Goldman Sachs Lowers its Price Target on Upwork Inc. (UPWK) to $27 and Maintains a Buy Rating

Upwork Inc. (NASDAQ:UPWK) is among the 15 Best Small Cap Stocks to Buy According to Wall Street.

On February 11, 2026, Goldman Sachs lowered its price target on Upwork Inc. (NASDAQ:UPWK) to $27 from $28 and maintained a Buy rating. The firm said the company delivered a solid fourth-quarter report, with revenue and adjusted EBITDA at or slightly above the high end of prior guidance, based on management’s earnings release and forward commentary.

Other firms were more cautious on near-term trends. On February 10, 2026, Scotiabank reduced its price target to $15 from $17 and kept a Sector Perform rating, saying it is waiting for clearer evidence that AI is expanding the platform’s user base rather than simply increasing engagement. That same day, UBS lowered its price target to $23 from $26 and maintained a Buy rating, describing the fourth-quarter results and first-quarter guidance as “underwhelming.”

Upwork reported fourth-quarter revenue of $198.4 million on February 10, 2026, slightly above the $197.52 million consensus estimate. CEO Hayden Brown said 2025 was the year the company rebuilt for “human-plus-AI collaboration,” positioning itself for what she described as a $1.3 trillion market opportunity in flexible digital knowledge work. For 2026, the company guided revenue to $835 million to $850 million, compared with the consensus of $838.24 million.

Upwork Inc. (NASDAQ:UPWK) operates a work marketplace that connects businesses with independent professionals and agencies across multiple service categories worldwide.

While we acknowledge the potential of UPWK as an investment, we believe certain AI stocks offer greater upside potential and carry less downside risk. If you’re looking for an extremely undervalued AI stock that also stands to benefit significantly from Trump-era tariffs and the onshoring trend, see our free report on the

READ NEXT: 10 Most Profitable Undervalued Stocks to Buy and 11 Best Mining Stocks to Buy According to Wall Street

Disclosure: None.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Herc Holdings: Fourth Quarter Earnings Overview

Ethereum $2,000 Level Faces Fresh Rejection

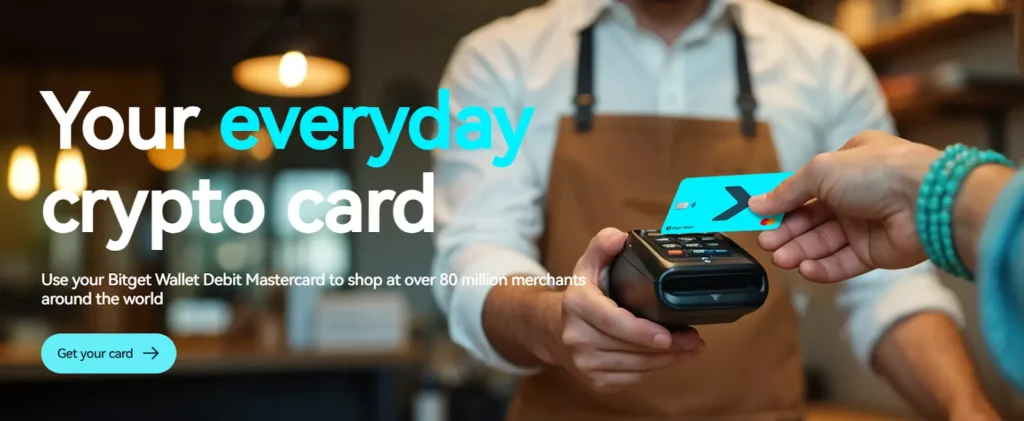

What Is the Best Crypto Card for Payments?

InterDigital renews license agreement with Sony