing user growth over immediate monetization optimization. From a long-term perspective, investing in better pedagogy and expanding the user base may strengthen the ecosystem. From a market perspective, however, this shift introduces tension.

Wall Street tends to reward visible monetization pathways. When companies emphasize growth experiments over short-term revenue maximization, investors often respond with caution. A pivot toward longer-term initiatives can create an earnings visibility gap, especially when the stock is priced for premium performance.

Competitive Durability vs. Investor Expectations

There is little doubt that Duolingo’s product remains compelling. Its brand recognition is strong, its engagement mechanics are refined, and its data moat is meaningful. As adoption increases globally, it could deepen its presence in formal education environments and corporate training programs.

But investing is not only about business quality, but it is also about the price paid for that quality.

When expectations remain elevated, even modest execution missteps can lead to disproportionate stock reactions. If monetization lags while growth initiatives ramp, or if AI-driven competition compresses perceived differentiation, valuation multiples may continue to recalibrate.

Duolingo is a Sell Right Now

Despite its durable product and valuable data assets, Duolingo appears priced for sustained excellence at a time when strategic shifts introduce uncertainty. The emphasis on long-term user growth over immediate monetization creates a temporary disconnect between execution and investor expectations. Combined with a valuation that still sits above industry norms and competitive pressure amplified by AI narratives, the risk-reward balance leans cautious. Until the premium multiple meaningfully compresses or monetization visibility improves, the stock’s downside risk may outweigh its upside potential. For now, the answer leans toward yes; it looks like a sell.

DUOL currently carries a Zacks Rank #4 (Sell).

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Can Bitcoin Price Recover? Billionaire Dan Tapiero Says “Capitulation First,” Predicts What Comes Next

Crypto Institutional Investment: The Profound Shift from Speculation to Strategic Portfolio Management

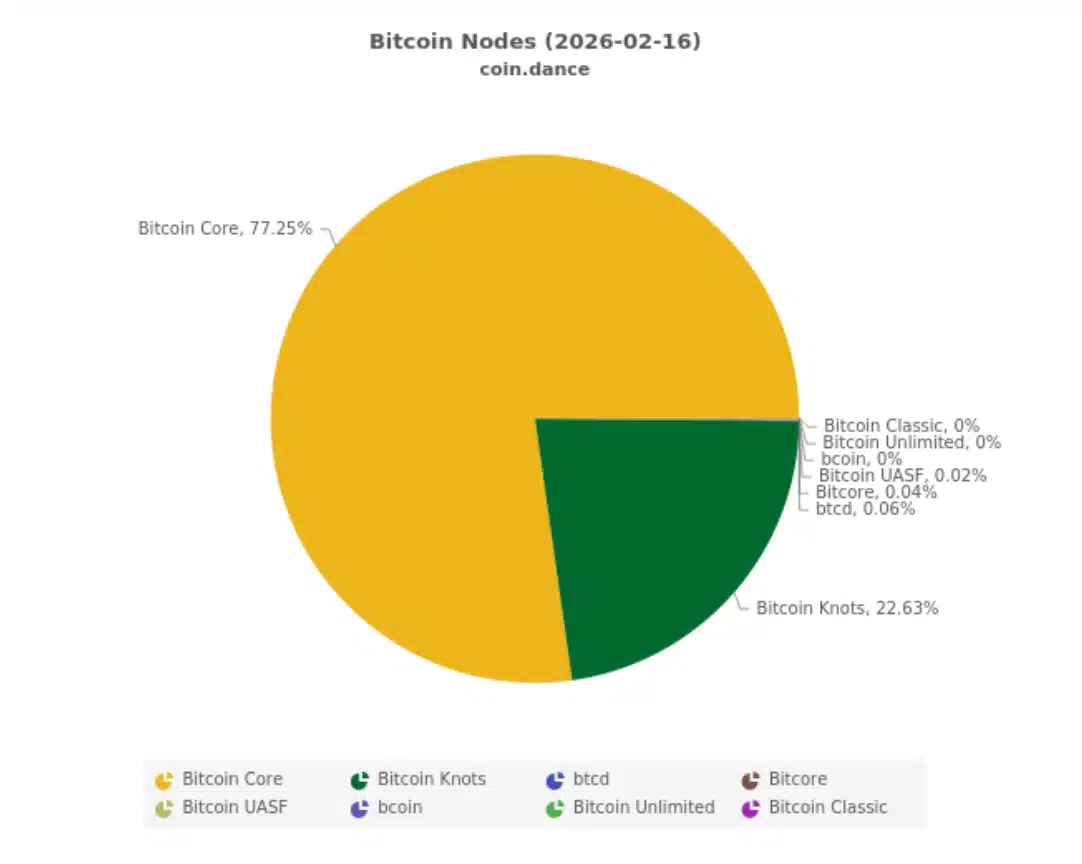

Adam Back warns of ‘lynch mob’ tactics – Is Bitcoin facing fork fight?

Meta's Platfroms' New Bull: Why Billionaire Bill Ackman Is Buying