Oil Slips During Holiday Trading as Attention Turns to Iran-US Negotiations in Geneva

Oil Prices Dip Amid Anticipation of US-Iran Talks

Oil prices edged lower during light Asian trading as the market looked ahead to a second round of negotiations in Geneva between the United States and Iran, a key OPEC member, scheduled for later on Tuesday.

Brent crude retreated toward $68 per barrel after a 1.3% gain the previous day, while West Texas Intermediate remained above $63. Trading activity was subdued, with US and Canadian markets closed for holidays and many Asian exchanges observing Lunar New Year celebrations.

Geopolitical Tensions in Focus

Recent events in the Middle East have renewed concerns about global stability, especially as Iran’s naval maneuvers near a crucial shipping lane have heightened anxieties ahead of diplomatic discussions with the US. According to the semi-official Tasnim news agency, Iran’s Revolutionary Guard is conducting military exercises in the vicinity of the Strait of Hormuz, a passageway responsible for nearly 20% of the world’s oil shipments.

In parallel, Iranian Foreign Minister Abbas Araghchi has met with the head of the UN’s nuclear agency to review proposals he plans to bring to indirect talks with US Special Envoy Steve Witkoff. US Secretary of State Marco Rubio expressed optimism that the longstanding hostilities between Tehran and Washington could be resolved, paving the way for a potential agreement.

Meanwhile, separate negotiations between Russia and Ukraine are set to take place in Geneva over the next two days. However, hopes for a rapid resolution to the nearly four-year conflict—and the return of Russian oil supplies—remain dim.

Analysts Brian Martin and Daniel Hynes from ANZ Group Holdings Ltd. commented, “Geopolitical uncertainty continues to unsettle the market. Should tensions in the Middle East subside or significant progress be made in the Ukraine conflict, the risk premium currently factored into oil prices could quickly diminish.”

©2026 Bloomberg L.P.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Ethereum $2,000 Level Faces Fresh Rejection

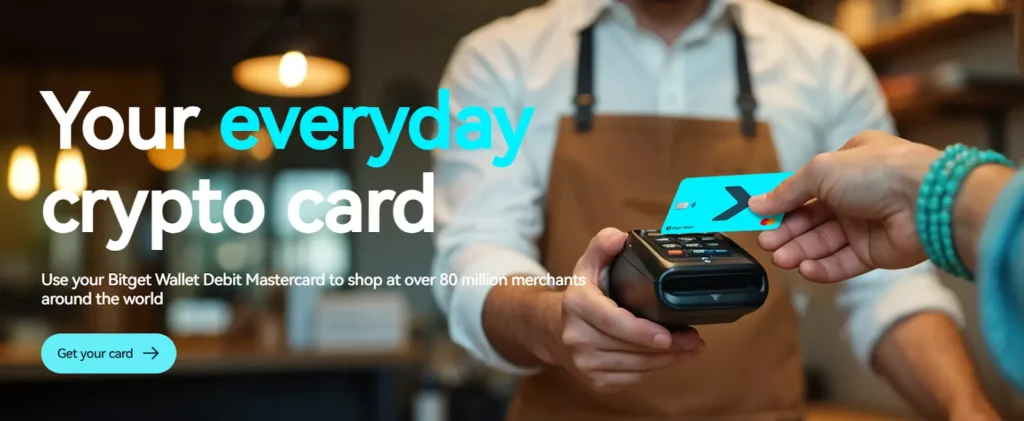

What Is the Best Crypto Card for Payments?

InterDigital renews license agreement with Sony

Louisiana-Pacific: Fourth Quarter Earnings Overview